Question: Please help with attached question: The process used to model a risk is a Poisson surplus process with Poisson parameter _ and individual claim size

Please help with attached question:

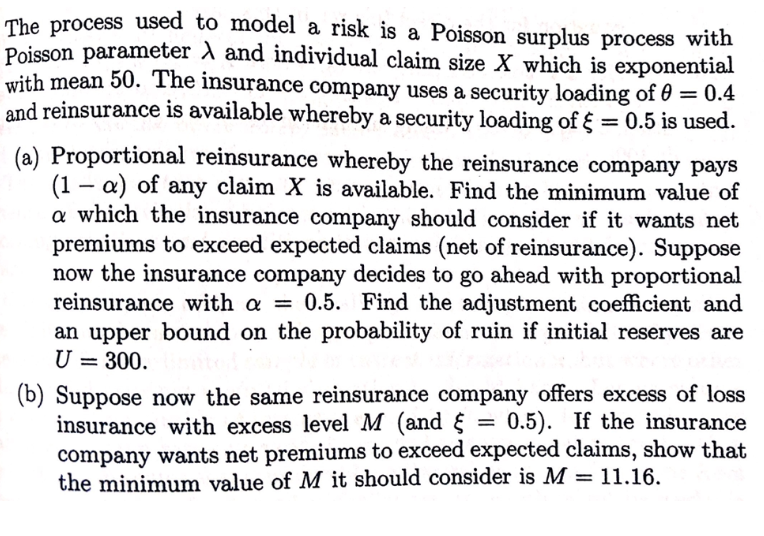

The process used to model a risk is a Poisson surplus process with Poisson parameter _ and individual claim size X which is exponential with mean 50. The insurance company uses a security loading of 0 = 0.4 and reinsurance is available whereby a security loading of { = 0.5 is used. (a) Proportional reinsurance whereby the reinsurance company pays (1 - @) of any claim X is available. Find the minimum value of a which the insurance company should consider if it wants net premiums to exceed expected claims (net of reinsurance). Suppose now the insurance company decides to go ahead with proportional reinsurance with a = 0.5. Find the adjustment coefficient and an upper bound on the probability of ruin if initial reserves are U = 300. (b) Suppose now the same reinsurance company offers excess of loss insurance with excess level M (and { = 0.5). If the insurance company wants net premiums to exceed expected claims, show that the minimum value of M it should consider is M = 11.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts