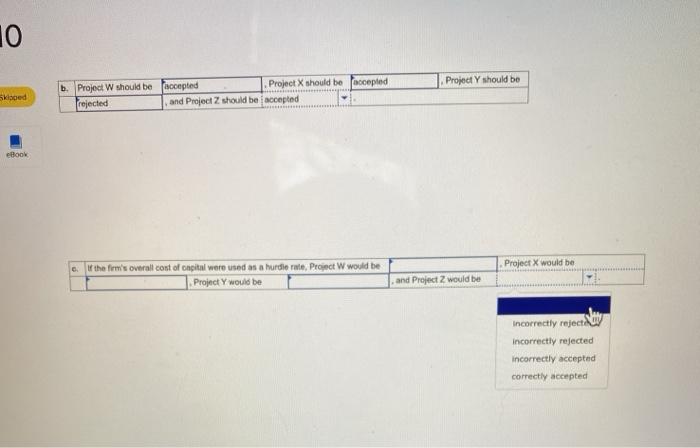

Question: please help verify answers for part A. need help witj C! 10 Project Y should be Skiced b. Project W should be accepted Project X

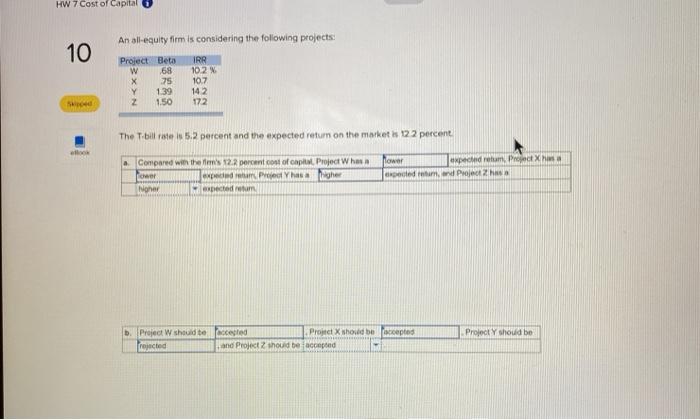

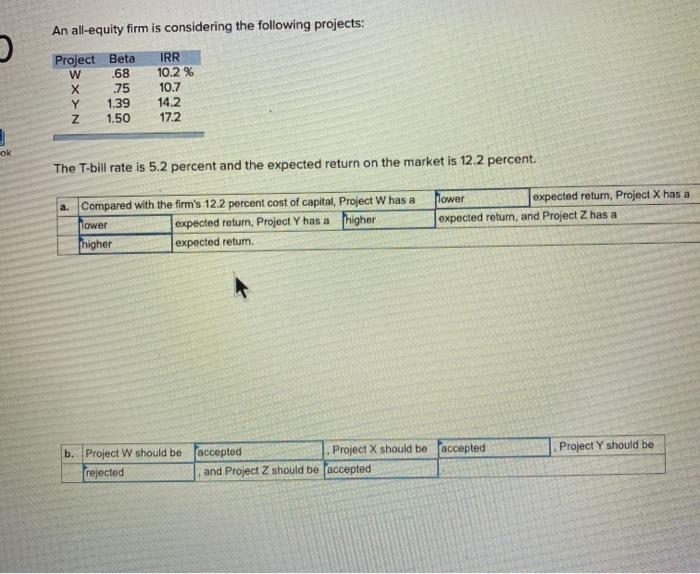

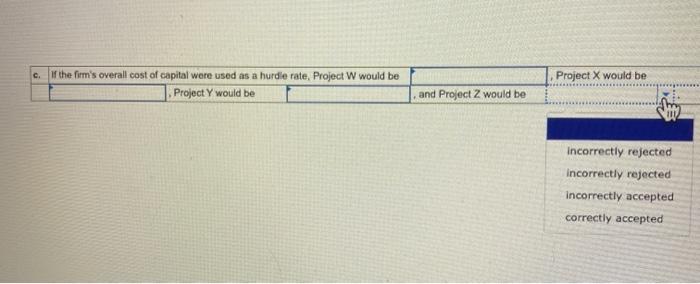

10 Project Y should be Skiced b. Project W should be accepted Project X should be noepled rejected and Project Z should be accepted eBook Project X would be the firm's overall cost of capital were used as a hurdle role, Project W would be Project Y would be and Project would be Incorrectly rejectie incorrectly rejected incorrectly accepted correctly accepted HW 7 Cost of Capital An all-equity firm is considering the following projects 10 IRR 10.2 Project Beta w 68 X 75 Y 1.39 Z 1.50 107 142 172 The Tbill rate is 5.2 percent and the expected return on the market is 12.2 percent a. Compared with them's 12.2 percent cost of capital Project When Tower Phasa Migher Noner bected retum Tower expected eam Project expected and Project b. Project should be Projected accepted Project should be accepted and Project should be accepted Project should be An all-equity firm is considering the following projects: Project Beta w .68 .75 Y 1.39 Z 1,50 IRR 10.2 % 10.7 14.2 17.2 ok The T-bill rate is 5.2 percent and the expected return on the market is 12.2 percent. a. Compared with the firm's 12.2 percent cost of capital, Project W has a lower expected return, Project Y has a higher Thigher expected return. lower expected return, Project X has a expected return, and Project Z has a accepted Project should be b. Project W should be rejected accepted Project X should be and Project Z should be accepted c. Project X would be If the firm's overall cost of capital were used as a hurdle rate, Project W would be Project Y would be and Project Z would be incorrectly rejected incorrectly rejected Incorrectly accepted correctly accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts