Question: #1 Pleases help with formulas Expected total return. Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value.

#1 Pleases help with formulas Expected total return.

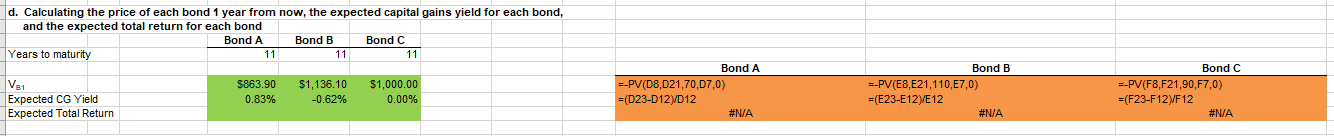

Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value.

Bond B has an 11% annual coupon, matures in 12 years, and has a $1,000 face value.

Bond C has a 9% annual coupon, matures in 12 years, and has a $1,000 face value.

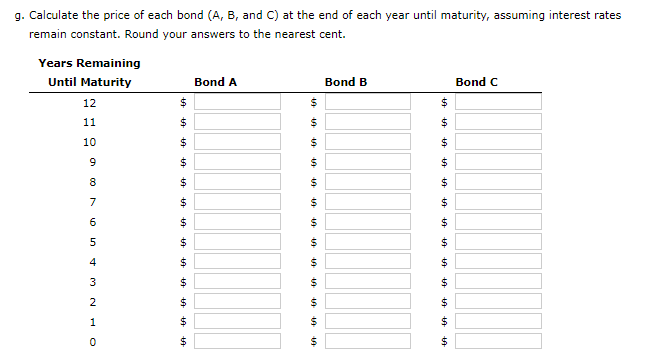

#2 Please help with part G in excel

d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, and the expected total return for each bond g. Calculate the price of each bond (A,B, and C) at the end of each year until maturity, assuming interest rates remain constant. Round your answers to the nearest cent. d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, and the expected total return for each bond g. Calculate the price of each bond (A,B, and C) at the end of each year until maturity, assuming interest rates remain constant. Round your answers to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts