Question: Please help with all asap please Question 1 XYZ operates indoor tracks. The firm is evaluating the Santa Fe projec and total costs of $78,800

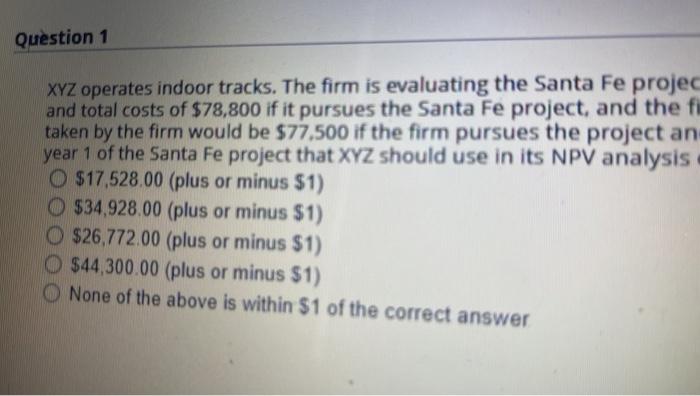

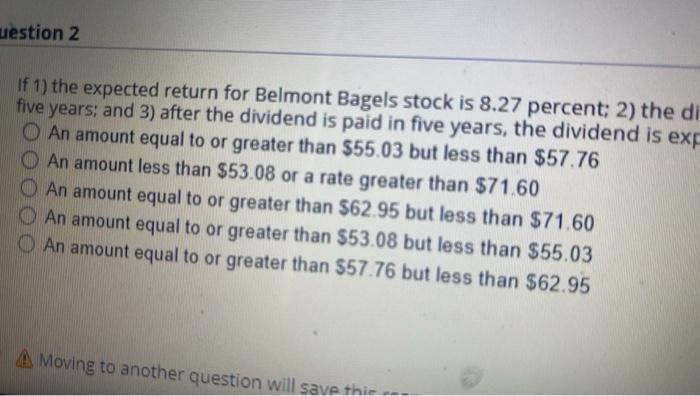

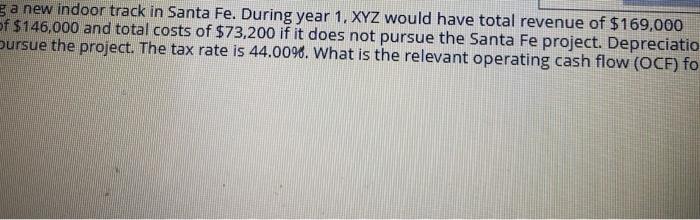

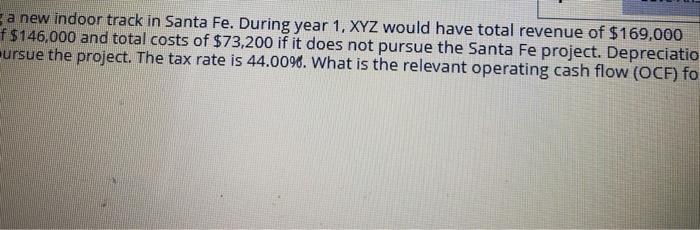

Question 1 XYZ operates indoor tracks. The firm is evaluating the Santa Fe projec and total costs of $78,800 if it pursues the Santa Fe project, and the fi taken by the firm would be $77,500 if the firm pursues the project and year 1 of the Santa Fe project that XYZ should use in its NPV analysis. O $17,528.00 (plus or minus $1) O $34,928.00 (plus or minus $1) $26,772.00 (plus or minus $1) $44,300.00 (plus or minus $1) None of the above is within $1 of the correct answer uestion 2 If 1) the expected return for Belmont Bagels stock is 8.27 percent; 2) the di five years; and 3) after the dividend is paid in five years, the dividend is exp O An amount equal to or greater than $55.03 but less than $57.76 An amount less than $53.08 or a rate greater than $71.60 O An amount equal to or greater than $62.95 but less than $71.60 An amount equal to or greater than $53.08 but less than $55.03 An amount equal to or greater than $57.76 but less than $62.95 A Moving to another question will save this ga new indoor track in Santa Fe. During year 1, XYZ would have total revenue of $169,000 of $146,000 and total costs of $73,200 if it does not pursue the Santa Fe project. Depreciatio Oursue the project. The tax rate is 44.00%. What is the relevant operating cash flow (OCF) fo a new indoor track in Santa Fe. During year 1, XYZ would have total revenue of $169,000 f$146,000 and total costs of $73,200 if it does not pursue the Santa Fe project. Depreciatio ursue the project. The tax rate is 44.0096. What is the relevant operating cash flow (OCF) fo Question 1 XYZ operates indoor tracks. The firm is evaluating the Santa Fe projec and total costs of $78,800 if it pursues the Santa Fe project, and the fi taken by the firm would be $77,500 if the firm pursues the project and year 1 of the Santa Fe project that XYZ should use in its NPV analysis. O $17,528.00 (plus or minus $1) O $34,928.00 (plus or minus $1) $26,772.00 (plus or minus $1) $44,300.00 (plus or minus $1) None of the above is within $1 of the correct answer uestion 2 If 1) the expected return for Belmont Bagels stock is 8.27 percent; 2) the di five years; and 3) after the dividend is paid in five years, the dividend is exp O An amount equal to or greater than $55.03 but less than $57.76 An amount less than $53.08 or a rate greater than $71.60 O An amount equal to or greater than $62.95 but less than $71.60 An amount equal to or greater than $53.08 but less than $55.03 An amount equal to or greater than $57.76 but less than $62.95 A Moving to another question will save this ga new indoor track in Santa Fe. During year 1, XYZ would have total revenue of $169,000 of $146,000 and total costs of $73,200 if it does not pursue the Santa Fe project. Depreciatio Oursue the project. The tax rate is 44.00%. What is the relevant operating cash flow (OCF) fo a new indoor track in Santa Fe. During year 1, XYZ would have total revenue of $169,000 f$146,000 and total costs of $73,200 if it does not pursue the Santa Fe project. Depreciatio ursue the project. The tax rate is 44.0096. What is the relevant operating cash flow (OCF) fo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts