Question: Please help with exercise 3-19 only thank you CHAPTER 3 Adjusting Accounts for Financial Statements CHAPTER 3 Adjusting Accounts for Financial Statements Nuna Music Trial

Please help with exercise 3-19 only thank you

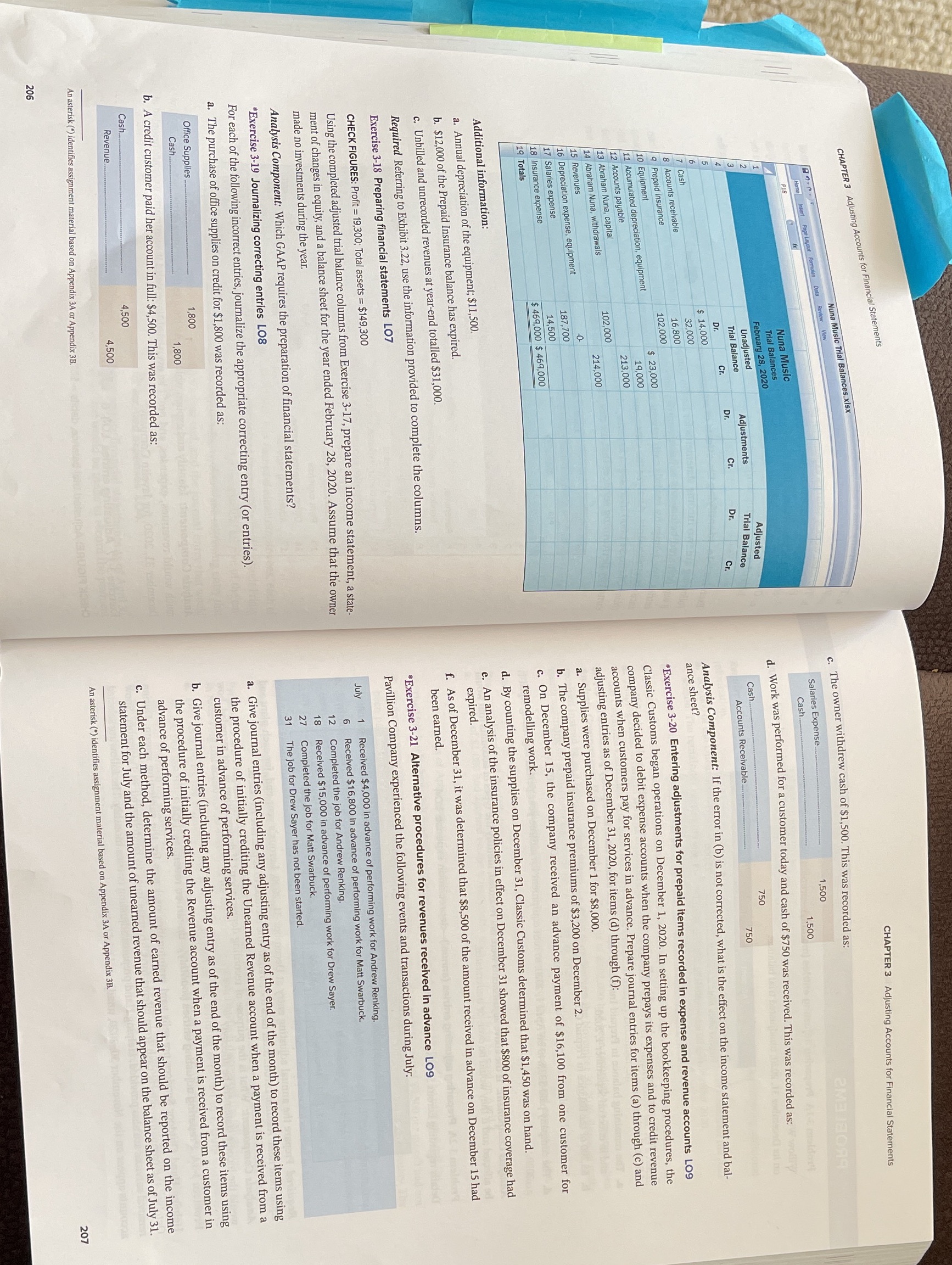

CHAPTER 3 Adjusting Accounts for Financial Statements CHAPTER 3 Adjusting Accounts for Financial Statements Nuna Music Trial Balances.xisx Horne Insert Page Layout Formations Data Review View c . The owner withdrew cash of $1,500 . This was recorded as : P18 ) tx Salaries Expense . 1,500 2Ma 18094 Nuna Music Cash .. 1.500 Trial Balances ebruary 28, 2020 Unadjusted Adjusted d. Work was performed for a customer today and cash of $750 was received. This was recorded as: Trial Balance Adjustments Trial Balance Cash. 750 Dr. Cr. Dr. Cr. Dr. Cr. Accounts Receivable . 750 $ 14,000 7 Cash 32,000 8 Accounts receivable Analysis Component: If the error in (b) is not corrected, what is the effect on the income statement and bal- 16,800 9 Prepaid insurance ance sheet? 102,000 10 Equipment $ 23,000 11 Accumulated depreciation, equipment "Exercise 3-20 Entering adjustments for prepaid items recorded in expense and revenue accounts LO9 19.000 12 Accounts payable 213.000 Classic Customs began operations on December 1, 2020. In setting up the bookkeeping procedures, the 13 Abraham Nuna, capital 14 Abraham Nuna, withdrawals 102,000 company decided to debit expense accounts when the company prepays its expenses and to credit revenue 214,000 accounts when customers pay for services in advance. Prepare journal entries for items (a) through (c) and 15 Revenues 16 Depreciation expense, equipment o adjusting entries as of December 31, 2020, for items (d) through (f): 17 Salaries expense 87,700 a. Supplies were purchased on December 1 for $8,000. 18 Insurance expense 14,500 19 Totals $ 469,000 $ 469,000 b. The company prepaid insurance premiums of $3,200 on December 2. c. On December 15, the company received an advance payment of $16,100 from one customer for remodelling work. Additional information: d. By counting the supplies on December 31, Classic Customs determined that $1,450 was on hand. a. Annual depreciation of the equipment; $11,500. e. An analysis of the insurance policies in effect on December 31 showed that $800 of insurance coverage had b. $12,000 of the Prepaid Insurance balance has expired. expired . C. Unbilled and unrecorded revenues at year-end totalled $31,000. f. As of December 31, it was determined that $8,500 of the amount received in advance on December 15 had Required Referring to Exhibit 3.22, use the information provided to complete the columns. been earned. Exercise 3-18 Preparing financial statements LO7 *Exercise 3-21 Alternative procedures for revenues received in advance LO9 CHECK FIGURES: Profit = 19,300; Total assets = $149,300 Pavillion Company experienced the following events and transactions during July: Using the completed adjusted trial balance columns from Exercise 3-17, prepare an income statement, a state July 1 Received $4,000 in advance of performing work for Andrew Renking. ment of changes in equity, and a balance sheet for the year ended February 28, 2020. Assume that the owner Received $16,800 in advance of performing work for Matt Swarbuck . made no investments during the year. 6 N 0O Completed the job for Andrew Renking. Received $15,000 in advance of performing work for Drew Sayer. Analysis Component: Which GAAP requires the preparation of financial statements? 27 Completed the job for Matt Swarbuck. *Exercise 3-19 Journalizing correcting entries LO8 31 The job for Drew Sayer has not been started . For each of the following incorrect entries, journalize the appropriate correcting entry ( or entries). a. Give journal entries (including any adjusting entry as of the end of the month) to record these items using a. The purchase of office supplies on credit for $1,800 was recorded as: the procedure of initially crediting the Unearned Revenue account when a payment is received from a Office Supplies .. 1,800 customer in advance of performing services. Cash.. 1.800 b. Give journal entries (including any adjusting entry as of the end of the month) to record these items using b. A credit customer paid her account in full: $4,500. This was recorded as: the procedure of initially crediting the Revenue account when a payment is received from a customer in advance of performing services. Cash.. 4,500 Revenue ... c. Under each method, determine the amount of earned revenue that should be reported on the income 4,500 statement for July and the amount of unearned revenue that should appear on the balance sheet as of July 31. An asterisk (") identifies assignment material based on Appendix 3A or Appendix 3B. An asterisk (') identifies assignment material based on Appendix 3A or Appendix 3B. 206 207

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts