Question: please help. Unsure if this is more than one question, if it is please ignore first image. i thinn these are the answers for the

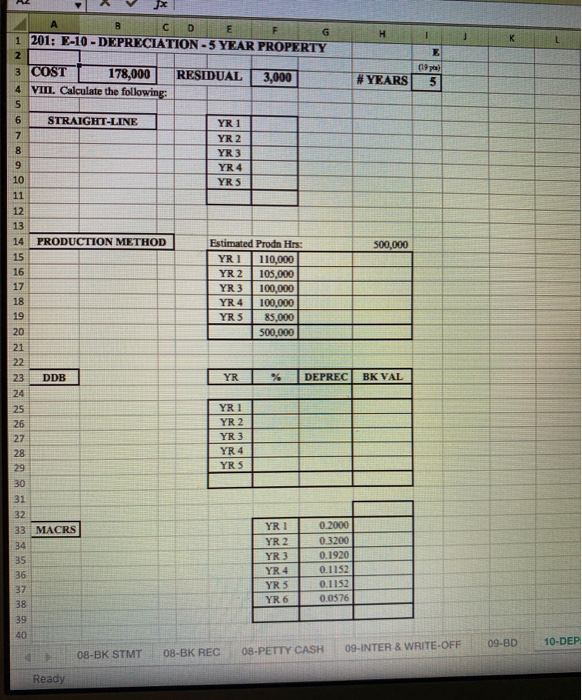

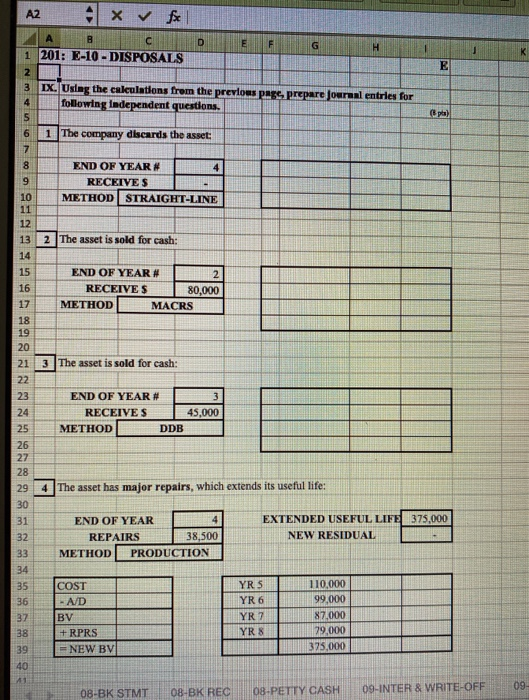

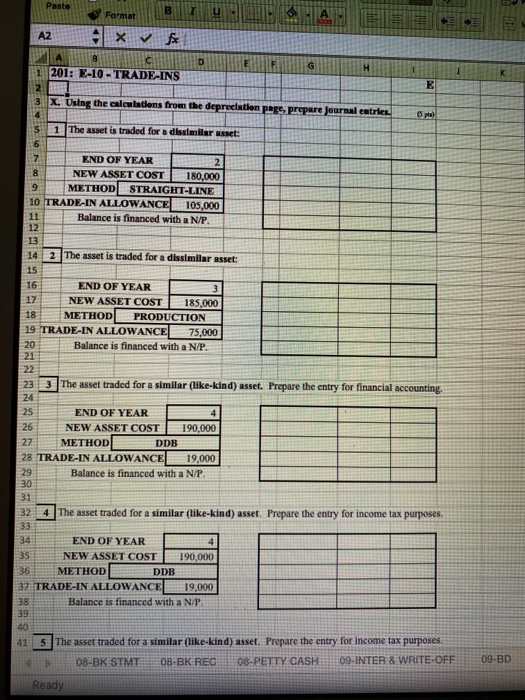

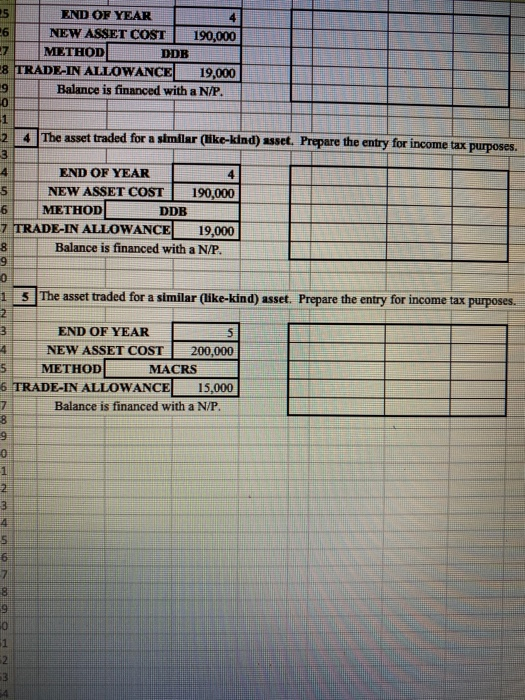

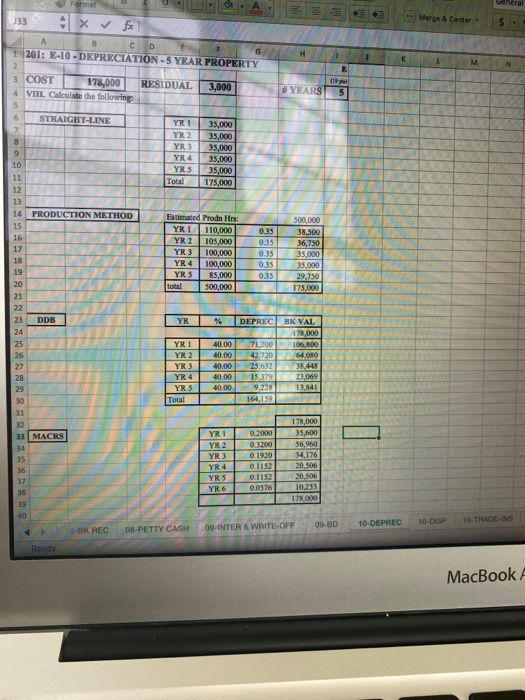

B C D E GH 1 201: E-10 - DEPRECIATION - 5 YEAR PROPERTY 1 ICOST L 178,000 RESIDUAL 3,000 # YEARS VIII. Calculate the following: ( ) S STRAIGHT-LINE YR 1 PRODUCTION METHOD 500.000 Estimated Prod Hrs: YR I 110,000 YR 2 105.000 YR 3 100,000 YR 4 100.000 YR5 85,000 500,000 . DDB YR % DEPREC BKVAL YRITT YR21 YR 3 YR 4 MACRS YRI 02000 YR 2 YR 3 YR 4 0.3200 0.1920 0.1152 0.1152) 0.0576 YRS YR 6 08-BK STMT 08-PETTY CASH 09-8D 08-BK REC 09-INTER & WRITE-OFF 10-DEP Ready x & fc 201: E-10 - DISPOSALS IX. Using the calculations from the previous page, prepare Journal entries for following Independent questions. 1 The company discards the asset: END OF YEAR # RECEIVES METHOD STRAIGHT-LINE The asset is sold for cash: Nemo N 00999 999 HASANS END OF YEAR# RECEIVES 80,000 METHOD MACRS 3 The asset is sold for cash: END OF YEAR # RECEIVES 45,000 METHODSDDB 4 The asset has major repairs, which extends its useful life: END OF YEAR REPAIRS 38,500 METHOD PRODUCTION EXTENDED USEFUL LIFE375,000 NEW RESIDUAL YRS YR 6 COST AD BV +RPRS = NEW BV YR 7 1 10000 99,000 87.000 29.000 375.000 YR 08-BK STMT 08-BK REC 08-PETTY CASH 09-INTER & WRITE-OFF 09 BUAH fo x 201: E-10 - TRADE-INS X. Using the calculations from the depreciation pere, prepare journal entries ) The asset is traded for a dissimilar usset: WE DO NO END OF YEART 2 NEW ASSET COST 180,000 METHOD STRAIGHT-LINE TRADE-IN ALLOWANCE 105,000 Balance is financed with a N/P 2 The asset is traded for a dissimilar asset: END OF YEAR 31 NEW ASSET COST 185,000 METHOD PRODUCTION 19 TRADE-IN ALLOWANCE 75.000 Balance is financed with a NP. 3 The asset traded for a similar (like-kind) asset. Prepare the entry for financial accounting END OF YEART NEW ASSET COST 190,000 METHODL DDB 28 TRADE-IN ALLOWANCE 19,000 Balance is financed with a N/P 324 The asset traded for a similar (like-kind) asset. Prepare the entry for income tax purposes. END OF YEAR NEW ASSET COST 190,000 METHODE DDB 32 TRADE-IN ALLOWANCE19,000 Balance is financed with a NP 415 The asset traded for a similar (like-kind) asset. Prepare the entry for income tax purposes 08-BK STMT08-BK REG 08-PETTY CASH 09-INTER & WRITE-OFF Ready 09-BD / IL END OF YEART 4 NEW ASSET COST 190,000 METHODDDB TRADE-IN ALLOWANCE 319,000 Balance is financed with a N/P. // / 7 T LE 4 The asset traded for a similar (like-kind) asset. Prepare the entry for income tax purposes. WALDO UN NOU END OF YEAR NEW ASSET COST 190,000 METHOD DDB 7 TRADE-IN ALLOWANCE19,000 Balance is financed with a N/P. 5 The asset traded for a similar (like-kind) asset. Prepare the entry for income tax purposes. END OF YEAR NEW ASSET COST 200,000 METHOD MACRS TRADE-IN ALLOWANCE15,000 Balance is financed with a N/P Marga Ace Pored L A . EB 133 x vfx de A B C D G 201: X-10 - DEPRECIATION - 5 YEAR PROPERTY 3 COST VIIL C 178,000 ute the following RESIDUAL 3,000 STRAIGHT-LINE YR YR 2 YR 3 YR 4 35.000 35.000 35,000 Total 35,000 175,000 12 13 PRODUCTION METHOD Estimated Prod Hrs YR 2 YR3 YR 4 105,000 100,000 100,000 85.000 500.000 0.35 0.35 total 23 DDB YR % 40.00 40.00 40.00 40.00 40.00 DEPRECK VALE 178,000 71,200 106,800 42.720 6 4080 25.632 38.448 15.379 23.069 9.22 13.841 164,159 JE YR 1 YR 2 YR 3 YR 4 YR 5 YR 6 0 0 0 0 0 0 .2000 .3200 .1920 .1152 .1152 .0576 178,000 35,600 56,960 34,176 20.506 20,506 10253 178,000 09-30 10-DEPREC 10-DISP 10-TRADE-INS BK REC 08-PETTY CASH 09 INTER A WRITE-OFF MacBook A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts