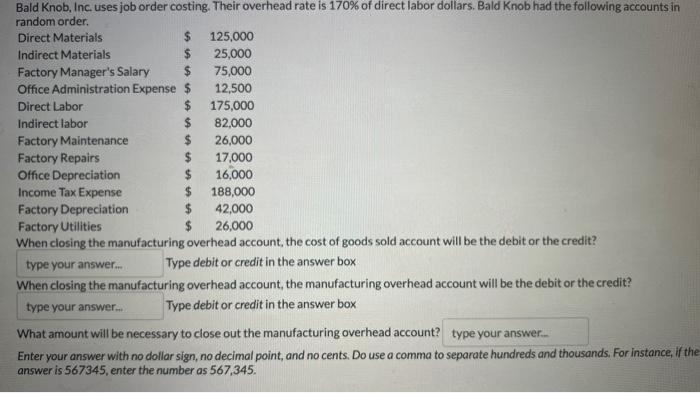

Question: please help!!! When closing the manufacturing overhead account, the cost of goods sold account will be the debit or the credit? Type debit or credit

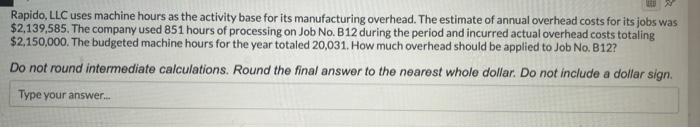

When closing the manufacturing overhead account, the cost of goods sold account will be the debit or the credit? Type debit or credit in the answer box When closing the manufacturing overhead account, the manufacturing overhead account will be the debit or the credit? Type debit or credit in the answer box What amount will be necessary to close out the manufacturing overhead account? Enter your answer with no dollar sign, no decimal point, and no cents. Do use a comma to separate hundreds and thousands. For instance, if th answer is 567345 , enter the number as 567,345 . Rapido, LLC uses machine hours as the activity base for its manufacturing overhead. The estimate of annual overhead costs for its jobs was $2,139,585. The company used 851 hours of processing on Job No. B12 during the period and incurred actual overhead costs totaling $2,150,000. The budgeted machine hours for the year totaled 20,031. How much overhead should be applied to Job No. B12? Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Do not include a dollar sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts