Question: please help with number 9 and 10 with no excel 8. For the two period (each period is 6 months) binomial option pricing model, So

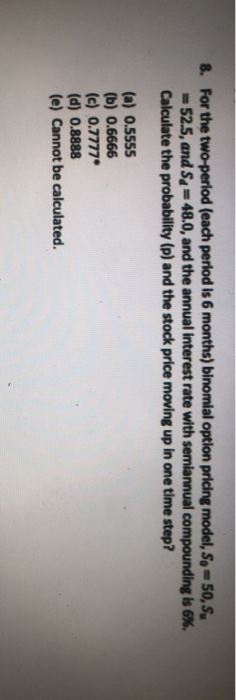

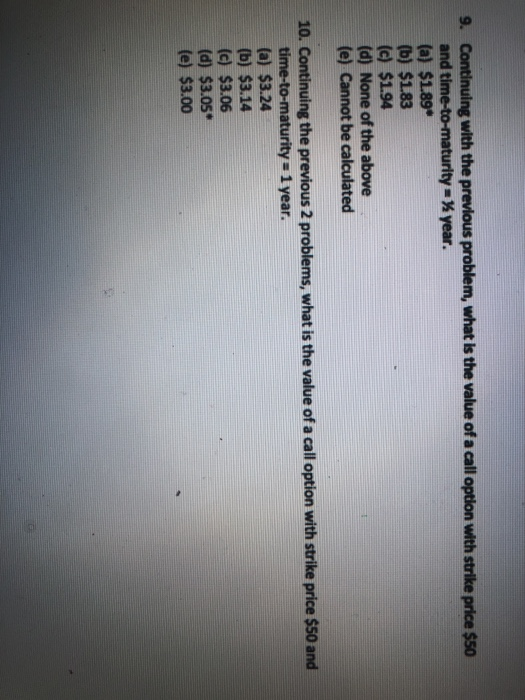

8. For the two period (each period is 6 months) binomial option pricing model, So = 50, S. 52.5, and Se=48.0, and the annual interest rate with semiannual compounding is 6%. Calculate the probability (p) and the stock price moving up in one time step? (a) 0.5555 (b) 0.6666 (c) 0.7777 (d) 0.8888 (e) Cannot be calculated. 9. Continuing with the previous problem, what is the value of a call option with strike price $50 and time-to-maturity = year. (a) $1.89* (b) $1.83 (c) $1.94 (d) None of the above (e) Cannot be calculated 10. Continuing the previous 2 problems, what is the value of a call option with strike price $50 and time-to-maturity = 1 year. (a) $3.24 (b) $3.14 (c) $3.06 (d) $3.05 (e) $3.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts