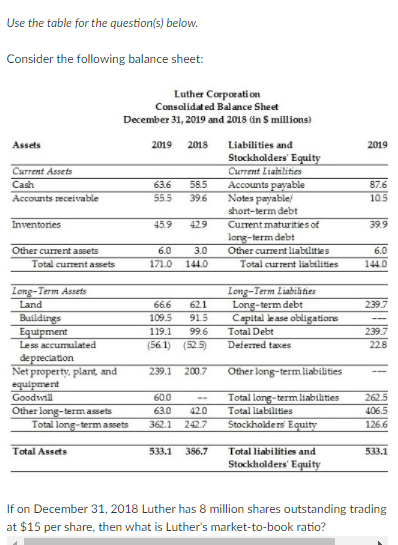

Question: Use the table for the question(s) below. Consider the following balance sheet: Assets 2019 Current Assets Cash Accounts receivable Luther Corporation Consolidated Balance Sheet December

Use the table for the question(s) below. Consider the following balance sheet: Assets 2019 Current Assets Cash Accounts receivable Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in S millions) 2019 2018 Liabilities and Stockholders' Equity Current Liabilities 63.6 585 Accounts payable 55.5 39.6 Notes payable! short-term debt 45.9 429 Current maturities of long-term debt 6.0 3.0 Other current liabilities 171.0 144.0 Total current liabilities 87.6 10.5 Inventories 399 60 Other current assets Total current assets 144.0 239.7 66.6 109.5 119.1 (561) 621 915 99.6 (52.5) Long-Term Liabilities Long-term debt Capital lease obligations Total Debt Deferred taxes 239.7 228 Long-Term Assets Land Buildings Equipment Less accumulated depreciation Net property, plant, and equipment Goodwill Other long-term assets Total long-term assets 239.1 2007 Other long-term liabilities 60.0 63.0 362.1 420 2427 Total long-term liabilities Total liabilities Stockholders' Equity 262.5 4065 1.26.6 Total Assets 533.1 386.7 533.1 Total liabilities and Stockholders' Equity If on December 31, 2018 Luther has 8 million shares outstanding trading at $15 per share, then what is Luther's market-to-book ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts