Question: please help with g and h Case 2: Spatial Technology. Inc. 66 Exhibit 5c Cash Flow Statements SPATIAL TECHNOLOGY INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

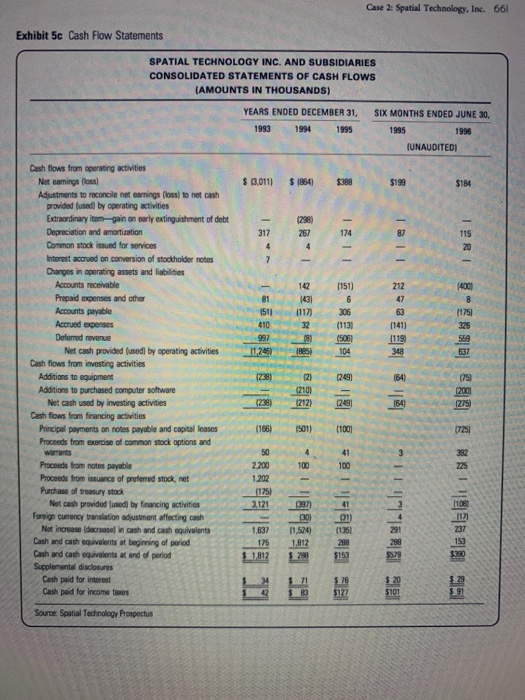

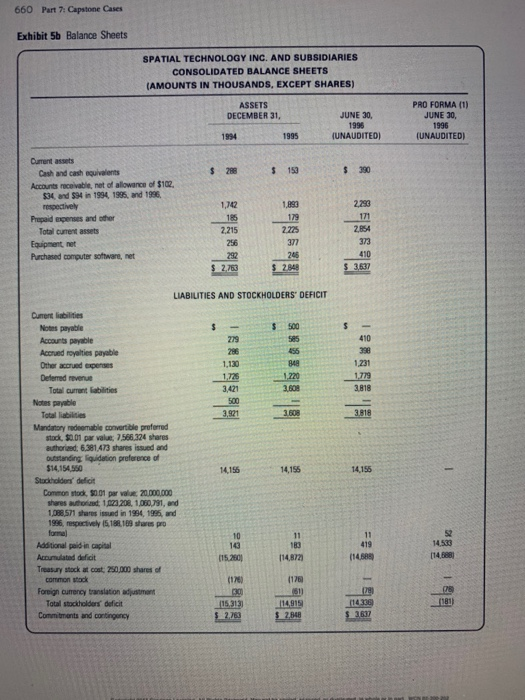

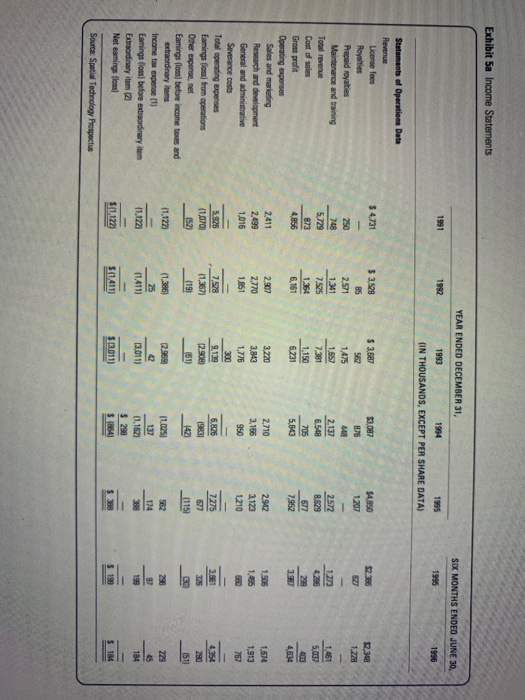

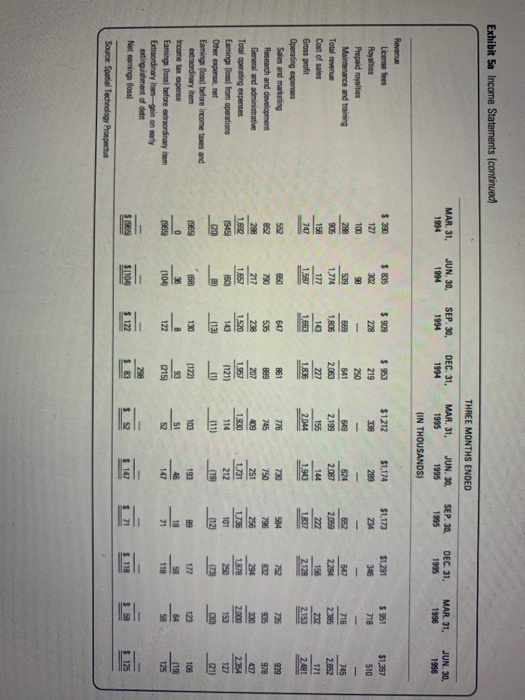

Case 2: Spatial Technology. Inc. 66 Exhibit 5c Cash Flow Statements SPATIAL TECHNOLOGY INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS AMOUNTS IN THOUSANDS) YEARS ENDED DECEMBER 31, SIX MONTHS ENDED JUNE 30, 1993 1994 1995 1995 1996 UNAUDITED Cash flows from aperating activities Net eamings (loss Adustments to reconcile net earnings (loss) to net cash S (3.011) (854) $388 $199 $184 provided lused) by operating activities Extraordinary item gain on early extinguishment of debt Depreciation and amortization Common stock issued for services Interest accrued on conversion of stockholder notes Changes in operating assets and liabilities 317 267 174 115 20 Accounts receivable Prepaid expenses and othr Accounts payable Accrued expenses Deferred revenue 142 (151) 212 47 141) (511 411 306 175 41032(113 -29- 104 238)12)(24) Net cash provid (used) by operating actites Cash flows from investing activities Additions to equipment Additions to purchased computer software Net cash used by investing activities Cash flows from financing activities Principal payments on notes payable and capital leases Proceeds from exercise of common stock options and 166) (501)(100 50 2200 100 100 1,202 (175, Proceeds from notes payable Proceeds from issuance of preferred stock, net Purchase of treasury stock Net cash provided jused) by financing activities Foreign cureny tans ation .smen arfectig cash 3121397) 41 1121 00-, Nat increase (decroasel in cash and cash equivaients Cash and cash eqivalents at beginning of porod Cash and cash equivalents at end of period Supplemental disclosures 637 1,524) (135 175 1312 Cash paid for intores Cash paid for income taxes Source Spatial Technology Prospectus 660 Part 7: Capstone Cases Exhibit 5b Balance Sheets SPATIAL TECHNOLOGY INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS AMOUNTS IN THOUSANDS, EXCEPT SHARES) ASSETS DECEMBER 31, PRO FORMA (1) JUNE 30, 1996 (UNAUDITED) JUNE 30, 1995 UNAUDITED) 1994 Cument assets S 153 S 390 Cash and cash equivalent Accounts receivable, net of allowance of $102 534 and S4 n 1994, 198, and 199 2,293 1,742 185 2,215 256 1, Prepaid expenses and other Total current assets Equipment net Purchased computer sofhware, net 373 410 S 3637 377 S 2,763 LIABILITIES AND STOCKHOLDERS DEFICIT Cuent liabilities 500 Notes payable Accounts payable Accrued royalties payable Other accrued epenses Deferred revenue 410 ,130 848 1,231 171220 3,421 Total cument iabilitiers Notes payable 818 Total liabilsies Mandatory redeemable convertible proferred such, $0.01 par val R. 7566.324 shares authoriaed, 6.381,473 shares issued and outstanding liquidation preference o $14,154550 14,155 14,155 14,155 Stockholders deficit Common stock, $0.01 par value 20.000,000 shares autho ed 1,023 208, 1,060,791, and 1,08,571 shares issued in 1994, 195, 1936, respectively 15,188 189 shares pro 52 14.533 14.688) 10 143 Aditional paid-in capital Accurnulatad deficit Treasury stock at cost 250,000 shares of 183 (14589 5.2)(14.872 common stock (17e) Foreign currency translation adjustmant 15.313014915 Total stockholders deficit 637 Commitments and contingency 211 2l6 2 sources have been used? Round A for $1,000,000 was raised from Nazem & Co. shortly after organization. Round B for $7,300,000 was from institutional investors and a potential customer (Hewlett Packard) Round C for $3,100,000 was again raised from the institutional investors Round D for $2,742,557 was raised from 3 of the institutional investors and Hewlett Packard G. Conduct a ratio analysis of Spatial Technology's past income statements and balance sheets. Note any performance strengths and weaknesses and discuss any ratio trends. H. Use the cash flow statements for Spatial Technology, Inc., to determine whether to venture has been building or burning cash, as well as possible trends in building or burning cash. Case 2: Spatial Technology. Inc. 66 Exhibit 5c Cash Flow Statements SPATIAL TECHNOLOGY INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS AMOUNTS IN THOUSANDS) YEARS ENDED DECEMBER 31, SIX MONTHS ENDED JUNE 30, 1993 1994 1995 1995 1996 UNAUDITED Cash flows from aperating activities Net eamings (loss Adustments to reconcile net earnings (loss) to net cash S (3.011) (854) $388 $199 $184 provided lused) by operating activities Extraordinary item gain on early extinguishment of debt Depreciation and amortization Common stock issued for services Interest accrued on conversion of stockholder notes Changes in operating assets and liabilities 317 267 174 115 20 Accounts receivable Prepaid expenses and othr Accounts payable Accrued expenses Deferred revenue 142 (151) 212 47 141) (511 411 306 175 41032(113 -29- 104 238)12)(24) Net cash provid (used) by operating actites Cash flows from investing activities Additions to equipment Additions to purchased computer software Net cash used by investing activities Cash flows from financing activities Principal payments on notes payable and capital leases Proceeds from exercise of common stock options and 166) (501)(100 50 2200 100 100 1,202 (175, Proceeds from notes payable Proceeds from issuance of preferred stock, net Purchase of treasury stock Net cash provided jused) by financing activities Foreign cureny tans ation .smen arfectig cash 3121397) 41 1121 00-, Nat increase (decroasel in cash and cash equivaients Cash and cash eqivalents at beginning of porod Cash and cash equivalents at end of period Supplemental disclosures 637 1,524) (135 175 1312 Cash paid for intores Cash paid for income taxes Source Spatial Technology Prospectus 660 Part 7: Capstone Cases Exhibit 5b Balance Sheets SPATIAL TECHNOLOGY INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS AMOUNTS IN THOUSANDS, EXCEPT SHARES) ASSETS DECEMBER 31, PRO FORMA (1) JUNE 30, 1996 (UNAUDITED) JUNE 30, 1995 UNAUDITED) 1994 Cument assets S 153 S 390 Cash and cash equivalent Accounts receivable, net of allowance of $102 534 and S4 n 1994, 198, and 199 2,293 1,742 185 2,215 256 1, Prepaid expenses and other Total current assets Equipment net Purchased computer sofhware, net 373 410 S 3637 377 S 2,763 LIABILITIES AND STOCKHOLDERS DEFICIT Cuent liabilities 500 Notes payable Accounts payable Accrued royalties payable Other accrued epenses Deferred revenue 410 ,130 848 1,231 171220 3,421 Total cument iabilitiers Notes payable 818 Total liabilsies Mandatory redeemable convertible proferred such, $0.01 par val R. 7566.324 shares authoriaed, 6.381,473 shares issued and outstanding liquidation preference o $14,154550 14,155 14,155 14,155 Stockholders deficit Common stock, $0.01 par value 20.000,000 shares autho ed 1,023 208, 1,060,791, and 1,08,571 shares issued in 1994, 195, 1936, respectively 15,188 189 shares pro 52 14.533 14.688) 10 143 Aditional paid-in capital Accurnulatad deficit Treasury stock at cost 250,000 shares of 183 (14589 5.2)(14.872 common stock (17e) Foreign currency translation adjustmant 15.313014915 Total stockholders deficit 637 Commitments and contingency 211 2l6 2 sources have been used? Round A for $1,000,000 was raised from Nazem & Co. shortly after organization. Round B for $7,300,000 was from institutional investors and a potential customer (Hewlett Packard) Round C for $3,100,000 was again raised from the institutional investors Round D for $2,742,557 was raised from 3 of the institutional investors and Hewlett Packard G. Conduct a ratio analysis of Spatial Technology's past income statements and balance sheets. Note any performance strengths and weaknesses and discuss any ratio trends. H. Use the cash flow statements for Spatial Technology, Inc., to determine whether to venture has been building or burning cash, as well as possible trends in building or burning cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts