Question: Please Help with part g. I will upvote. Excel Activity Bond Van Clifford Clarks are who is interested in grote bandisting Bond A has annual

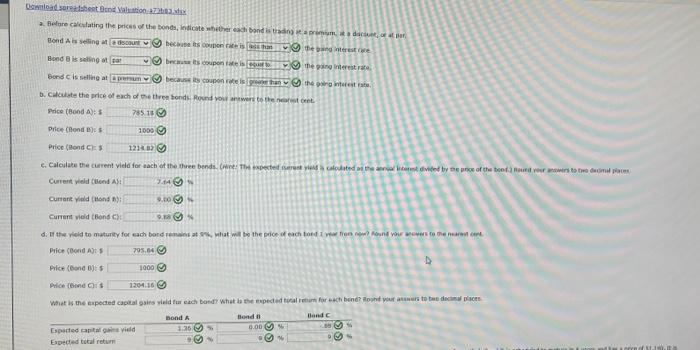

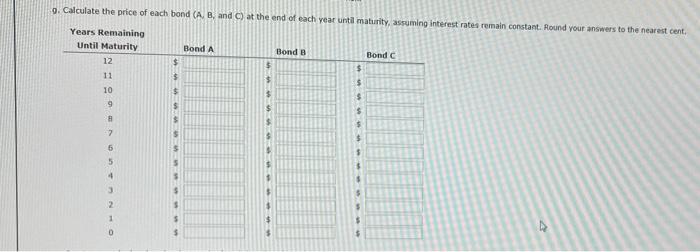

Excel Activity Bond Van Clifford Clarks are who is interested in grote bandisting Bond A has annual matures in 12.000 Bonih nalon, matures in 12 , . Maha 125 coupo, matures in Each boas a wild to maturity The data has been collected in the Marshall bow. Download the reader and perform the requires to the rest. Do not red ca am wat fan arrister, sro Download serbest Bonda a before calculating the prices of the bonds, lete with each and is to Bond Ais selling at leon Become soon Bond is not bet pontCOM the gang interest Bond is selling at pun becauses coupons than the interest b. Calculate the price of each of the bondsRound your awers to the Price (Bond AS 78511 Price Chond) 1000 Price (Rond CES 1234 c. Calotate the current yield for each of the three bends. Ce textes seront and cated with wided by a price of the bond over to tre domu pom Current yielded AS 9.44 9.00 Curtant yield (Hons) Current vild Bond C) 0.1 d. Er the yield to maturity for each bordo at what will be the price of each trend were to manual Price (Bond As 705,6 Price (Bonds 1000 Price is 1204.16 What is the expeded capital gains wield for each bond what the expected total for schond? Rurato de Bonde hond A 1.36 tondo 0.00 Espected at vid Expected total return 9. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Round your answers to the nearest cent Years Remaining Until Maturity 12 11 Bond A $ Bond B $ Bond $ $ 10 $ $ $ $ 9 $ $ $ 2 5 5 5 5 $ 4 3 $ 2 $ 1 $ > D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts