Question: please help using group 2 numbers d. Use the data developed in the table to construct the L division's free cash flows for 2016 through

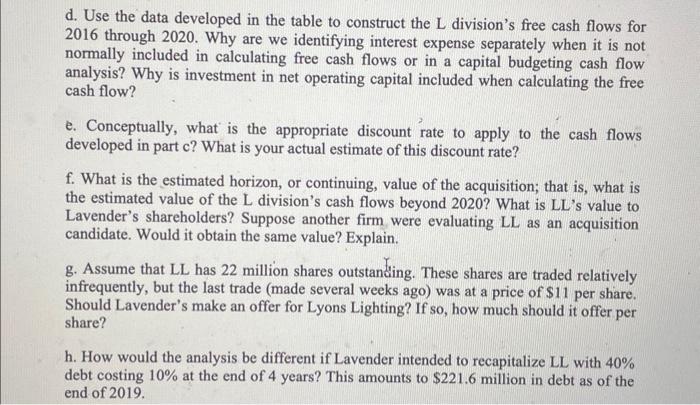

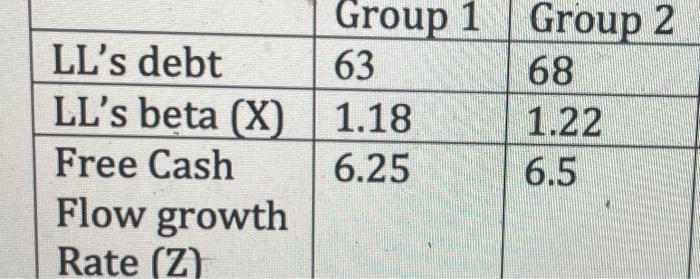

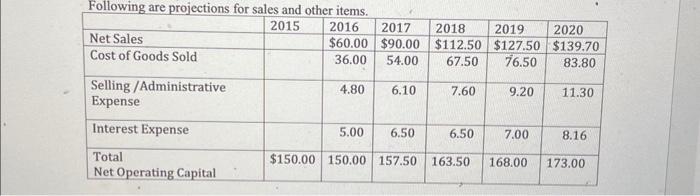

d. Use the data developed in the table to construct the L division's free cash flows for 2016 through 2020 . Why are we identifying interest expense separately when it is not normally included in calculating free cash flows or in a capital budgeting cash flow analysis? Why is investment in net operating capital included when calculating the free cash flow? e. Conceptually, what is the appropriate discount rate to apply to the cash flows developed in part c ? What is your actual estimate of this discount rate? f. What is the estimated horizon, or continuing, value of the acquisition; that is, what is the estimated value of the L division's cash flows beyond 2020? What is LL's value to Lavender's shareholders? Suppose another firm were evaluating LL as an acquisition candidate. Would it obtain the same value? Explain. g. Assume that LL has 22 million shares outstandaing. These shares are traded relatively infrequently, but the last trade (made several weeks ago) was at a price of $11 per share. Should Lavender's make an offer for Lyons Lighting? If so, how much should it offer per share? h. How would the analysis be different if Lavender intended to recapitalize LL with 40% debt costing 10% at the end of 4 years? This amounts to $221.6 million in debt as of the end of 2019. \begin{tabular}{|l|l|l|} \hline LL's debt & 63 & 68 \\ \hline LL's beta (X) & 1.18 & 1.22 \\ \hline FreeCashFlowgrowthRate(Z) & 6.25 & 6.5 \\ \hline \end{tabular} Following are nroiectione for calee and othar itamo d. Use the data developed in the table to construct the L division's free cash flows for 2016 through 2020 . Why are we identifying interest expense separately when it is not normally included in calculating free cash flows or in a capital budgeting cash flow analysis? Why is investment in net operating capital included when calculating the free cash flow? e. Conceptually, what is the appropriate discount rate to apply to the cash flows developed in part c ? What is your actual estimate of this discount rate? f. What is the estimated horizon, or continuing, value of the acquisition; that is, what is the estimated value of the L division's cash flows beyond 2020? What is LL's value to Lavender's shareholders? Suppose another firm were evaluating LL as an acquisition candidate. Would it obtain the same value? Explain. g. Assume that LL has 22 million shares outstandaing. These shares are traded relatively infrequently, but the last trade (made several weeks ago) was at a price of $11 per share. Should Lavender's make an offer for Lyons Lighting? If so, how much should it offer per share? h. How would the analysis be different if Lavender intended to recapitalize LL with 40% debt costing 10% at the end of 4 years? This amounts to $221.6 million in debt as of the end of 2019. \begin{tabular}{|l|l|l|} \hline LL's debt & 63 & 68 \\ \hline LL's beta (X) & 1.18 & 1.22 \\ \hline FreeCashFlowgrowthRate(Z) & 6.25 & 6.5 \\ \hline \end{tabular} Following are nroiectione for calee and othar itamo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts