Question: please help with both ill rate your answer! QUESTION 24 A life insurance company has offered you a new cash grower policy that will be

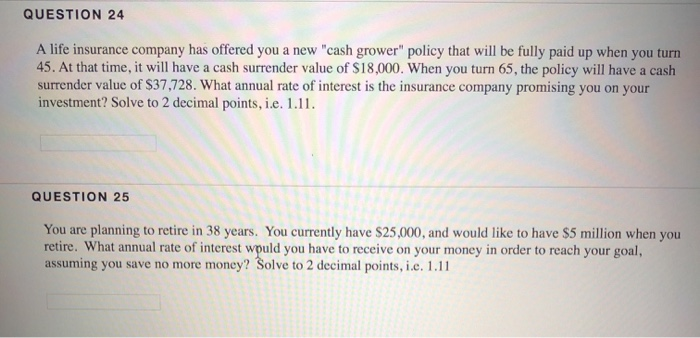

QUESTION 24 A life insurance company has offered you a new "cash grower" policy that will be fully paid up when you turn 45. At that time, it will have a cash surrender value of $18,000. When you turn 65, the policy will have a cash surrender value of $37,728. What annual rate of interest is the insurance company promising you on your investment? Solve to 2 decimal points, i.e. 1.11. QUESTION 25 You are planning to retire in 38 years. You currently have $25,000, and would like to have $5 million when you retire. What annual rate of interest would you have to receive on your money in order to reach your goal, assuming you save no more money? Solve to 2 decimal points, i.e. 1.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts