Question: please help with number 7 PROBLEM SETS The following annual excess rates of return were obtained for nine individual stocks (AI) and a market index.

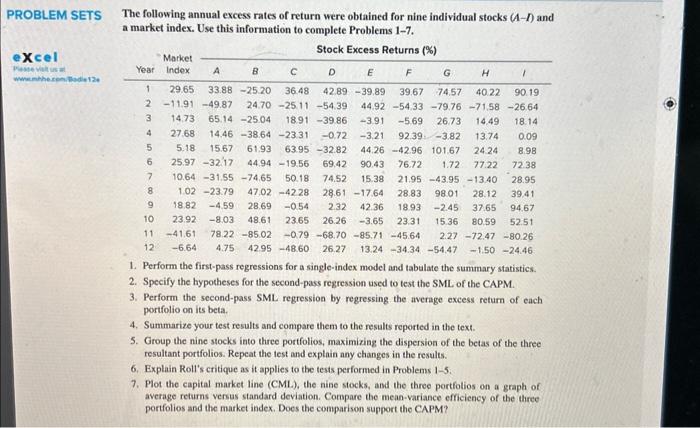

PROBLEM SETS The following annual excess rates of return were obtained for nine individual stocks (AI) and a market index. Use this information to complete Problems 1-7. excel menthorminoderat 1. Perform the first-pass regressions for a single-index model and tabulate the summary statistics. 2. Specify the hypotheses for the second-pass regression used to test the SML of the CAPM. 3. Perform the second-pass SML regression by regressing the average excess return of each portfolio on its beta. 4. Summarize your test results and compare them to the results reported in the text. 5. Group the nine stocks into three portfolios, maximizing the dispersion of the betas of the three resultant portfolios. Repeat the test and explain any changes in the results. 6. Explain Roll's critique as it applies to the tests performed in Problems 1-5. 7. Plot the capital market line (CML), the nine stocks, and the three portfolios on a graph of average returns versus standard deviation. Compare the mean-variance efficiency of the three portfolios and the market index. Does the comparison support the CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts