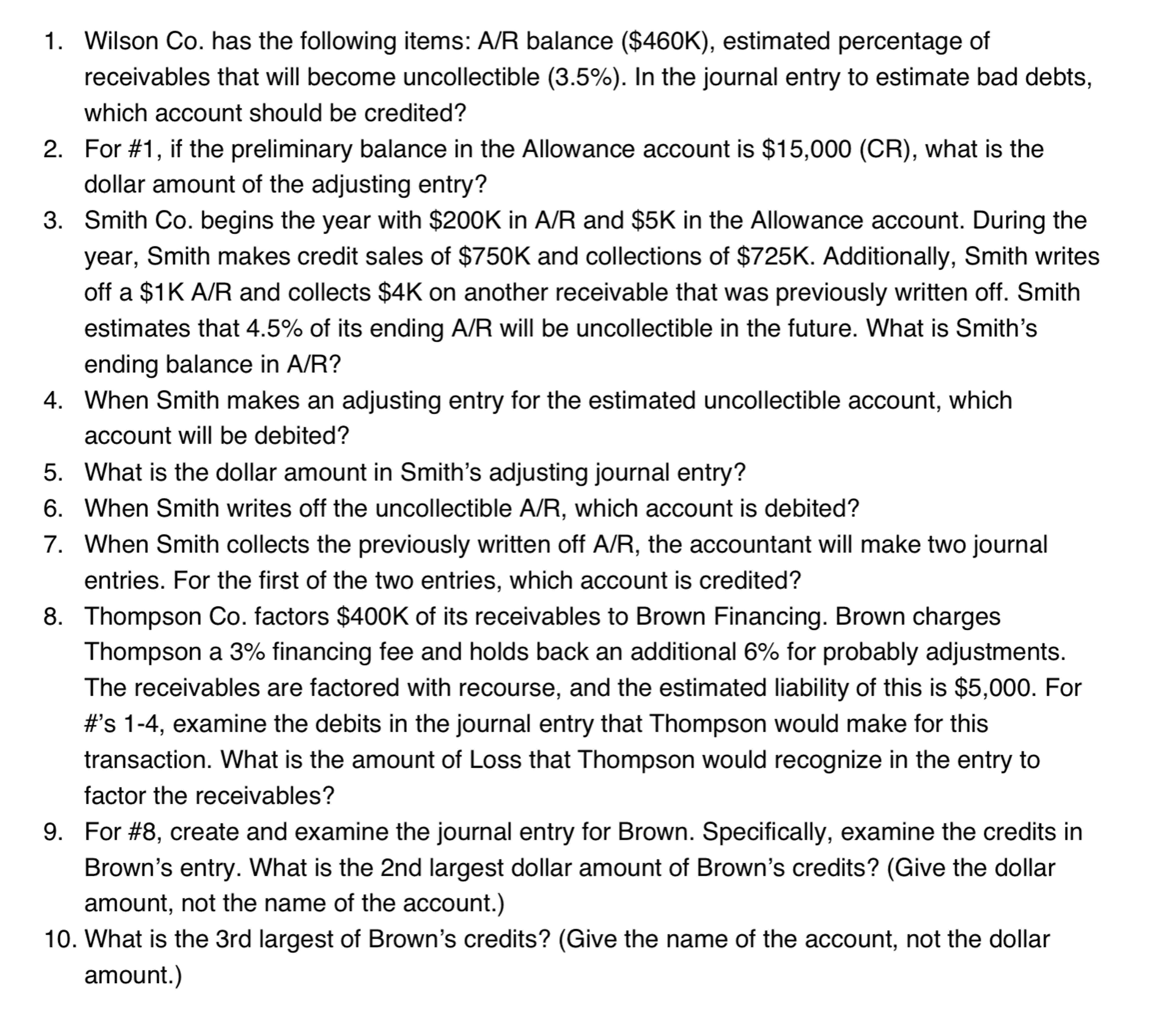

Question: PLEASE HELP WITH 8 , 9 , 1 0 . 1 . Wilson Co . has the following items: A / R balance (

PLEASE HELP WITH Wilson Co has the following items: AR balance $K estimated percentage of receivables that will become uncollectible In the journal entry to estimate bad debts, which account should be credited?

For # if the preliminary balance in the Allowance account is $ mathrmCR what is the dollar amount of the adjusting entry?

Smith Co begins the year with $ mathrm~K in mathrmAmathrmR and $ mathrm~K in the Allowance account. During the year, Smith makes credit sales of $ mathrm~K and collections of $ mathrm~K Additionally, Smith writes off a $ mathrm~K A mathrmR and collects $ mathrm~K on another receivable that was previously written off. Smith estimates that of its ending A R will be uncollectible in the future. What is Smith's ending balance in A R

When Smith makes an adjusting entry for the estimated uncollectible account, which account will be debited?

What is the dollar amount in Smith's adjusting journal entry?

When Smith writes off the uncollectible A R which account is debited?

When Smith collects the previously written off A R the accountant will make two journal entries. For the first of the two entries, which account is credited?

Thompson Co factors $ mathrm~K of its receivables to Brown Financing. Brown charges Thompson a financing fee and holds back an additional for probably adjustments. The receivables are factored with recourse, and the estimated liability of this is $ For #s examine the debits in the journal entry that Thompson would make for this transaction. What is the amount of Loss that Thompson would recognize in the entry to factor the receivables?

For # create and examine the journal entry for Brown. Specifically, examine the credits in Brown's entry. What is the nd largest dollar amount of Brown's credits? Give the dollar amount, not the name of the account.

What is the rd largest of Brown's credits? Give the name of the account, not the dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock