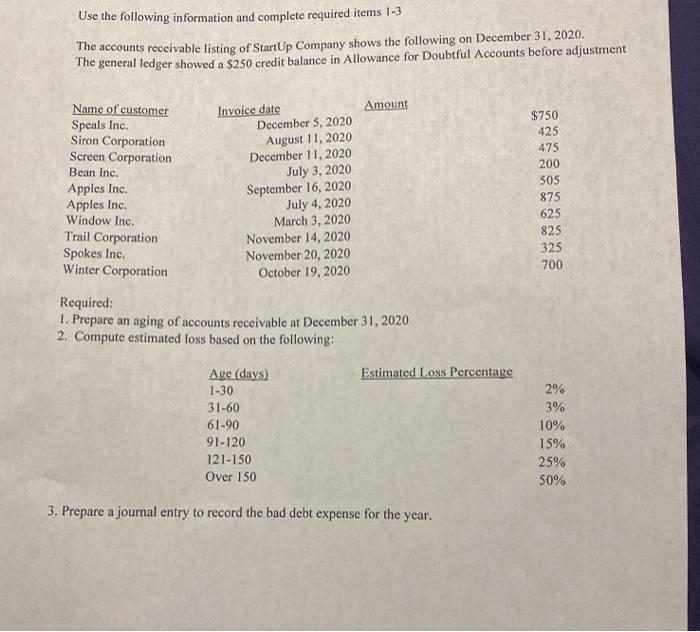

Question: Please help Use the following information and complete required items 1-3 The accounts receivable listing of StartUp Company shows the following on December 31, 2020.

Use the following information and complete required items 1-3 The accounts receivable listing of StartUp Company shows the following on December 31, 2020. The general ledger showed a $250 credit balance in Allowance for Doubtful Accounts before adjustment Amount Name of customer Speals Inc. Siron Corporation Screen Corporation Bean Inc. Apples Inc. Apples Inc. Window Inc. Trail Corporation Spokes Inc. Winter Corporation Invoice date December 5, 2020 August 11, 2020 December 11, 2020 July 3, 2020 September 16, 2020 July 4, 2020 March 3, 2020 November 14, 2020 November 20, 2020 October 19, 2020 $750 425 475 200 505 875 625 825 325 700 Required: 1. Prepare an aging of accounts receivable at December 31, 2020 2. Compute estimated loss based on the following: Estimated Loss Percentage Age (days) 1-30 31-60 61-90 91-120 121-150 Over 150 2% 3% 10% 15% 25% 50% 3. Prepare a journal entry to record the bad debt expense for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts