Question: PLEASE HELP URGENT AND PLEASE SHOW STEP BY STEP PROCEDURE THANK YOU ! GIBELY manufactures a product A using a raw material X and a

PLEASE HELP URGENT AND PLEASE SHOW STEP BY STEP PROCEDURE THANK YOU !

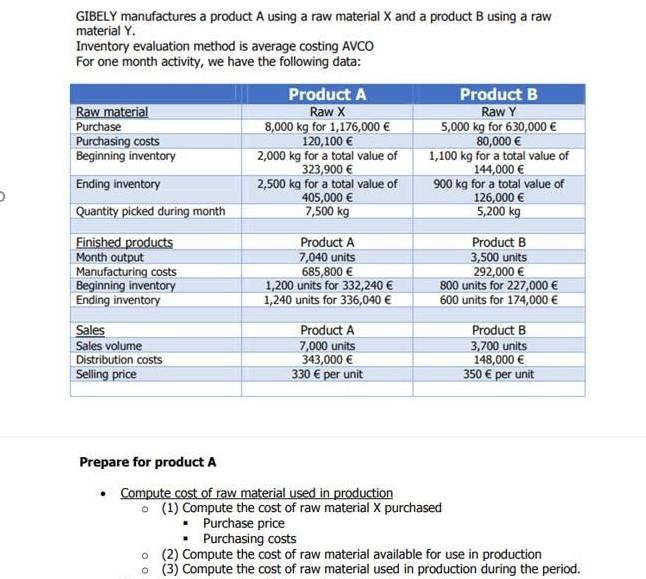

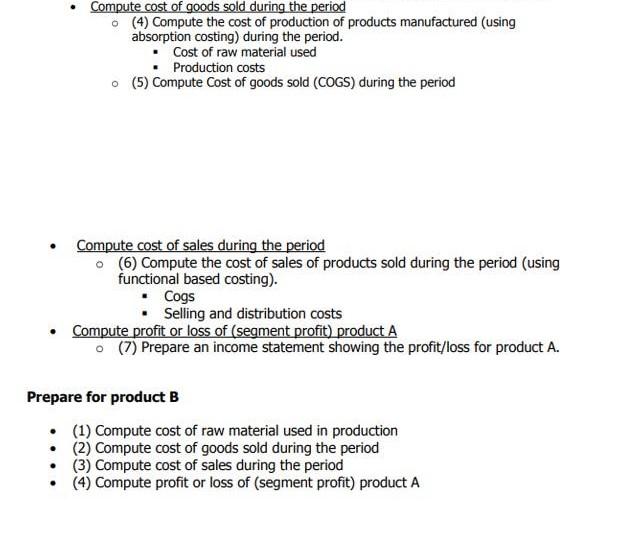

GIBELY manufactures a product A using a raw material X and a product B using a raw material Y. Inventory evaluation method is average costing AVCO For one month activity, we have the following data: Prepare for product A - Compute cost of raw material used in production (1) Compute the cost of raw material X purchased - Purchase price - Purchasing costs (2) Compute the cost of raw material available for use in production - (3) Compute the cost of raw material used in production during the period. - Compute cost of goods sold during the period (4) Compute the cost of production of products manufactured (using absorption costing) during the period. - Cost of raw material used - Production costs - (5) Compute Cost of goods sold (COGS) during the period - Compute cost of sales during the period (6) Compute the cost of sales of products sold during the period (using functional based costing). - Cogs - Selling and distribution costs - Compute profit or loss of (segment profit) product A (7) Prepare an income statement showing the profit/loss for product A. Prepare for product B - (1) Compute cost of raw material used in production - (2) Compute cost of goods sold during the period - (3) Compute cost of sales during the period - (4) Compute profit or loss of (segment profit) product A GIBELY manufactures a product A using a raw material X and a product B using a raw material Y. Inventory evaluation method is average costing AVCO For one month activity, we have the following data: Prepare for product A - Compute cost of raw material used in production (1) Compute the cost of raw material X purchased - Purchase price - Purchasing costs (2) Compute the cost of raw material available for use in production - (3) Compute the cost of raw material used in production during the period. - Compute cost of goods sold during the period (4) Compute the cost of production of products manufactured (using absorption costing) during the period. - Cost of raw material used - Production costs - (5) Compute Cost of goods sold (COGS) during the period - Compute cost of sales during the period (6) Compute the cost of sales of products sold during the period (using functional based costing). - Cogs - Selling and distribution costs - Compute profit or loss of (segment profit) product A (7) Prepare an income statement showing the profit/loss for product A. Prepare for product B - (1) Compute cost of raw material used in production - (2) Compute cost of goods sold during the period - (3) Compute cost of sales during the period - (4) Compute profit or loss of (segment profit) product A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts