Question: please! help What is the term used when a public firm is allowed to record a new securities issue with the SEC and given the

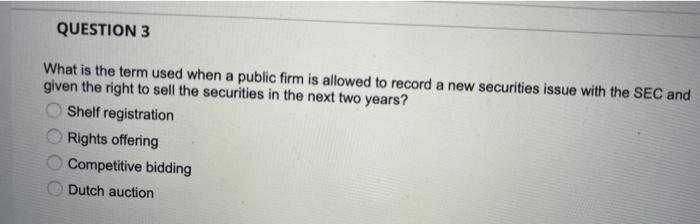

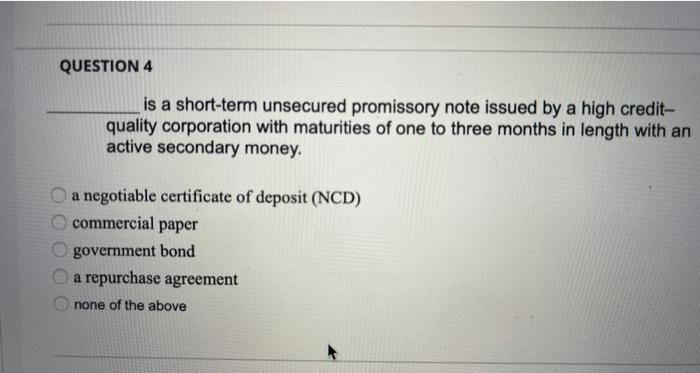

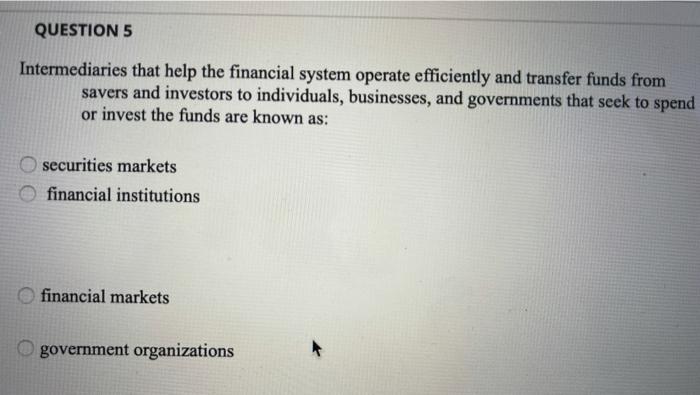

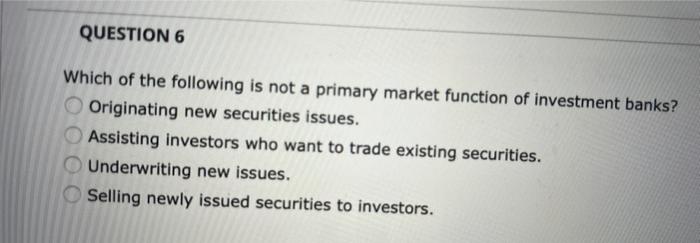

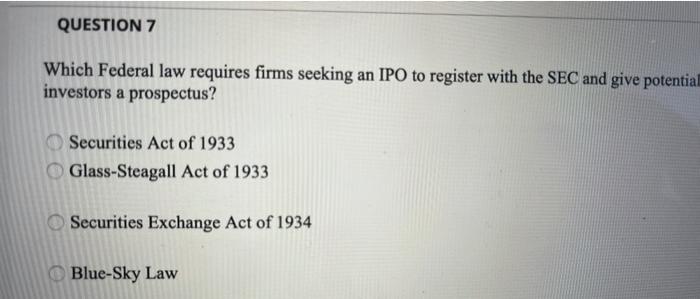

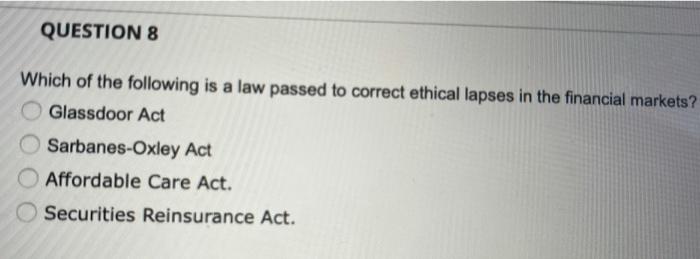

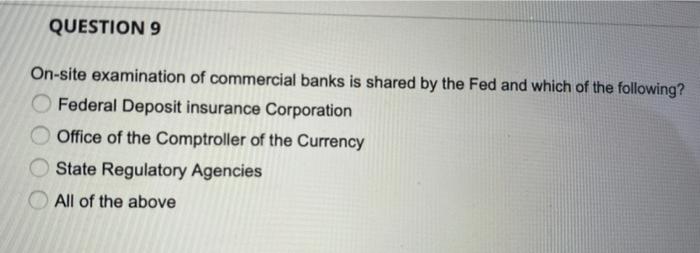

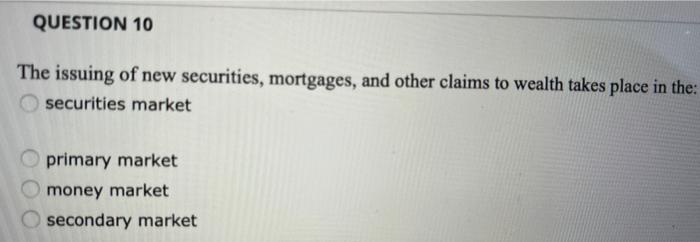

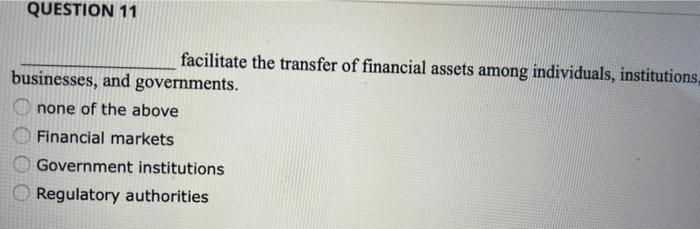

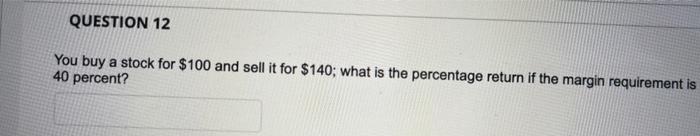

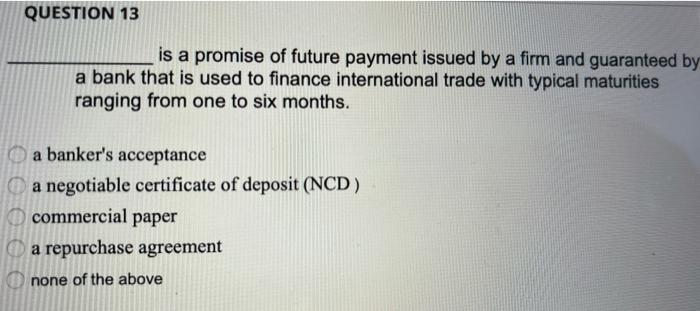

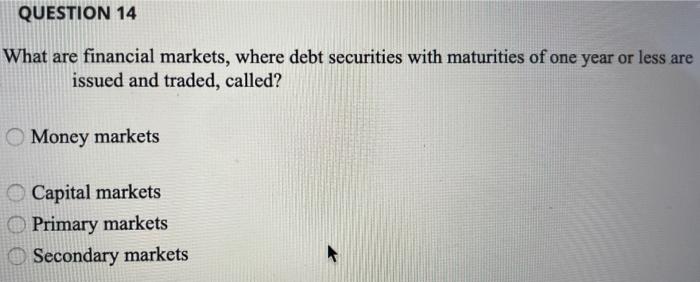

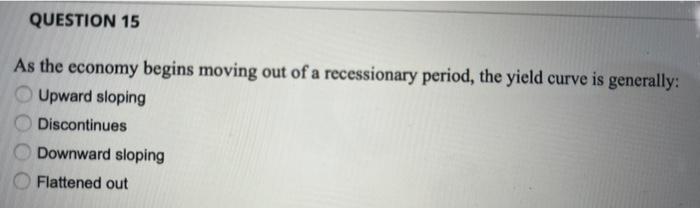

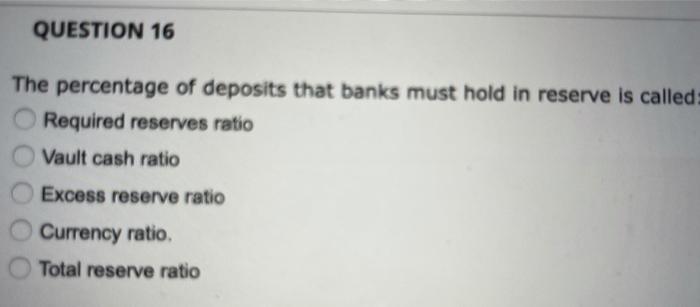

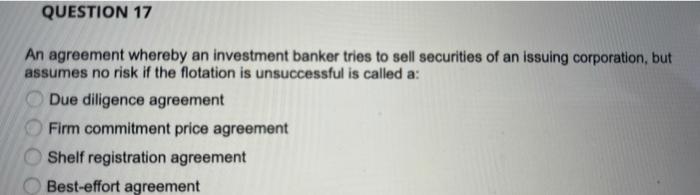

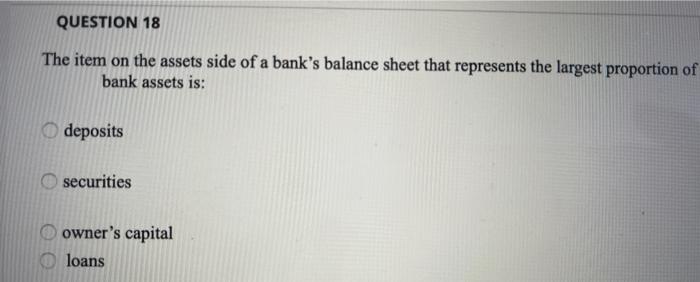

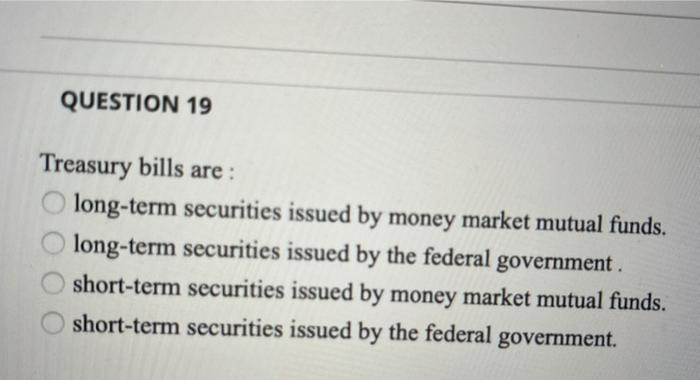

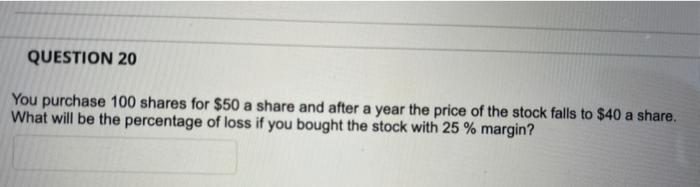

What is the term used when a public firm is allowed to record a new securities issue with the SEC and given the right to sell the securities in the next two years? Shelf registration Rights offering Competitive bidding Dutch auction is a short-term unsecured promissory note issued by a high creditquality corporation with maturities of one to three months in length with an active secondary money. a negotiable certificate of deposit (NCD) commercial paper government bond a repurchase agreement none of the above Intermediaries that help the financial system operate efficiently and transfer funds from savers and investors to individuals, businesses, and governments that seek to spend or invest the funds are known as: securities markets financial institutions financial markets government organizations Which of the following is not a primary market function of investment banks? Originating new securities issues. Assisting investors who want to trade existing securities. Underwriting new issues. Selling newly issued securities to investors. Which Federal law requires firms seeking an IPO to register with the SEC and give potential investors a prospectus? Securities Act of 1933 Glass-Steagall Act of 1933 Securities Exchange Act of 1934 Blue-Sky Law Which of the following is a law passed to correct ethical lapses in the financial markets? Glassdoor Act Sarbanes-Oxley Act Affordable Care Act. Securities Reinsurance Act. On-site examination of commercial banks is shared by the Fed and which of the following? Federal Deposit insurance Corporation Office of the Comptroller of the Currency State Regulatory Agencies All of the above The issuing of new securities, mortgages, and other claims to wealth takes place in the: securities market primary market money market secondary market facilitate the transfer of financial assets among individuals, institutions, businesses, and governments. none of the above Financial markets Government institutions Regulatory authorities You buy a stock for $100 and sell it for $140; what is the percentage return if the margin requirement is 40 percent? is a promise of future payment issued by a firm and guaranteed by a bank that is used to finance international trade with typical maturities ranging from one to six months. a banker's acceptance a negotiable certificate of deposit (NCD) commercial paper a repurchase agreement none of the above What are financial markets, where debt securities with maturities of one year or less are issued and traded, called? Money markets Capital markets Primary markets Secondary markets As the economy begins moving out of a recessionary period, the yield curve is generally: Upward sloping Discontinues Downward sloping Flattened out The percentage of deposits that banks must hold in reserve is called Required reserves ratio Vault cash ratio Excess reserve ratio Currency ratio. Total reserve ratio An agreement whereby an investment banker tries to sell securities of an issuing corporation, but assumes no risk if the flotation is unsuccessful is called a: Due diligence agreement Firm commitment price agreement Shelf registration agreement Best-effort agreement The item on the assets side of a bank's balance sheet that represents the largest proportion of bank assets is: deposits securities owner's capital loans QUESTION 19 Treasury bills are : long-term securities issued by money market mutual funds. long-term securities issued by the federal government . short-term securities issued by money market mutual funds. short-term securities issued by the federal government. You purchase 100 shares for $50 a share and after a year the price of the stock falls to $40 a share. What will be the percentage of loss if you bought the stock with 25% margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts