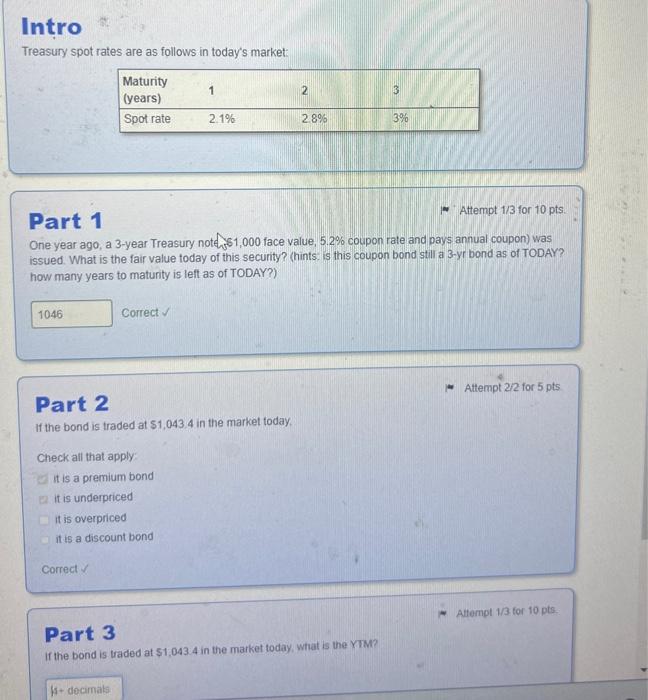

Question: please help with part 3 of this homework assignment Treasury spot rates are as follows in today's market: Part 1 N Attempt 1/3 for 10

Treasury spot rates are as follows in today's market: Part 1 N Attempt 1/3 for 10 pts. One year ago, a 3-year Treasury noten $1,000 face value, 5.2% coupon rate and pays annual coupon) was issued. What is the fair value today of this security? (hints. is this coupon bond still a 3-yr bond as of TODAY? how many years to maturity is left as of TODAY?) Correct Attempt 2/2 for 5 pts Part 2 If the bond is traded at 51,043.4 in the market today, Check all that apply it is a premium bond it is underpriced it is overpriced it is a discount bond Correct x Part 3 If the bond is traded at $1;043.4 in the market today, what is the YIM? Treasury spot rates are as follows in today's market: Part 1 N Attempt 1/3 for 10 pts. One year ago, a 3-year Treasury noten $1,000 face value, 5.2% coupon rate and pays annual coupon) was issued. What is the fair value today of this security? (hints. is this coupon bond still a 3-yr bond as of TODAY? how many years to maturity is left as of TODAY?) Correct Attempt 2/2 for 5 pts Part 2 If the bond is traded at 51,043.4 in the market today, Check all that apply it is a premium bond it is underpriced it is overpriced it is a discount bond Correct x Part 3 If the bond is traded at $1;043.4 in the market today, what is the YIM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts