Question: please help with number 3? ! Required information [The following information applies to the questions displayed below.] Louis files as a single taxpayer. In April

please help with number 3?

![to the questions displayed below.] Louis files as a single taxpayer. In](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671813abb7a73_147671813ab4910c.jpg)

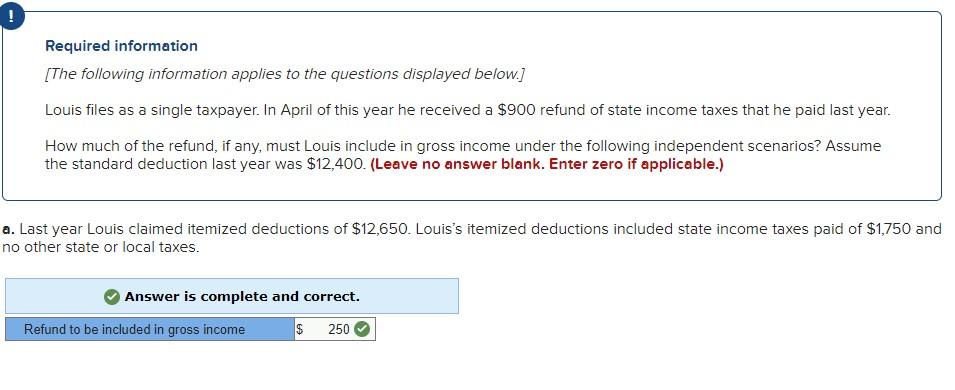

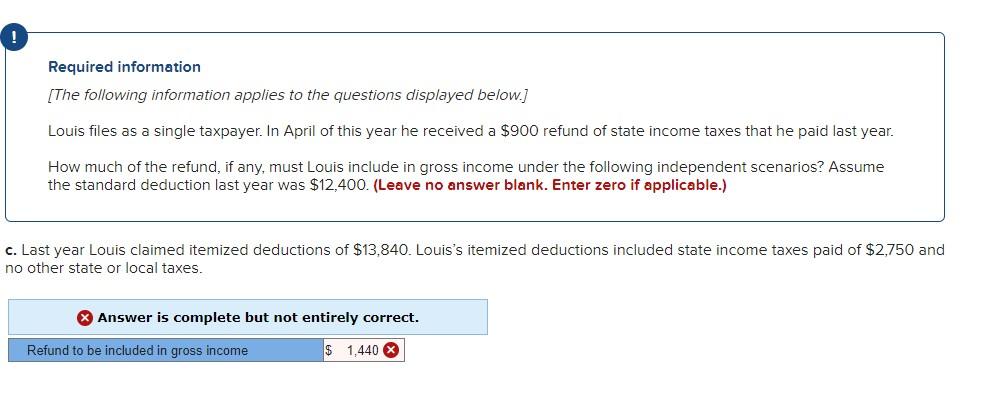

! Required information [The following information applies to the questions displayed below.] Louis files as a single taxpayer. In April of this year he received a $900 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) a. Last year Louis claimed itemized deductions of $12,650. Louis's itemized deductions included state income taxes paid of $1,750 and no other state or local taxes. Answer is complete and correct. Refund to be included in gross income $ 250 Required information [The following information applies to the questions displayed below.] Louis files as a single taxpayer. In April of this year he received a $900 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) b. Last year Louis had itemized deductions of $10,800 and he chose to claim the standard deduction. Louis's itemized deductions included state income taxes paid of $1,750 and no other state or local taxes. Answer is complete and correct. Refund to be included in gross income $ 0 Required information (The following information applies to the questions displayed below.) Louis files as a single taxpayer. In April of this year he received a $900 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) c. Last year Louis claimed itemized deductions of $13,840. Louis's itemized deductions included state income taxes paid of $2,750 and no other state or local taxes. Answer is complete but not entirely correct. Refund to be included in gross income $ 1.440

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts