Question: please help with question 1-4 D Question 1 1 pts You would like to purchase a T-bill that has a $10,000 face value and is

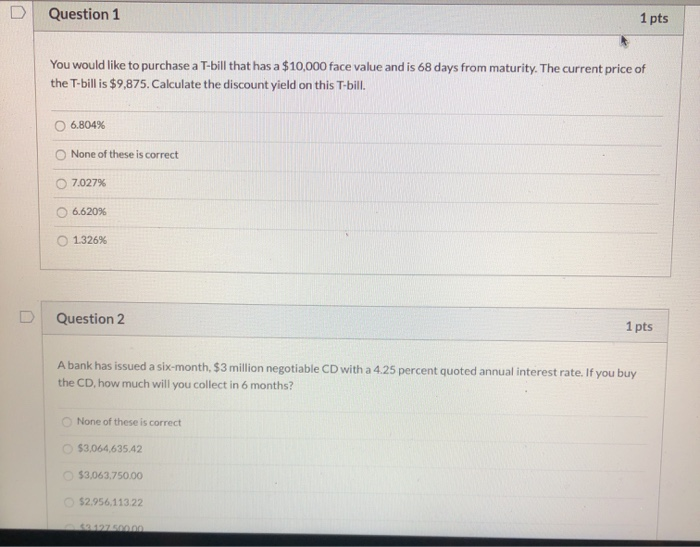

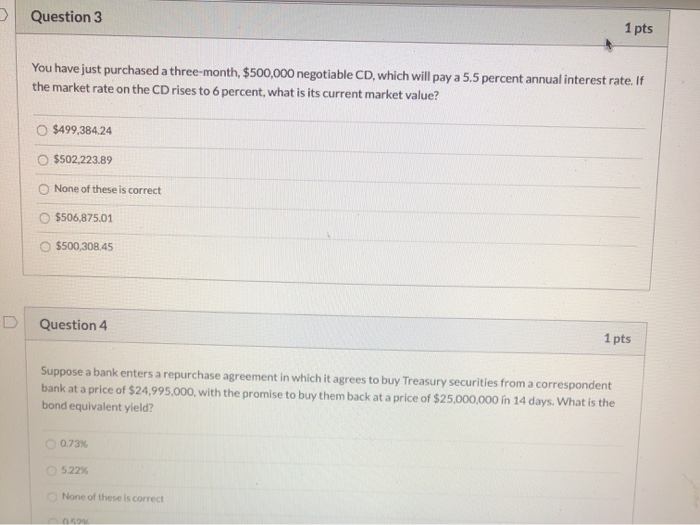

D Question 1 1 pts You would like to purchase a T-bill that has a $10,000 face value and is 68 days from maturity. The current price of the T-bill is $9,875. Calculate the discount yield on this T-bill. 6.804% None of these is correct 7.027% 6.620% 1326% Question 2 1 pts A bank has issued a six-month, $3 million negotiable CD with a 4.25 percent quoted annual interest rate. If you buy the CD, how much will you collect in 6 months? None of these is correct $3,064,635.42 $3.063.750.00 $2.956,113.22 Question 3 1 pts You have just purchased a three-month, $500,000 negotiable CD, which will pay a 5.5 percent annual interest rate. If the market rate on the CD rises to 6 percent, what is its current market value? O $499,384.24 O $502,223.89 None of these is correct $506,875.01 $500,300.45 Question 4 1 pts Suppose a bank enters a repurchase agreement in which it agrees to buy Treasury securities from a correspondent bank at a price of $24,995,000, with the promise to buy them back at a price of $25,000,000 in 14 days. What is the bond equivalent yield? 0.73% 522 None of these is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts