Question: please help to answer the following questions: 2. (a) Given the risk-neutral process dSJS; = rd: + oa'z, with 0 being constant, show that 382185

please help to answer the following questions:

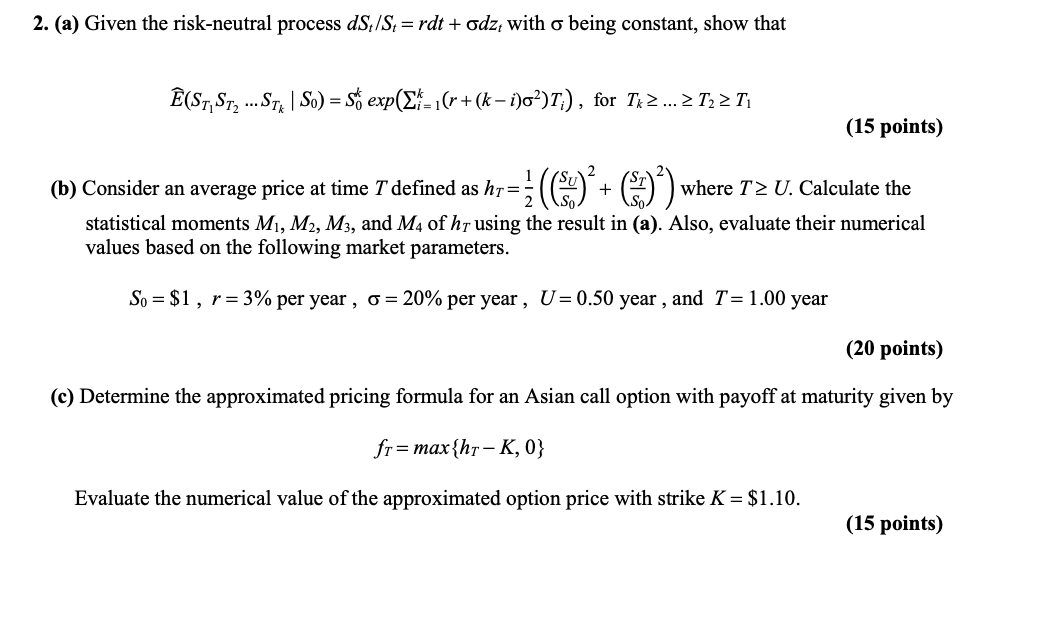

2. (a) Given the risk-neutral process dSJS; = rd: + oa'z, with 0 being constant, show that 382185 ".331 | so) =55 exp(Ef-'= 1(r+(k 95%), for r. :_> 2 r2 2 r, (15 points) 2 2 (b) Consider an average price at time Tdened as him; (6H) + (%) ) where T2 U. Calculate the I) 0 statistical moments M1, M2, M3, and M4 of by using the result in (:1). Also, evaluate their numerical values based on the following market parameters. So: $1, r= 3% peryear , o: 20%peryear, U: 0.50 year, and T: 1.00 year (20 points) (c) Determine the approximated pricing formula for an Asian call option with payoff at maturity given by fr: max{hr-K, 0} Evaluate the numerical value of the approximated option price with strike K = $1.10. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts