Question: Please help with A and B Grenouille Properties. Grenouille Properties (U.S.) expects to receive cash dividends from a French joint venture over the coming three

Please help with A and B

Please help with A and B

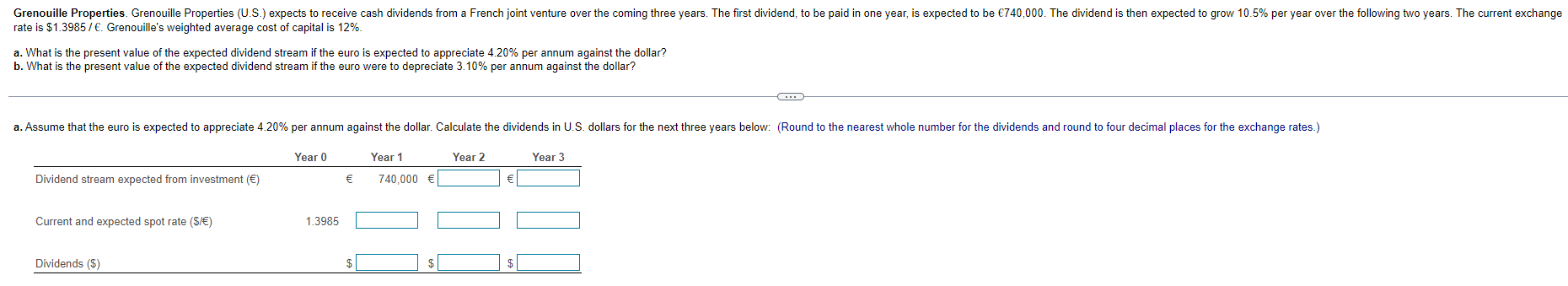

Grenouille Properties. Grenouille Properties (U.S.) expects to receive cash dividends from a French joint venture over the coming three years. The first dividend, to be paid in one year, is expected to be 740,000. The dividend is then expected to grow 10.5% per year over the following two years. The current exchange rate is $1.39857. Grenouille's weighted average cost of capital is 12%. a. What is the present value of the expected dividend stream if the euro is expected to appreciate 4.20% per annum against the dollar? b. What is the present value of the expected dividend stream if the euro were to depreciate 3.10% per annum against the dollar? . a. Assume that the euro is expected to appreciate 4.20% per annum against the dollar. Calculate the dividends in U.S. dollars for the next three years below: (Round to the nearest whole number for the dividends and round to four decimal places for the exchange rates.) Year 0 Year 1 Year 2 Year 3 Dividend stream expected from investment () 740,000 Current and expected spot rate (S/) 1.3985 Dividends ($)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts