Question: Please help with part A, B and C Suppose our company has the following capital structure, and a 35% Effective Tax Rate. Suppose that the

Please help with part A, B and C

Please help with part A, B and C

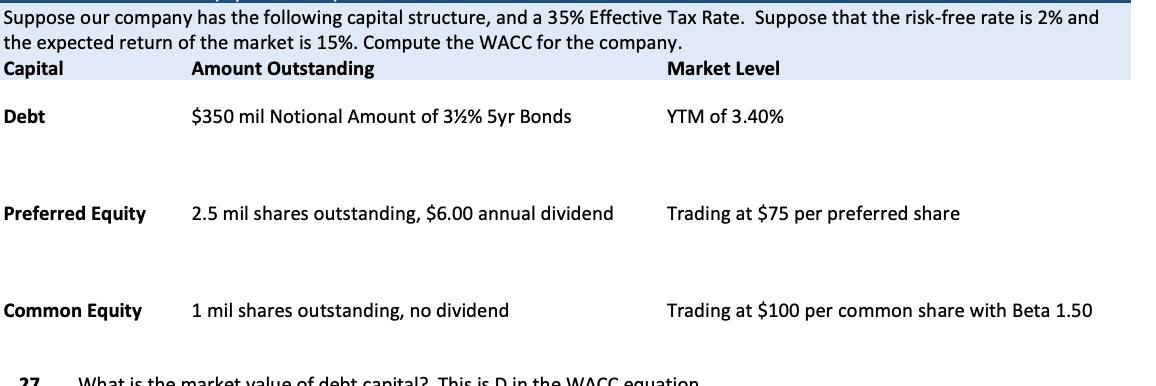

Suppose our company has the following capital structure, and a 35% Effective Tax Rate. Suppose that the risk-free rate is 2% and the expected return of the market is 15%. Compute the WACC for the company. Capital Amount Outstanding Market Level Debt $350 mil Notional Amount of 37% 5yr Bonds YTM of 3.40% Preferred Equity 2.5 mil shares outstanding, $6.00 annual dividend Trading at $75 per preferred share Common Equity 1 mil shares outstanding, no dividend Trading at $100 per common share with Beta 1.50 27 What is the market value of debt canital? This is in the WACCaation What is the market value of debt capital? This is D in the WACC equation. What is the market value of preferred equity capital? This is P in the WACC equation. What is the market value of common equity capital? This is E in the WACC equation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts