Question: Please Help, Urgent Current interest rates are ( i_{$}=4 % ; i_{epsilon}=6 % ). Expected interest rates next year are: ( i_{$}=7 % ; i_{epsilon}=3

Please Help, Urgent

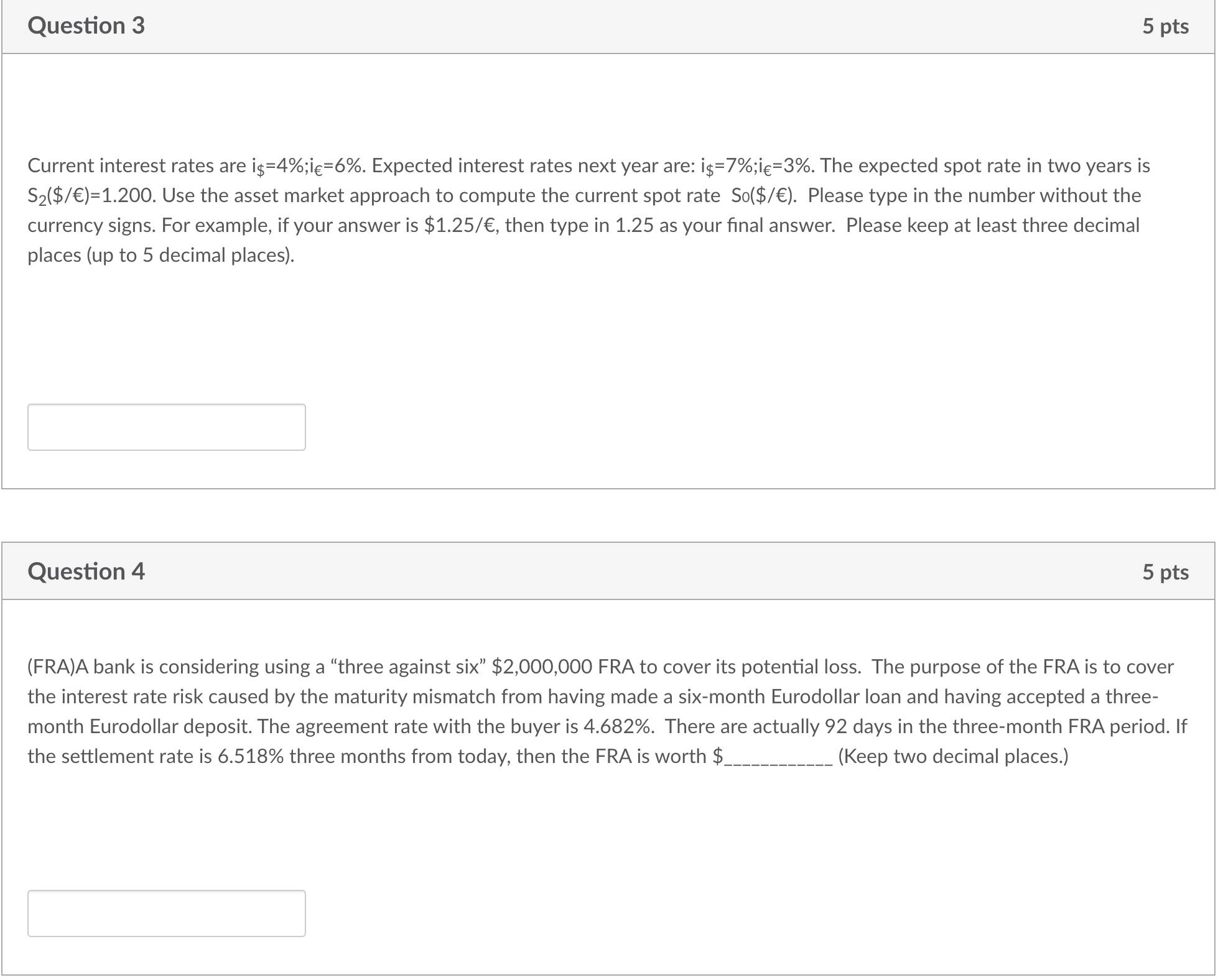

Current interest rates are \\( i_{\\$}=4 \\% ; i_{\\epsilon}=6 \\% \\). Expected interest rates next year are: \\( i_{\\$}=7 \\% ; i_{\\epsilon}=3 \\% \\). The expected spot rate in two years is \\( S_{2}(\\$ / )=1.200 \\). Use the asset market approach to compute the current spot rate \\( S_{0}(\\$ / ) \\). Please type in the number without the currency signs. For example, if your answer is \\( \\$ 1.25 / \\), then type in 1.25 as your final answer. Please keep at least three decimal places (up to 5 decimal places). Question 4 5 pts (FRA)A bank is considering using a \"three against six\" \\$2,000,000 FRA to cover its potential loss. The purpose of the FRA is to cover the interest rate risk caused by the maturity mismatch from having made a six-month Eurodollar loan and having accepted a threemonth Eurodollar deposit. The agreement rate with the buyer is \4.682. There are actually 92 days in the three-month FRA period. If the settlement rate is \6.518 three months from today, then the FRA is worth \\( \\) (Keep two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts