Question: Please help with encoded or typed solutions II. The capital accounts of Reyes and Ramirez at the end of the fiscal year 2020 are as

Please help with encoded or typed solutions

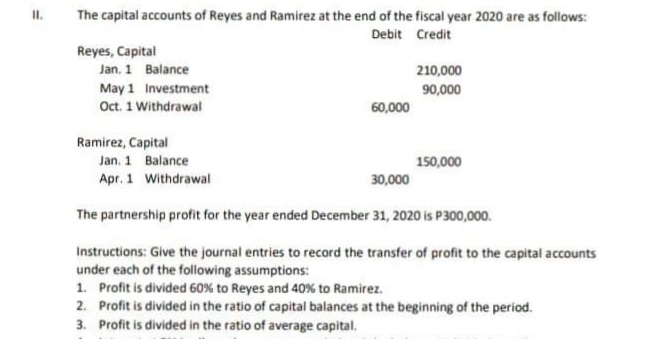

II. The capital accounts of Reyes and Ramirez at the end of the fiscal year 2020 are as follows: Debit Credit Reyes, Capital Jan, 1 Balance 210,000 May 1 Investment 90,000 Oct. 1 Withdrawal 60,000 Ramirez, Capital Jan. 1 Balance 150,000 Apr. 1 Withdrawal 30,000 The partnership profit for the year ended December 31, 2020 is P300,000. Instructions: Give the journal entries to record the transfer of profit to the capital accounts under each of the following assumptions: 1. Profit is divided 60%% to Reyes and 40% to Ramirez. 2. Profit is divided in the ratio of capital balances at the beginning of the period. 3. Profit is divided in the ratio of average capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts