Question: Please help to gain understanding with explanation thanks b) A company has budgeted for a capital investment of 160,000. There are three different project proposals

Please help to gain understanding with explanation thanks

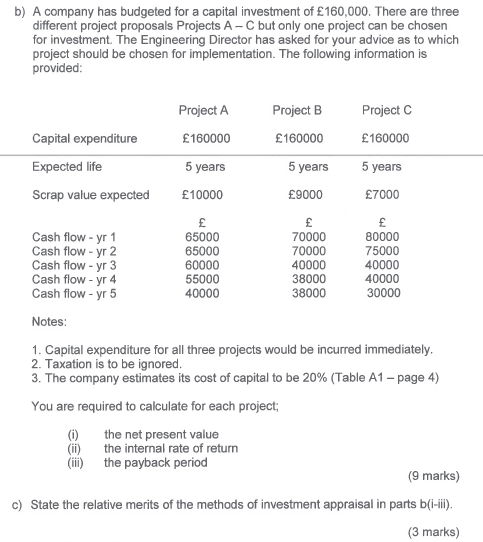

b) A company has budgeted for a capital investment of 160,000. There are three different project proposals Projects A-C but only one project can be chosen for investment. The Engineering Director has asked for your advice as to which project should be chosen for implementation. The following information is provided: Project A Project B Project C Capital expenditure 160000 160000 160000 Expected life 5 years 5 years 5 years Scrap value expected 10000 9000 7000 Cash flow - yr 1 65000 70000 80000 Cash flow - yr 2 65000 70000 75000 Cash flow - yr 3 60000 40000 40000 Cash flow - yr 4 55000 38000 40000 Cash flow - yr 5 40000 38000 30000 Notes: 1. Capital expenditure for all three projects would be incurred immediately. 2. Taxation is to be ignored. 3. The company estimates its cost of capital to be 20% (Table A1 - page 4) You are required to calculate for each project; (0) the net present value the internal rate of return the payback period (9 marks) c) State the relative merits of the methods of investment appraisal in parts b(i-ill)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts