Question: PLEASE help with letter E only Please answer letter E only...Please help with letter E Unit- and Batch-Level Cost Drivers Kentucky Fried Chicken (a reportable

PLEASE help with letter "E" only

Please answer letter "E" only...Please help with letter "E"

Please answer letter "E" only...Please help with letter "E"

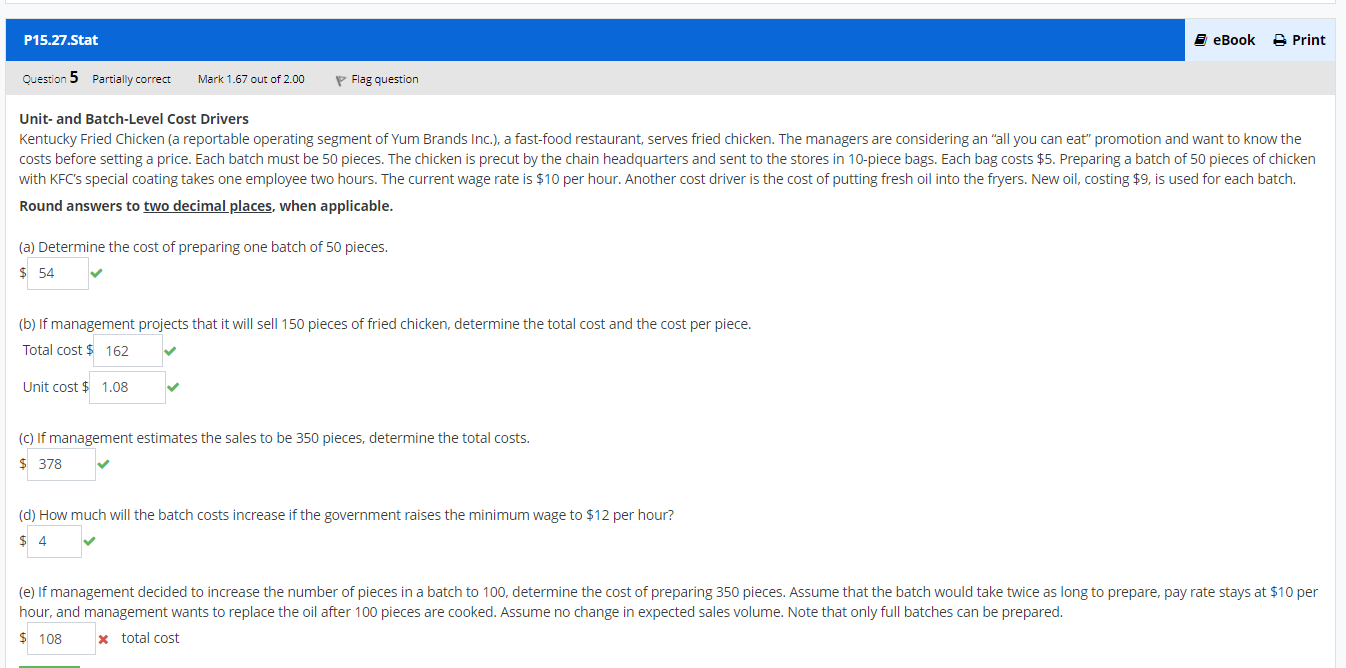

Unit- and Batch-Level Cost Drivers Kentucky Fried Chicken (a reportable operating segment of Yum Brands Inc.), a fast-food restaurant, serves fried chicken. The managers are considering an "all you can eat" promotion and want to know the costs before setting a price. Each batch must be 50 pieces. The chicken is precut by the chain headquarters and sent to the stores in 10-piece bags. Each bag costs $5. Preparing a batch of 50 pieces of chicken with KFC's special coating takes one employee two hours. The current wage rate is $10 per hour. Another cost driver is the cost of putting fresh oil into the fryers. New oil, costing $9, is used for each batch. Round answers to two decimal places, when applicable. (a) Determine the cost of preparing one batch of 50 pieces. (b) If management projects that it will sell 150 pieces of fried chicken, determine the total cost and the cost per piece. Total cost \$ Unit cost \$ (c) If management estimates the sales to be 350 pieces, determine the total costs. (d) How much will the batch costs increase if the government raises the minimum wage to $12 per hour? (e) If management decided to increase the number of pieces in a batch to 100 , determine the cost of preparing 350 pieces. Assume that the batch would take twice as long to prepare, pay rate stays at $10 per hour, and management wants to replace the oil after 100 pieces are cooked. Assume no change in expected sales volume. Note that only full batches can be prepared. x total cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts