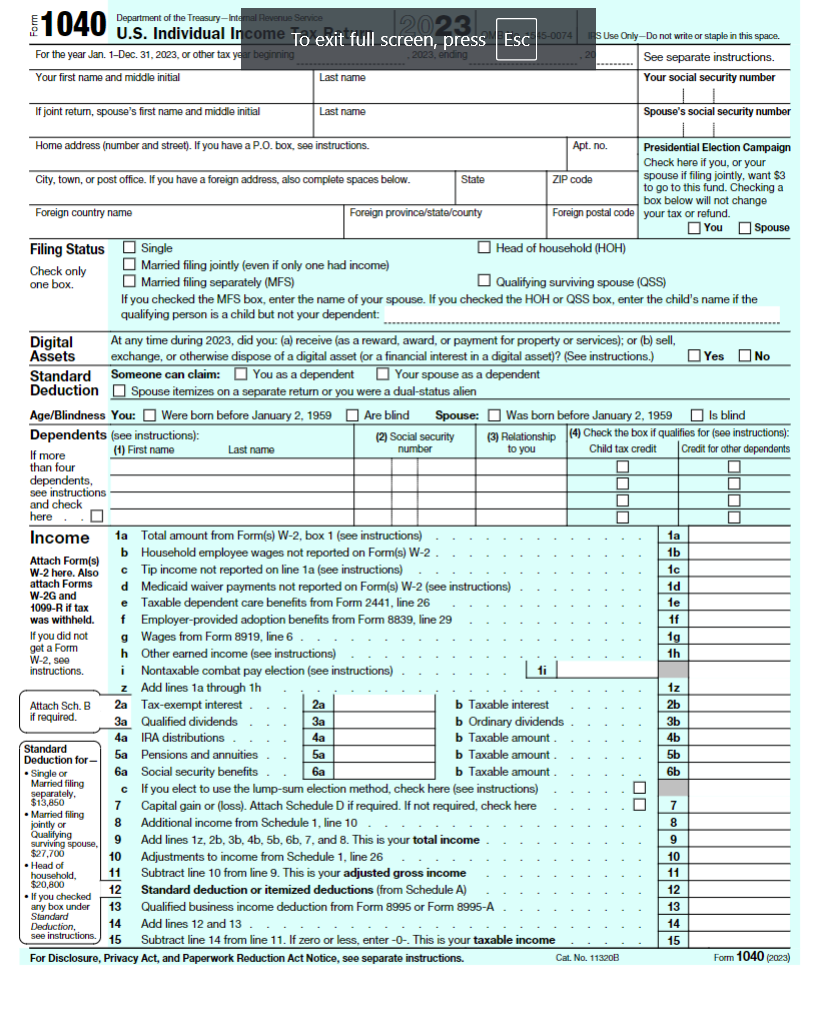

Question: Please help to fill out part two, For this part of the assignment, you will use the components of gross income, adjusted gross income, deductions,

Please help to fill out part two,

For this part of the assignment, you will use the components of gross income, adjusted gross income, deductions, taxable income, taxable income, taxable liability, and tax refundpayable information provided in the Scenario from Part to complete the following forms:

Complete Federal pages and

Complete Schedule pages and

Part I Additional Income

Taxable refunds, credits, or offsets of state and local income taxes

a Alimony received

b Date of original divorce or separation agreement see instructions:

Business income or loss Attach Schedule C

Other gains or losses Attach Form

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

Farm income or loss Attach Schedule F

Unemployment compensation

Other income:

a Net operating loss

b Gambling

c Cancellation of debt

d Foreign earned income exclusion from Form

e Income from Form

f Income from Form

g Alaska Permanent Fund dividends

h Jury duty pay.

i Prizes and awards

j Activity not engaged in for profit income

k Stock options.

I Income from the rental of personal property if you engaged in the rental

for profit but were not in the business of renting such property

m Olympic and Paralympic medals and USOC prize money see

instructions

n Section a inclusion see instructions

Section Aa inclusion see instructions

p Section l excess business loss adjustment

q Taxable distributions from an ABLE account see instructions

r Scholarship and fellowship grants not reported on Form W

s Nontaxable amount of Medicaid waiver payments included on Form

line a or d

t Pension or annuity from a nonqualifed deferred compensation plan or

a nongovernmental section plan

u Wages earned while incarcerated

z Other income. List type and amount:

Total other income. Add lines a through

SR or NR line

Combine lines through and This is your additional income. Enter here and on Form Part II Adjustments to Income Tax Rate Schedules

Schedule YMarried Filing Jointly or Qualifying surviving spouse

Schedule ZHead of Household

Schedule YMarried Filing Separately

Part one information to insert numbers into part two

Marc and Mikkel are married and file a joint tax return. Marc and Mikkel earned salaries this year of $ and $ respectively. In addition to their salaries, they received interest of $ from municipal bonds and $ from corporate bonds. Marc contributed $ to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $under a divorce decree effective June Marc and Mikkel have a yearold adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $ child tax credit for Mason. Marc and Mikkel paid $ of expenditures that qualify as itemized deductions, and they had a total of $ in federal income taxes withheld from their paychecks during the year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock