Question: Please help with #3-5 BE7 due 0405, 1 point The brief exercise from the book has two requirements, please see below Requirements. Please show work

Please help with #3-5

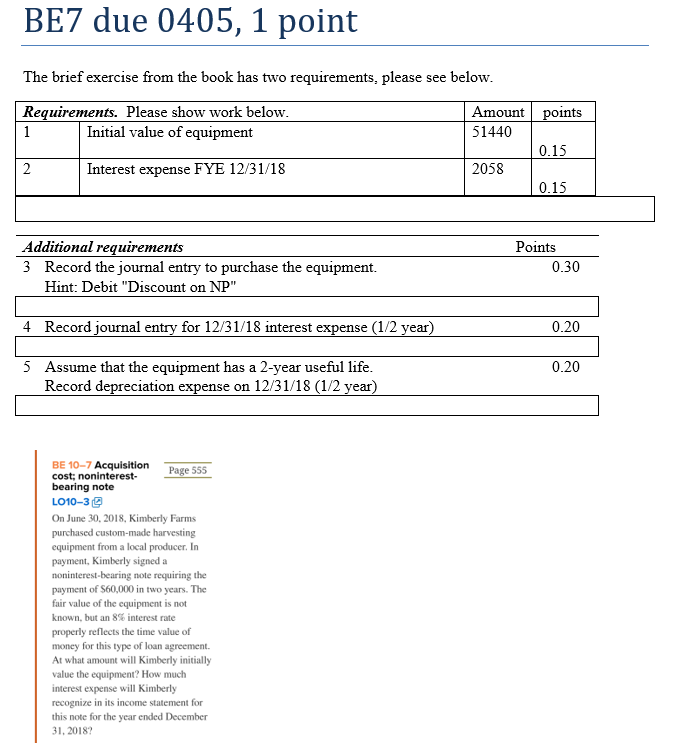

BE7 due 0405, 1 point The brief exercise from the book has two requirements, please see below Requirements. Please show work below Amount 51440 oints Initial value of equipment 0.15 Interest expense FYE 12/31/18 2058 0.15 Additional reauirements Points 3 Record the journal entry to purchase the equipment. Hint: Debit "Discount on NP" 0.30 4 Record journal entry for 12/31/18 interest e se (1/2 year) 0.20 5 Assume that the equipment has a 2-year useful life Record depreciation expense on 12/31/18 (1/2 year 0.20 BE 10-7 Acquisition Page 555 cost; noninterest- bearing note LO10-3 g On June 30. 2018, Kimberly Farms equipment from a local producer. In payment, Kimberly signed a noninterest-bearing note requiring the payment of $60,000 in two years. The fair value of the equipment is not known, but an 8% interest rate properly reflects the time value of money for this type of loan agreement. At what amount will Kimberly initially value the equipment? How much interest expense will Kimberly recognize in its income statement for this note for the year ended December 31, 20187

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts