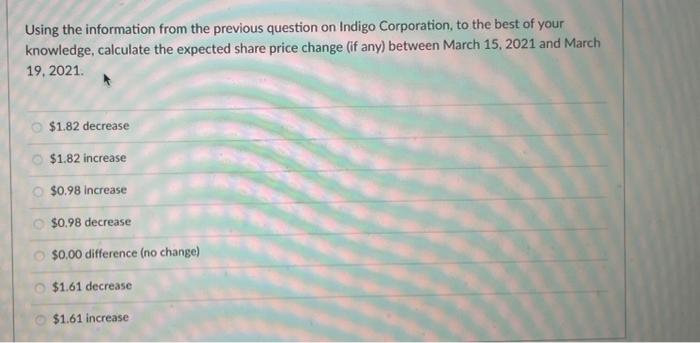

Question: PLEASE HELP URGENT ASAP !!!70 Using the information from the previous question on Indigo Corporation, to the best of your knowledge, calculate the expected share

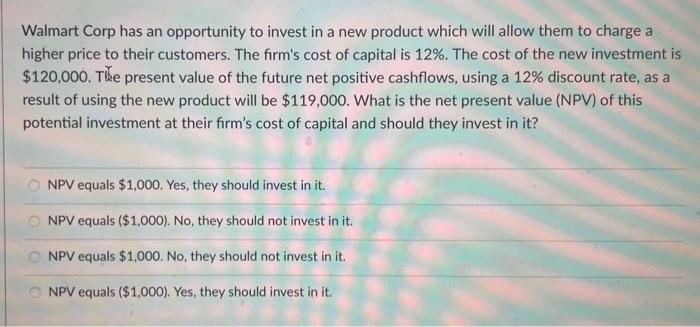

Using the information from the previous question on Indigo Corporation, to the best of your knowledge, calculate the expected share price change (if any) between March 15, 2021 and March 19.2021. $1.82 decrease $1.82 increase $0.98 Increase $0.98 decrease $0.00 difference (no change) $1.61 decrease $1.61 increase Walmart Corp has an opportunity to invest in a new product which will allow them to charge a higher price to their customers. The firm's cost of capital is 12%. The cost of the new investment is $120,000. The present value of the future net positive cashflows, using a 12% discount rate, as a result of using the new product will be $119,000. What is the net present value (NPV) of this potential investment at their firm's cost of capital and should they invest in it? NPV equals $1,000. Yes, they should invest in it. NPV equals ($1,000). No, they should not invest in it. NPV equals $1,000. No, they should not invest in it. NPV equals ($1,000). Yes, they should invest in it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts