Question: Please Help With Accounting Exercise BE8-13 Enclosed in image is exercise. Please Complete on Microsoft Excel. Thank You. 60,000 Ratios: Gross profit ratio for 2018

Please Help With Accounting Exercise BE8-13

Enclosed in image is exercise. Please Complete on Microsoft Excel. Thank You.

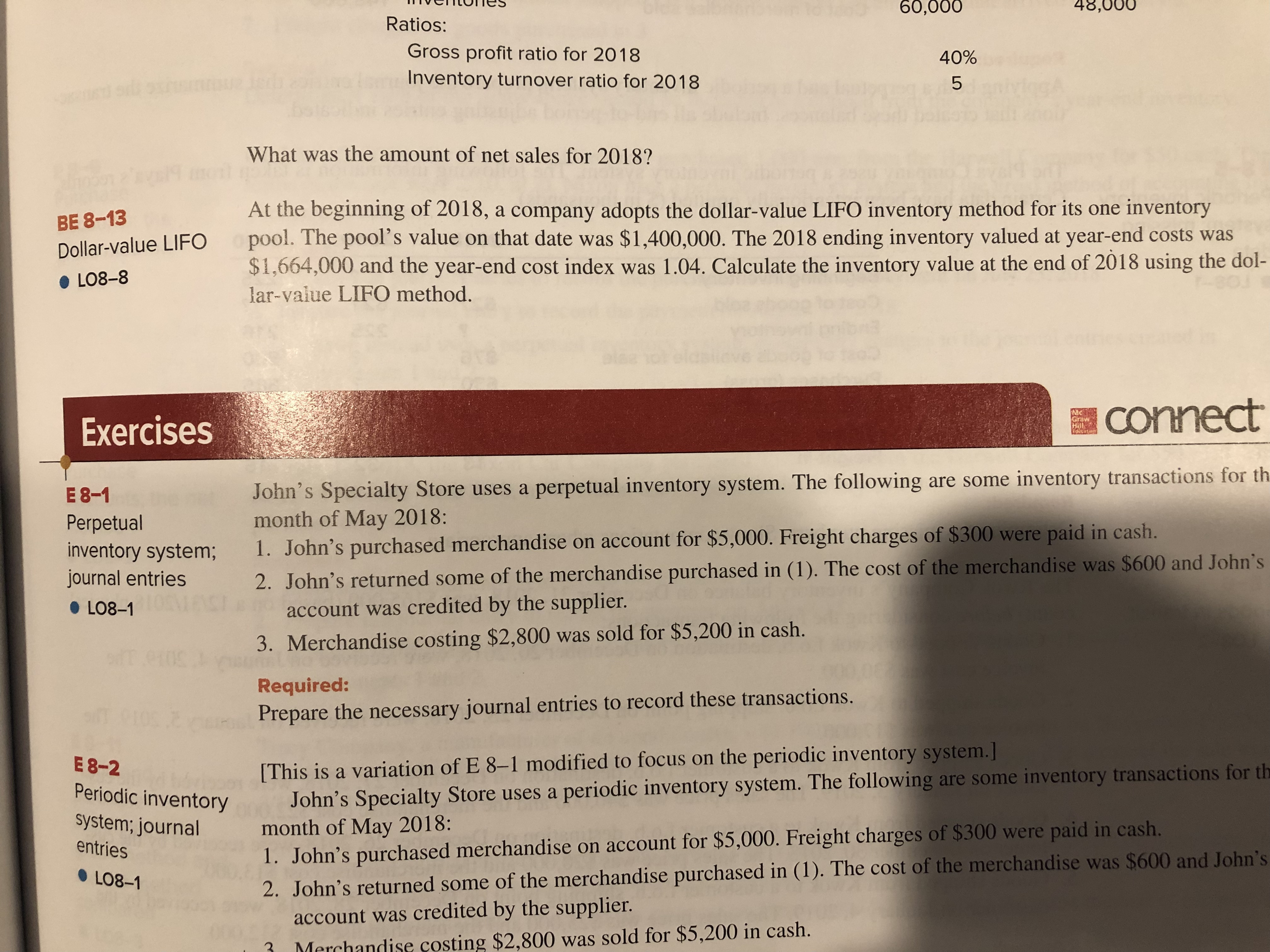

60,000 Ratios: Gross profit ratio for 2018 40% Inventory turnover ratio for 2018 5 What was the amount of net sales for 2018? BE 8-13 At the beginning of 2018, a company adopts the dollar-value LIFO inventory method for its one inventory Dollar-value LIFO pool. The pool's value on that date was $1,400,000. The 2018 ending inventory valued at year-end costs was . LO8-8 $1,664,000 and the year-end cost index was 1.04. Calculate the inventory value at the end of 2018 using the dol- lar-value LIFO method. Exercises connect E 8-1 John's Specialty Store uses a perpetual inventory system. The following are some inventory transactions for th Perpetual month of May 2018: inventory system; 1. John's purchased merchandise on account for $5,000. Freight charges of $300 were paid in cash. journal entries 2. John's returned some of the merchandise purchased in (1). The cost of the merchandise was $600 and John's . LO8-1 account was credited by the supplier. 3. Merchandise costing $2,800 was sold for $5,200 in cash. Required: Prepare the necessary journal entries to record these transactions. E8-2 [This is a variation of E 8-1 modified to focus on the periodic inventory system. ] Periodic inventory John's Specialty Store uses a periodic inventory system. The following are some inventory transactions for th system; journal month of May 2018: entries 1. John's purchased merchandise on account for $5,000. Freight charges of $300 were paid in cash. . L08-1 2. John's returned some of the merchandise purchased in (1). The cost of the merchandise was $600 and John's account was credited by the supplier. costing $2,800 was sold for $5,200 in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts