Question: Please help, Will thumbs up b. Complete the table given below to calculate the total operating cost for year 1, year 2 and year 3.

Please help, Will thumbs up

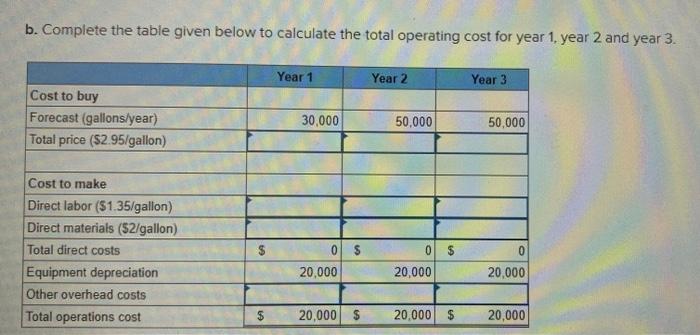

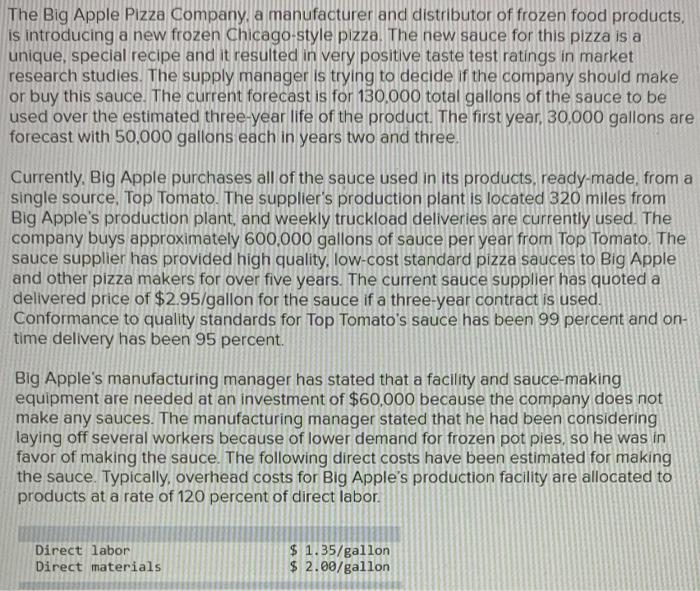

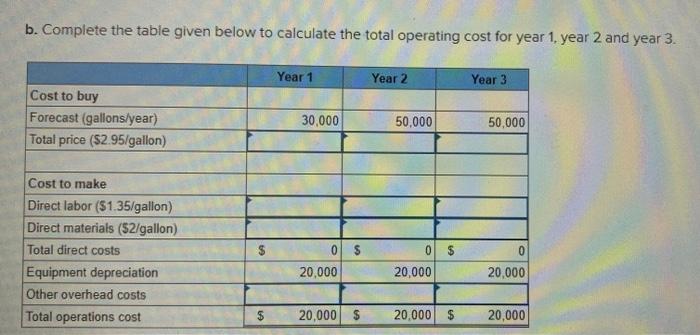

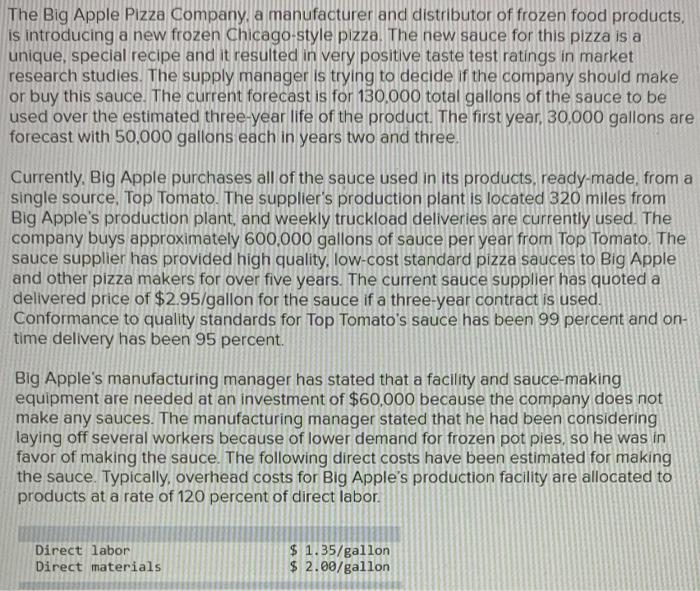

b. Complete the table given below to calculate the total operating cost for year 1, year 2 and year 3. Year 1 Year 2 Year 3 Cost to buy Forecast (gallons/year) Total price (52.95/gallon) 30,000 50,000 50,000 Cost to make Direct labor ($1.35/gallon) Direct materials (52/gallon) Total direct costs Equipment depreciation Other overhead costs Total operations cost 0 $ 20,000 20,000 20,000 $ 20,000 $ 20,000 $ 20,000 The Big Apple Pizza Company, a manufacturer and distributor of frozen food products, is introducing a new frozen Chicago-style pizza. The new sauce for this pizza is a unique, special recipe and it resulted in very positive taste test ratings in market research studies. The supply manager is trying to decide if the company should make or buy this sauce. The current forecast is for 130,000 total gallons of the sauce to be used over the estimated three-year life of the product. The first year, 30.000 gallons are forecast with 50,000 gallons each in years two and three. Currently, Big Apple purchases all of the sauce used in its products, ready-made, from a single source, Top Tomato. The supplier's production plant is located 320 miles from Big Apple's production plant, and weekly truckload deliveries are currently used. The company buys approximately 600,000 gallons of sauce per year from Top Tomato. The sauce supplier has provided high quality, low-cost standard pizza sauces to Big Apple and other pizza makers for over five years. The current sauce supplier has quoted a delivered price of $2.95/gallon for the sauce if a three-year contract is used. Conformance to quality standards for Top Tomato's sauce has been 99 percent and on- time delivery has been 95 percent. Big Apple's manufacturing manager has stated that a facility and sauce-making equipment are needed at an investment of $60,000 because the company does not make any sauces. The manufacturing manager stated that he had been considering laying several workers because of lower demand for frozen pot pies, so he was in favor of making the sauce. The following direct costs have been estimated for making the sauce. Typically, overhead costs for Big Apple's production facility are allocated to products at a rate of 120 percent of direct labor. Direct labor Direct materials $ 1.35/gallon $ 2.00/gallon

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock