Question: Please Help With Accounting Exercise E9-4. Enclosed in image is exercise. Please Complete on Microsoft Excel. ThankYou. 104 Required: 1. Determine the carrying value of

Please Help With Accounting Exercise E9-4.

Enclosed in image is exercise. Please Complete on Microsoft Excel. ThankYou.

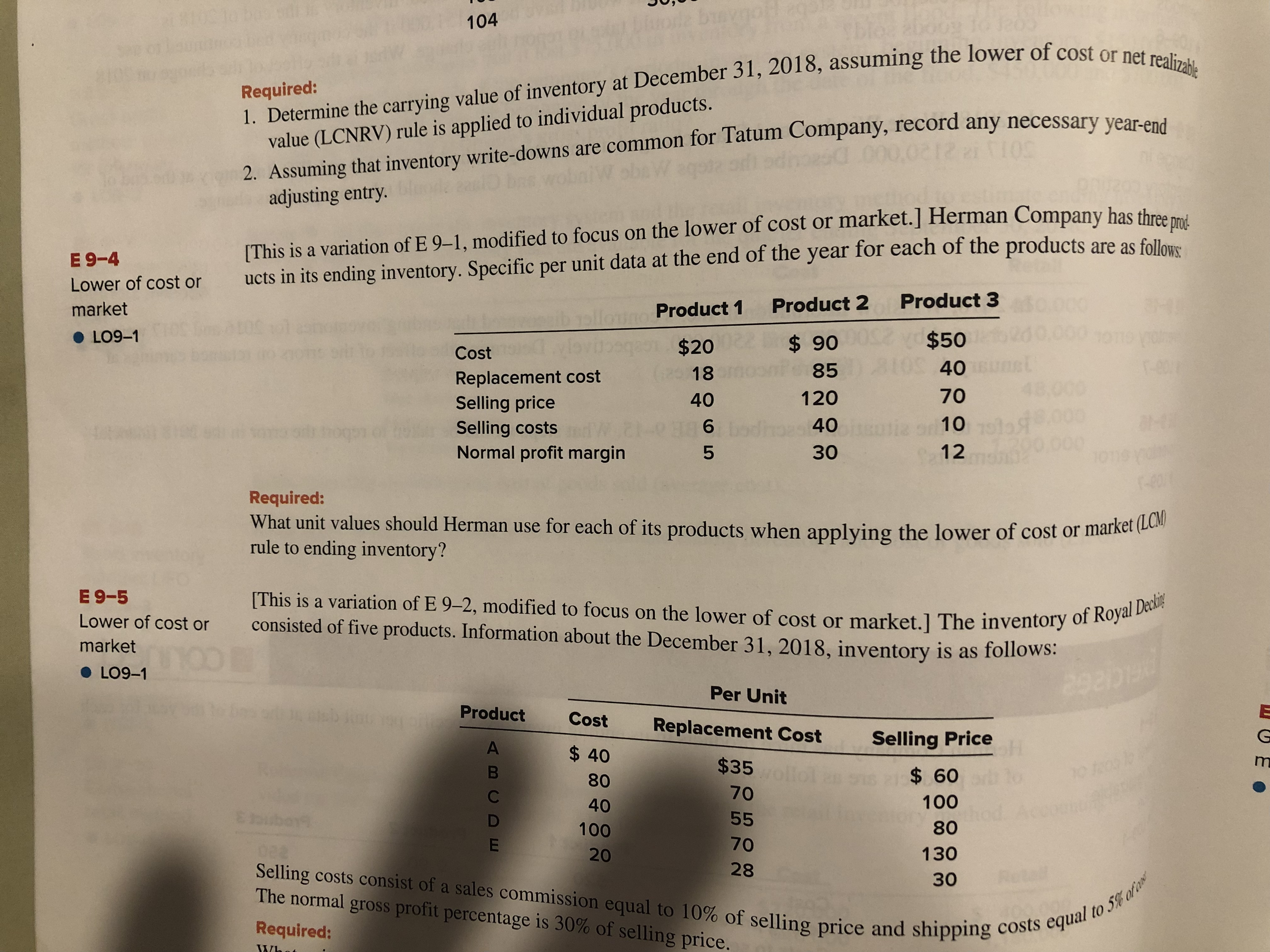

104 Required: 1. Determine the carrying value of inventory at December 31, 2018, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 2. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end 90.0212 2 109 adjusting entry. [This is a variation of E 9-1, modified to focus on the lower of cost or market. ] Herman Company has three prod. E9-4 ucts in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows: Lower of cost or market Product 1 Product 2 Product 3 . LO9-1 Cost $20 $ 90 $50 16260.090 one Yours Replacement cost 18 85 Selling price 40 120 70 48,000 Selling costs 6 40 Normal profit margin 30 12 Required: What unit values should Herman use for each of its products when applying the lower of cost or market (LCM) rule to ending inventory? E 9-5 Lower of cost or [This is a variation of E 9-2, modified to focus on the lower of cost or market.] The inventory of Royal Deckis market consisted of five products. Information about the December 31, 2018, inventory is as follows: . LO9-1 100 Per Unit Product Cost Replacement Cost Selling Price A $ 40 m B $35 80 $ 60 C 70 40 100 D 55 100 80 m 20 70 130 28 calling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% 30 Required: The normal gross profit percentage is 30% of selling price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts