Question: Please help! Will upvote, thank you!! Please help, I will not go through an outside source. Please answer through Chegg only. Thank you!!! Problem 11-14

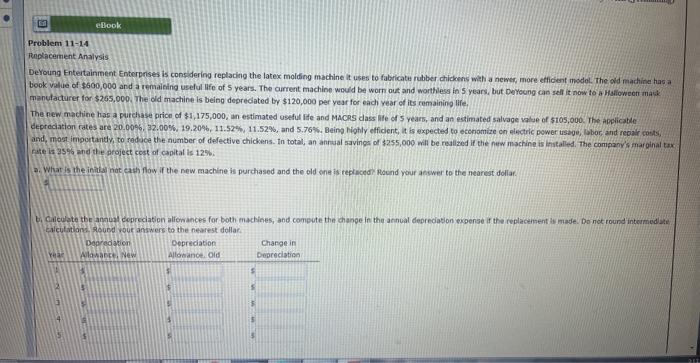

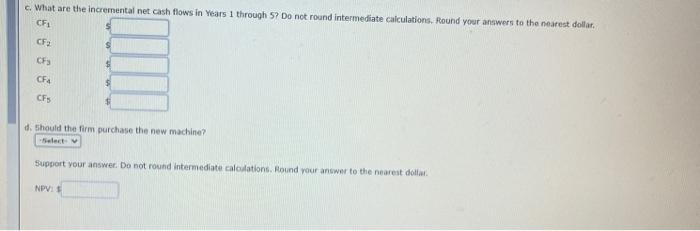

Problem 11-14 Renptacement Analysis DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chichens wh a nemer, more etficient modol. The old machine hag a book vilue of $600,000 and a remaieing useful llfe of 5 years. The current machine would be worn out and worthless in 5 years, but oeyoung cab sell it now to a Haliowecr matk manuacturer for $265,000. The did machine is being deprecated by $120,000 per year for ead year of its remaining life. The pew machine has a purchase price of \$1,175,000, an estimated osefur life and Macrs dass life of 5 years, and an estimated salvage value of stos, 000. Ihe abplicated and, mogt importantly, to redece the number of defective chickens. In total, an annual savings of 255,000 mill be realized if the new mochine is installed. The company's maroinal tax fite is 39% whe the arojest cost of capital is 12%. a. What is the inabliy not eath flow if the new machine is purchased and the old one is replacedr pocnd your aciwer to the nearest dollar. c. What are the incremental net cash flows in Years 1 through 5? Do not round intermediate calculations, found yoer answers to the nearest dollar, d. Should that firm purchase the new machine? Support your answer. Do not round intermediate calodations. Round rour answer to the nearest dollar. NEYi 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts