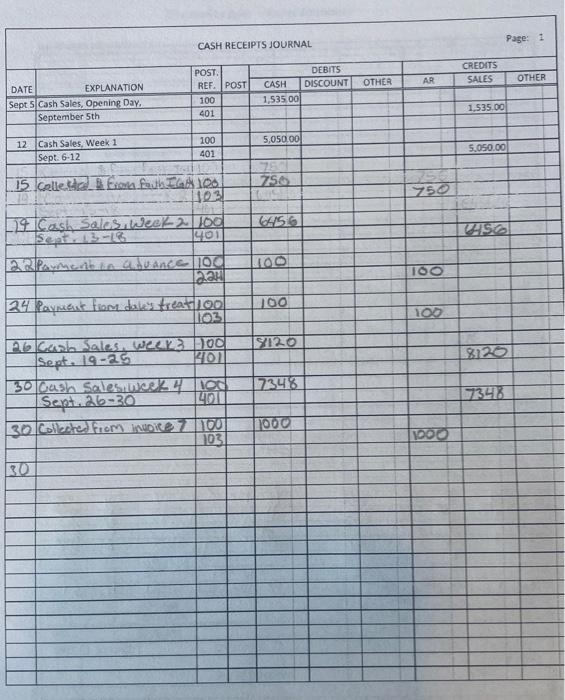

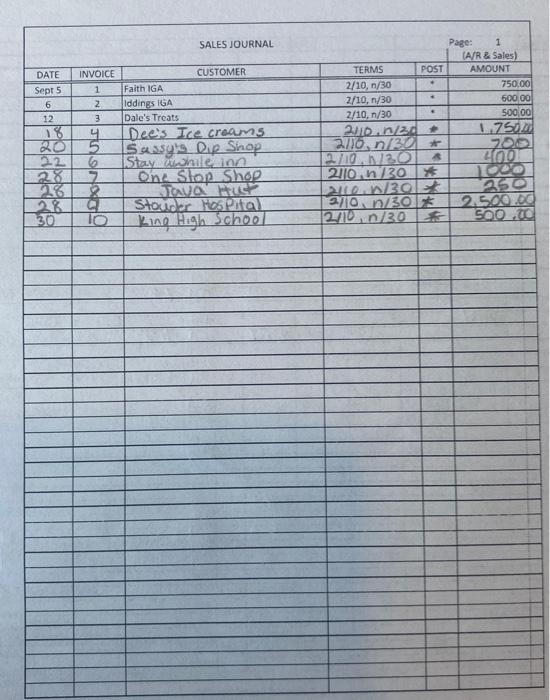

Question: Please help with Jo & Mo's Icy Delights Week 4 Transactions. I am struggling to know what to post specifically to my transactions. I have

Please help with Jo & Mo's Icy Delights Week 4 Transactions. I am struggling to know what to post specifically to my transactions. I have them sorted in the correct journals but I don't know the specifics. they also need to be posted on ledgers/ subsidiary ledgers. Good insight and help is appreciated!

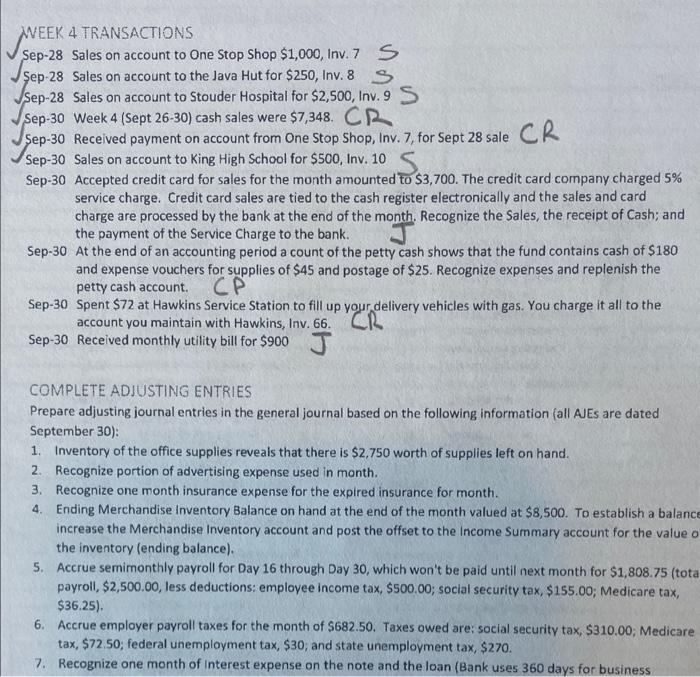

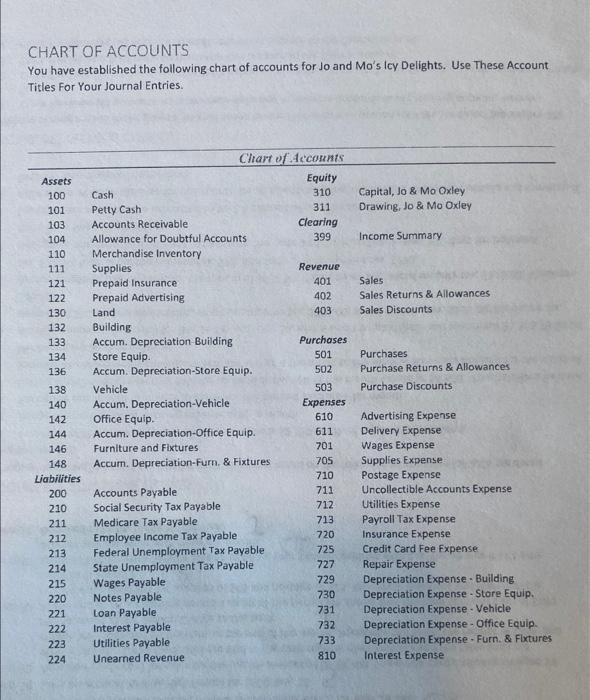

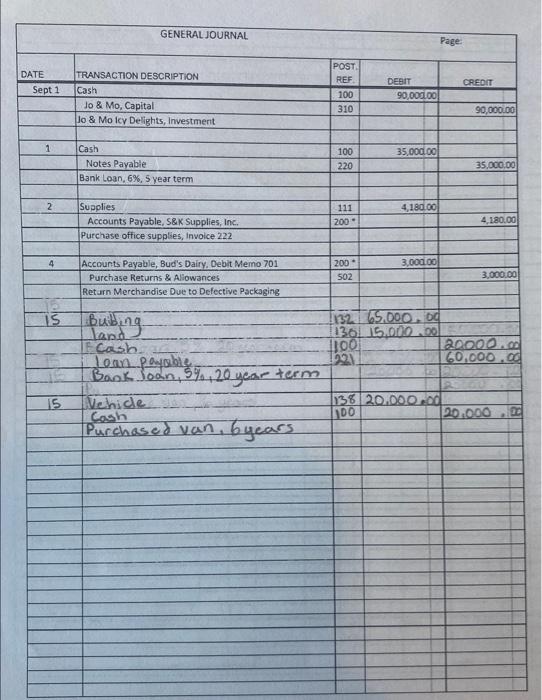

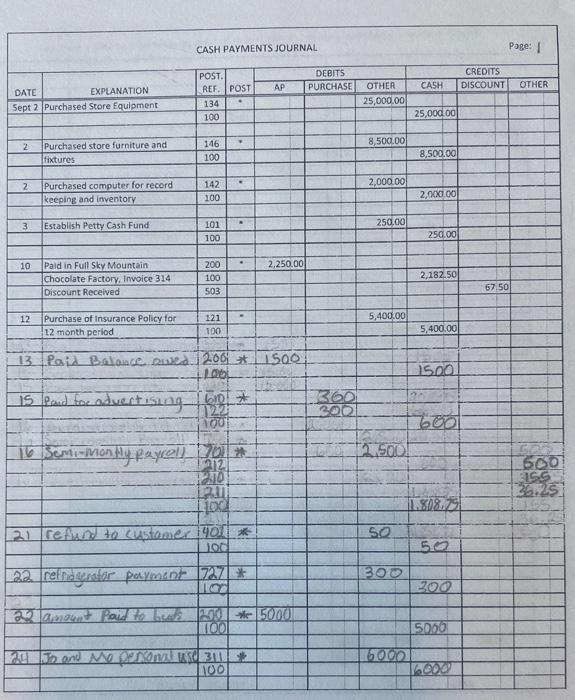

COMPLETE ADJUSTING ENTRIES Prepare adjusting journal entries in the general journal based on the following information fall AES are dated September 30): 1. Inventory of the office supplies reveals that there is $2,750 worth of supplies left on hand. 2. Recognize portion of advertising expense used in month. 3. Recognize one month insurance expense for the expired insurance for month. 4. Ending Merchandise Inventory Balance on hand at the end of the month valued at $8,500. To establish a balanc increase the Merchandise Inventory account and post the offset to the Income Summary account for the value the inventory (ending balance). 5. Accrue semimonthly payroll for Day 16 through Day 30 , which won't be paid until next month for $1,808.75 (tot. payroll, $2,500.00, less deductions: employee income tax, $500.00; social security tax, $155.00; Medicare tax, $36.25). 6. Accrue employer payroll taxes for the month of $682.50. Taxes owed are: social security tax, $310.00; Medicare tax, \$72.50; federal unemployment tax, \$30; and state unemployment tax, \$270. 7. Recognize one month of Interest expense on the note and the loan (Bank uses 360 days for business CHART OF ACCOUNTS You have established the following chart of accounts for Jo and Mo's lcy Delights. Use These Account Titles For Your Journal Entries. CASH PAYMENIS JOURNAL Poge: I COMPLETE ADJUSTING ENTRIES Prepare adjusting journal entries in the general journal based on the following information fall AES are dated September 30): 1. Inventory of the office supplies reveals that there is $2,750 worth of supplies left on hand. 2. Recognize portion of advertising expense used in month. 3. Recognize one month insurance expense for the expired insurance for month. 4. Ending Merchandise Inventory Balance on hand at the end of the month valued at $8,500. To establish a balanc increase the Merchandise Inventory account and post the offset to the Income Summary account for the value the inventory (ending balance). 5. Accrue semimonthly payroll for Day 16 through Day 30 , which won't be paid until next month for $1,808.75 (tot. payroll, $2,500.00, less deductions: employee income tax, $500.00; social security tax, $155.00; Medicare tax, $36.25). 6. Accrue employer payroll taxes for the month of $682.50. Taxes owed are: social security tax, $310.00; Medicare tax, \$72.50; federal unemployment tax, \$30; and state unemployment tax, \$270. 7. Recognize one month of Interest expense on the note and the loan (Bank uses 360 days for business CHART OF ACCOUNTS You have established the following chart of accounts for Jo and Mo's lcy Delights. Use These Account Titles For Your Journal Entries. CASH PAYMENIS JOURNAL Poge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts