Question: Please help with Jo & Mo's Icy Delights Week 4 Transactions. I am struggling to know where to post my transactions. Must be in one

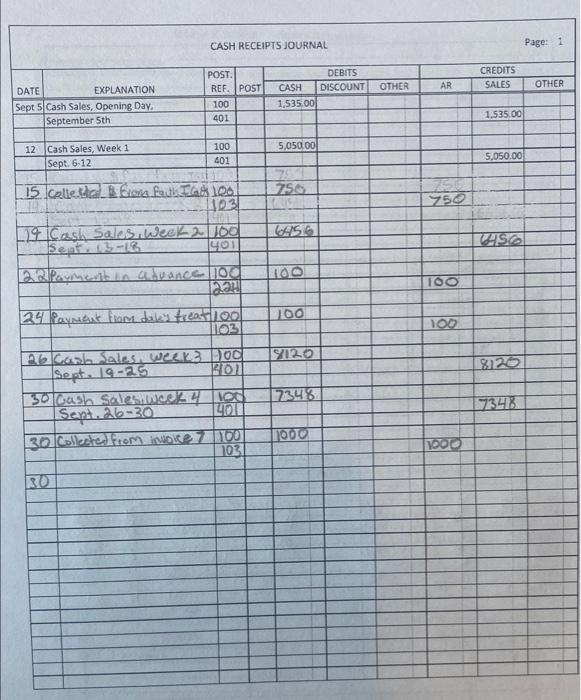

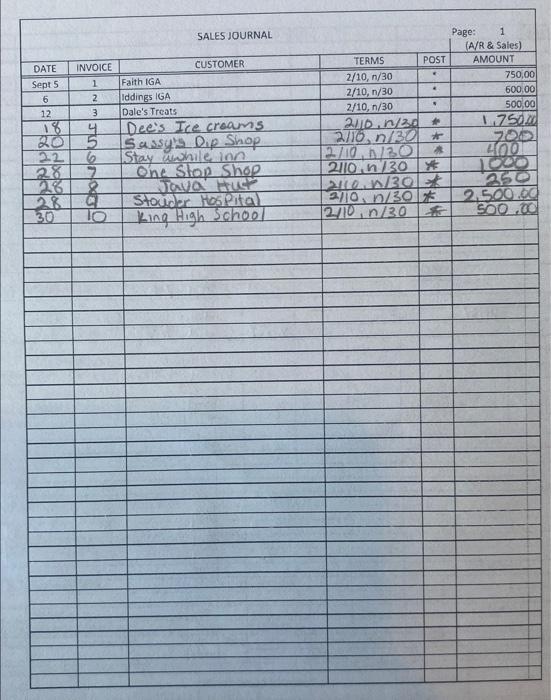

Please help with Jo & Mo's Icy Delights Week 4 Transactions. I am struggling to know where to post my transactions. Must be in one of the five journals (General, Cash payments, Cash receipts, Purchases, or Sales) then on general ledgers/subsidiary ledgers. Good insight and help is appreciated!

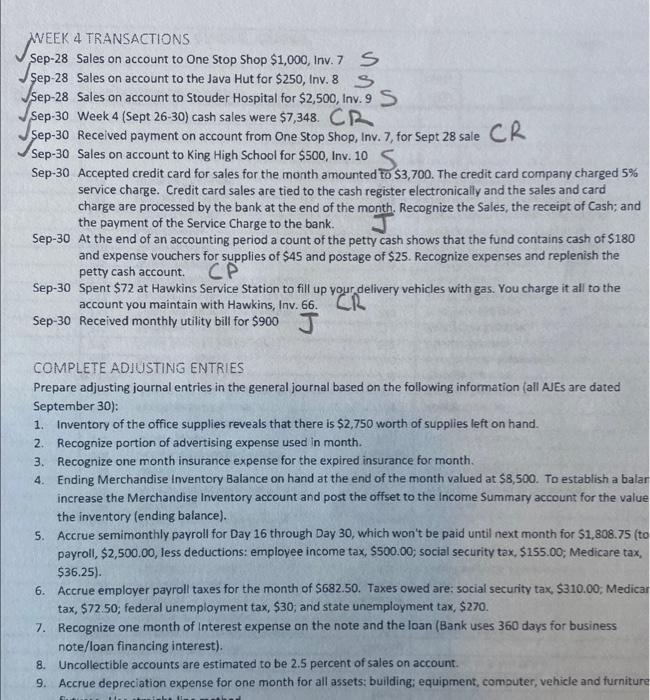

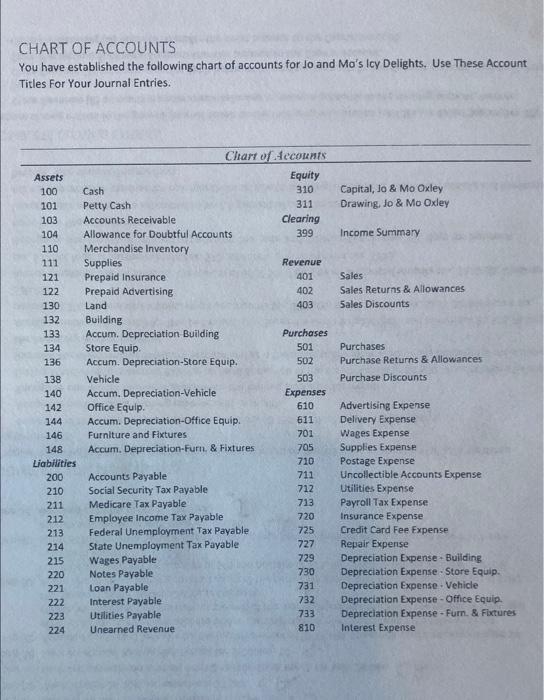

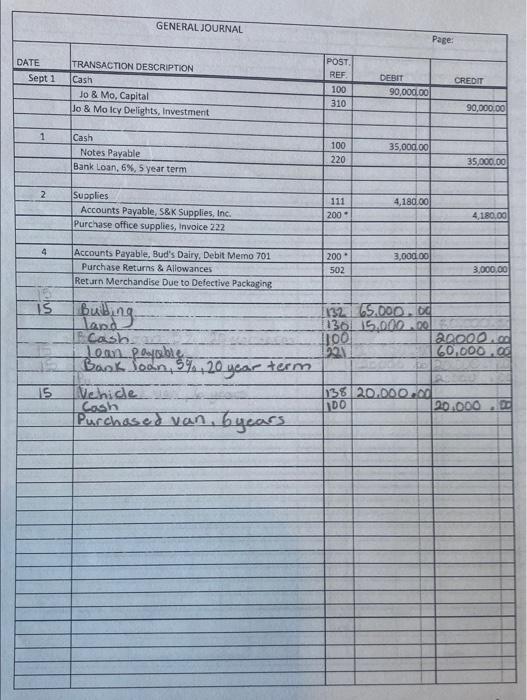

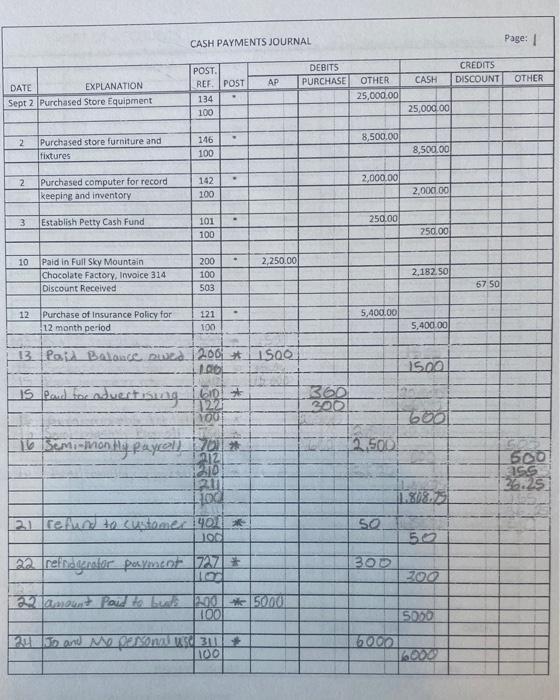

WEEK 4 TRANSACTIONS Sep-28 Sales on account to One Stop Shop $1,000, Inv. 7S Sep-28 Sales on account to the Java Hut for $250, Inv. 8 S Sep-28 Sales on account to Stouder Hospital for $2,500, Inv. 9S Sep-30 Week 4 (Sept 26-30) cash sales were $7,348. CR Sep-30 Received payment on account from One Stop Shop, Inv. 7, for Sept 28 sale CR Sep-30 Sales on account to King High School for $500, Inv. 10 Sep-30 Accepted credit card for sales for the month amounted to $3,700. The credit card company charged 5% service charge. Credit card sales are tied to the cash register electronically and the sales and card charge are processed by the bank at the end of the month. Recognize the Sales, the receipt of Cash; and the payment of the Service Charge to the bank. Sep-30 At the end of an accounting period a count of the petty cash shows that the fund contains cash of $180 and expense vouchers for supplies of $45 and postage of \$25. Recognize expenses and replenish the petty cash account. Sep-30 Spent $72 at Hawkins Service Station to fill up your delivery vehicles with gas. You charge it all to the account you maintain with Hawkins, Inv. 66 . CR Sep-30 Received monthly utility bill for $900 J COMPLETE ADIUSTING ENTRIES Prepare adjusting journal entries in the general journal based on the following information (all AJEs are dated September 30): 1. Inventory of the office supplies reveals that there is $2,750 worth of supplies left on hand. 2. Recognize portion of advertising expense used in month. 3. Recognize one month insurance expense for the expired insurance for month. 4. Ending Merchandise Inventory Balance on hand at the end of the month valued at $8,500. To establish a bala increase the Merchandise Inventory account and post the offset to the income Summary account for the valu the inventory (ending balance). 5. Accrue semimonthly payroll for Day 16 through Day 30 , which won't be paid until next month for $1,808.75 (t payroll, $2,500.00, less deductions: employee income tax, $500.00; social security tax, $155.00; Medicare tax, $36.25). 6. Accrue employer payroll taxes for the month of $682.50. Taxes owed are; social security tax, $310.00; Medic: tax, $72.50; federal unemployment tax, $30, and state unemployment tax, $270. 7. Recognize one month of Interest expense on the note and the loan (Bank uses 360 days for business note/loan financing interest). 8. Uncollectible accounts are estimated to be 2.5 percent of sales on account. 9. Accrue depreciation expense for one month for all assets: building; equipment, computer, vehicle and furnitur CHART OF ACCOUNTS You have established the following chart of accounts for Jo and Mo's lcy Delights. Use These Account Titles For Your Journal Entries. CASH PAYMENTS JOURNAL Page: WEEK 4 TRANSACTIONS Sep-28 Sales on account to One Stop Shop $1,000, Inv. 7S Sep-28 Sales on account to the Java Hut for $250, Inv. 8 S Sep-28 Sales on account to Stouder Hospital for $2,500, Inv. 9S Sep-30 Week 4 (Sept 26-30) cash sales were $7,348. CR Sep-30 Received payment on account from One Stop Shop, Inv. 7, for Sept 28 sale CR Sep-30 Sales on account to King High School for $500, Inv. 10 Sep-30 Accepted credit card for sales for the month amounted to $3,700. The credit card company charged 5% service charge. Credit card sales are tied to the cash register electronically and the sales and card charge are processed by the bank at the end of the month. Recognize the Sales, the receipt of Cash; and the payment of the Service Charge to the bank. Sep-30 At the end of an accounting period a count of the petty cash shows that the fund contains cash of $180 and expense vouchers for supplies of $45 and postage of \$25. Recognize expenses and replenish the petty cash account. Sep-30 Spent $72 at Hawkins Service Station to fill up your delivery vehicles with gas. You charge it all to the account you maintain with Hawkins, Inv. 66 . CR Sep-30 Received monthly utility bill for $900 J COMPLETE ADIUSTING ENTRIES Prepare adjusting journal entries in the general journal based on the following information (all AJEs are dated September 30): 1. Inventory of the office supplies reveals that there is $2,750 worth of supplies left on hand. 2. Recognize portion of advertising expense used in month. 3. Recognize one month insurance expense for the expired insurance for month. 4. Ending Merchandise Inventory Balance on hand at the end of the month valued at $8,500. To establish a bala increase the Merchandise Inventory account and post the offset to the income Summary account for the valu the inventory (ending balance). 5. Accrue semimonthly payroll for Day 16 through Day 30 , which won't be paid until next month for $1,808.75 (t payroll, $2,500.00, less deductions: employee income tax, $500.00; social security tax, $155.00; Medicare tax, $36.25). 6. Accrue employer payroll taxes for the month of $682.50. Taxes owed are; social security tax, $310.00; Medic: tax, $72.50; federal unemployment tax, $30, and state unemployment tax, $270. 7. Recognize one month of Interest expense on the note and the loan (Bank uses 360 days for business note/loan financing interest). 8. Uncollectible accounts are estimated to be 2.5 percent of sales on account. 9. Accrue depreciation expense for one month for all assets: building; equipment, computer, vehicle and furnitur CHART OF ACCOUNTS You have established the following chart of accounts for Jo and Mo's lcy Delights. Use These Account Titles For Your Journal Entries. CASH PAYMENTS JOURNAL Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts