Question: Please help wherever you can!! Common stock valueVariable growth Newman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year

Please help wherever you can!!

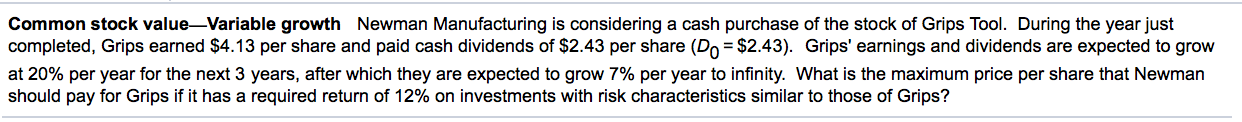

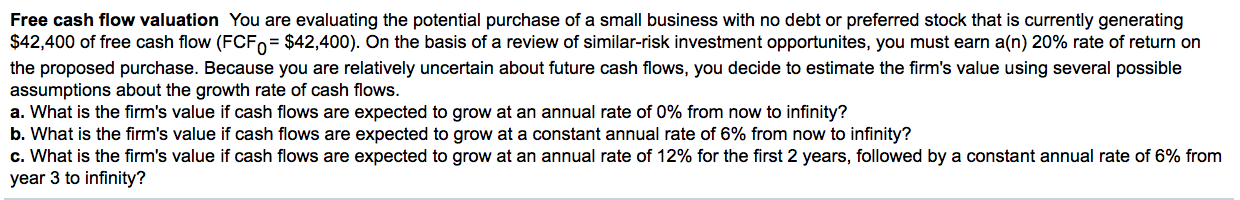

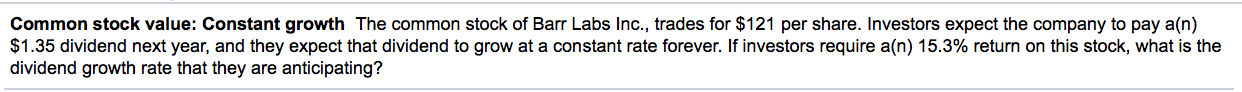

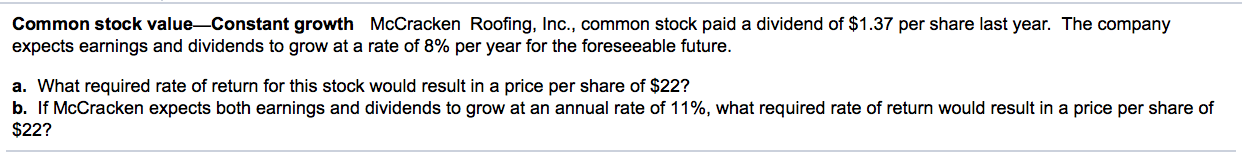

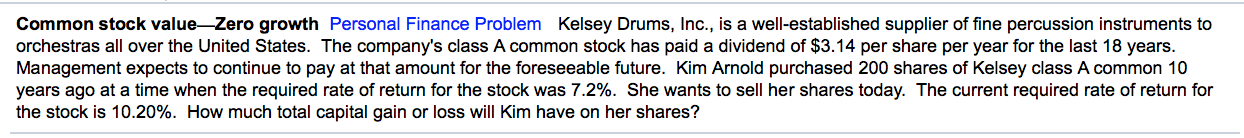

Common stock valueVariable growth Newman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year just completed, Grips earned $4.13 per share and paid cash dividends of $2.43 per share (Do = $2.43). Grips' earnings and dividends are expected to grow at 20% per year for the next 3 years, after which they are expected to grow 7% per year to infinity. What is the maximum price per share that Newman should pay for Grips if it has a required return of 12% on investments with risk characteristics similar to those of Grips? Free cash flow valuation You are evaluating the potential purchase of a small business with no debt or preferred stock that is currently generating $42,400 of free cash flow (FCFo= $42,400). On the basis of a review of similar-risk investment opportunites, you must earn an) 20% rate of return on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using several possible assumptions about the growth rate of cash flows. a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity? b. What is the firm's value if cash flows are expected to grow at a constant annual rate of 6% from now to infinity? c. What is the firm's value if cash flows are expected to grow at an annual rate of 12% for the first 2 years, followed by a constant annual rate of 6% from year 3 to infinity? Common stock value: Constant growth The common stock of Barr Labs Inc., trades for $121 per share. Investors expect the company to pay a(n) $1.35 dividend next year, and they expect that dividend to grow at a constant rate forever. If investors require a(n) 15.3% return on this stock, what is the dividend growth rate that they are anticipating? Common stock value-Constant growth McCracken Roofing, Inc., common stock paid a dividend of $1.37 per share last year. The company expects earnings and dividends to grow at a rate of 8% per year for the foreseeable future. a. What required rate of return for this stock would result in a price per share of $22? b. If McCracken expects both earnings and dividends to grow at an annual rate of 11%, what required rate of return would result in a price per share of $22? Common stock value-Zero growth Personal Finance Problem Kelsey Drums, Inc., is a well-established supplier of fine percussion instruments to orchestras all over the United States. The company's class A common stock has paid a dividend of $3.14 per share per year for the last 18 years. Management expects to continue to pay at that amount for the foreseeable future. Kim Arnold purchased 200 shares of Kelsey class A common 10 years ago at a time when the required rate of return for the stock was 7.2%. She wants to sell her shares today. The current required rate of return for the stock is 10.20%. How much total capital gain or loss will Kim have on her shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts