Question: Please help with entry 3 calclution and give me a correct answer. Required information (The following information applies to the questions displayed below.) The partnership

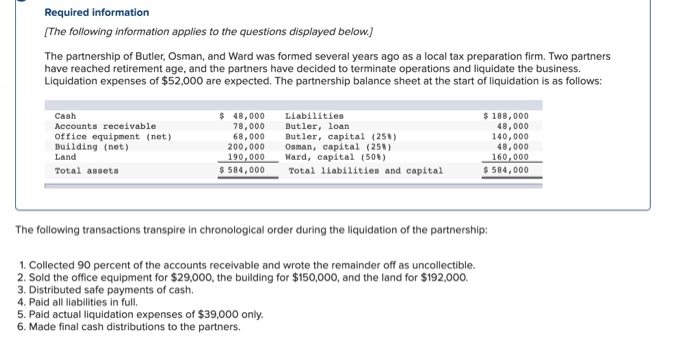

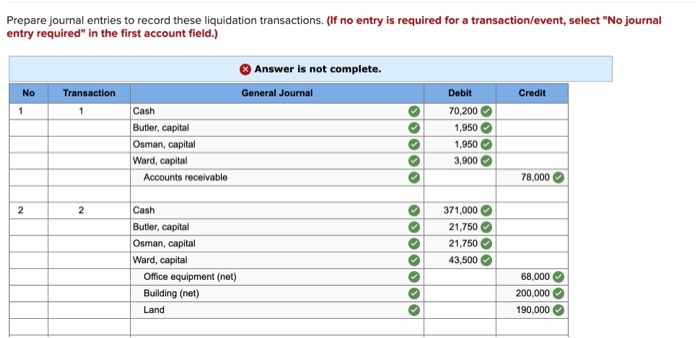

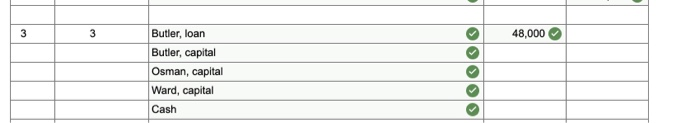

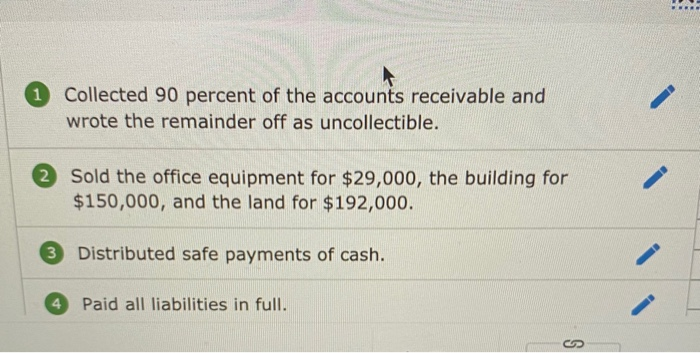

Required information (The following information applies to the questions displayed below.) The partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $52,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash Accounts receivable Office equipment (net) Building (net) Land Total assets $ 48,000 78,000 68,000 200,000 190,000 $ 584,000 Liabilities Butler, loan Butler, capital (251) Osman, capital (258) Ward, capital (508) Total liabilities and capital $ 188,000 48,000 140,000 48,000 160,000 $ 584,000 The following transactions transpire in chronological order during the liquidation of the partnership: 1. Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible. 2. Sold the office equipment for $29,000, the building for $150,000, and the land for $192,000. 3. Distributed safe payments of cash. 4. Paid all liabilities in full. 5. Paid actual liquidation expenses of $39,000 only. 6. Made final cash distributions to the partners. Prepare journal entries to record these liquidation transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. General Journal No 1 Transaction Credit Cash Butler, capital Osman, capital Ward, capital Accounts receivable Debit 70,200 1,950 1,950 3,900 78,000 2 2 371,000 21,750 21,750 43,500 Cash Butler, capital Osman, capital Ward, capital Office equipment (net) Building (net) Land OOO 000000 68,000 200,000 190,000 3 3 48,000 Butler, loan Butler, capital Osman, capital Ward, capital Cash OOOOO 1 Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible. 2 Sold the office equipment for $29,000, the building for $150,000, and the land for $192,000. 3 Distributed safe payments of cash. Paid all liabilities in full

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts