Question: Please help!! Will upvote, thank you!! You miust evaluate the purchase of a proposed spectrometer for the RsD department. The base price is $150,000, and

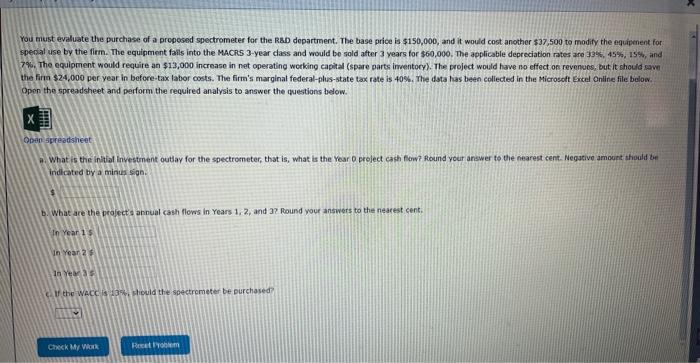

You miust evaluate the purchase of a proposed spectrometer for the RsD department. The base price is $150,000, and it would cost another $37,500 to modify the equipenent for sperial use by the firm. The equipment fails into the MACAS 3 -year dass and would be sold after 3 years for $60,000. The applicable depreciation rates are 335\%, 45%, 1S\%, and 7\%. The equipment would require an $13,000 increase in net operating werking capital (spare parts inventory). The project would have no effect on revenues, but it chould rave the firm \$24,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 40%. The data has been collected in the Microsoft Encel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Qoen spreadsheet a. What is the initial investment outlay for the spectrometer, that is, what is the Year Q prolect cash fors? foumd your answer to the nearest cent. Negutive amount ahould be indicated by a minus sign. b. What are the projects annual cash flows in Years 1, 2, and 3 ? pound wour answers to the neacest cent. In Year 15 in Year 75 10 reas 3= If the WaCc is 13 . Hiculd the spectrometer be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts