Question: ***PLEASE HELP WITH QUESTION 2*** DECISION TREE FOR Q1 2) Now suppose Mr. Buck has done some further research and found out that if upon

***PLEASE HELP WITH QUESTION 2***

***PLEASE HELP WITH QUESTION 2***

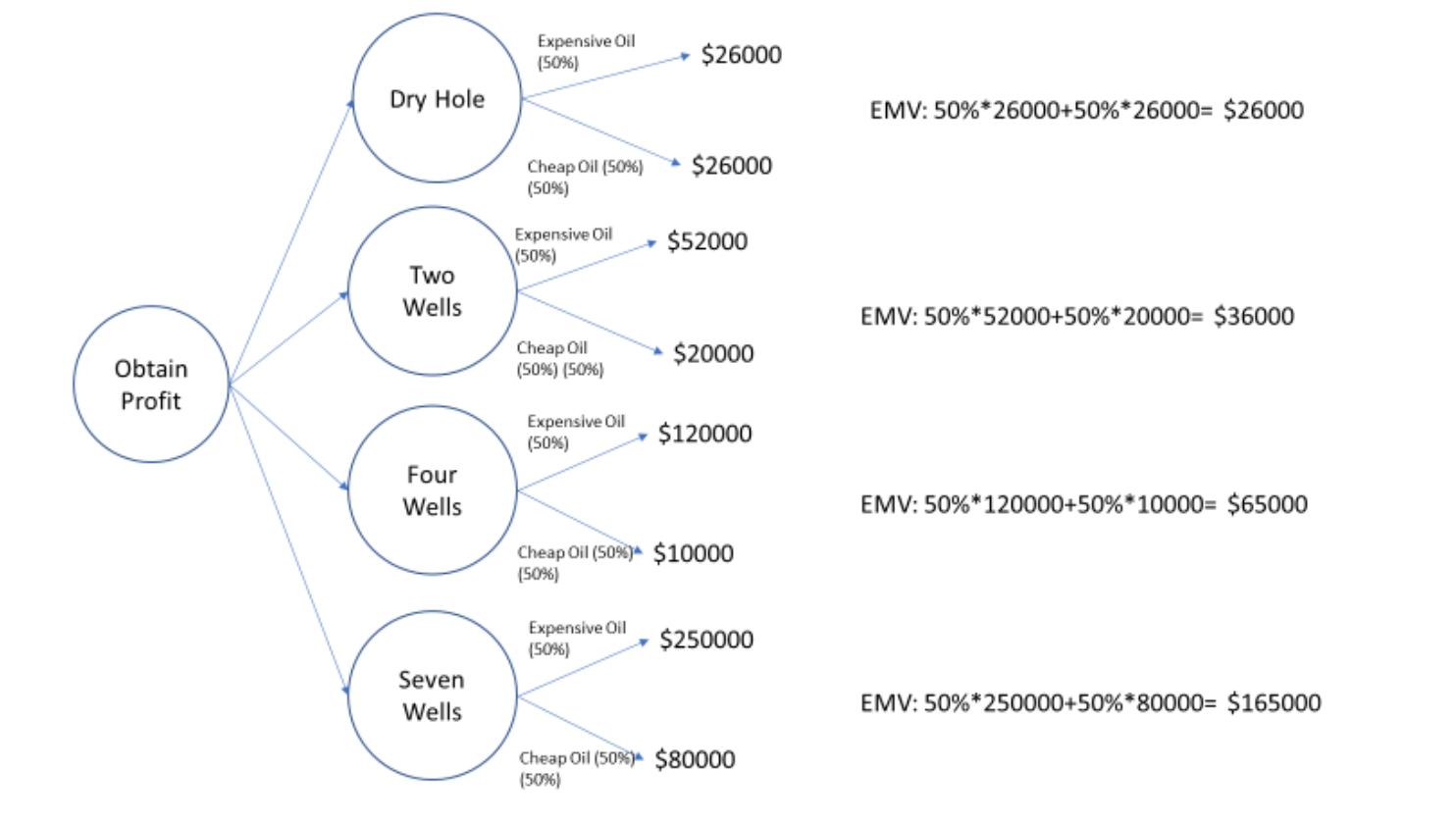

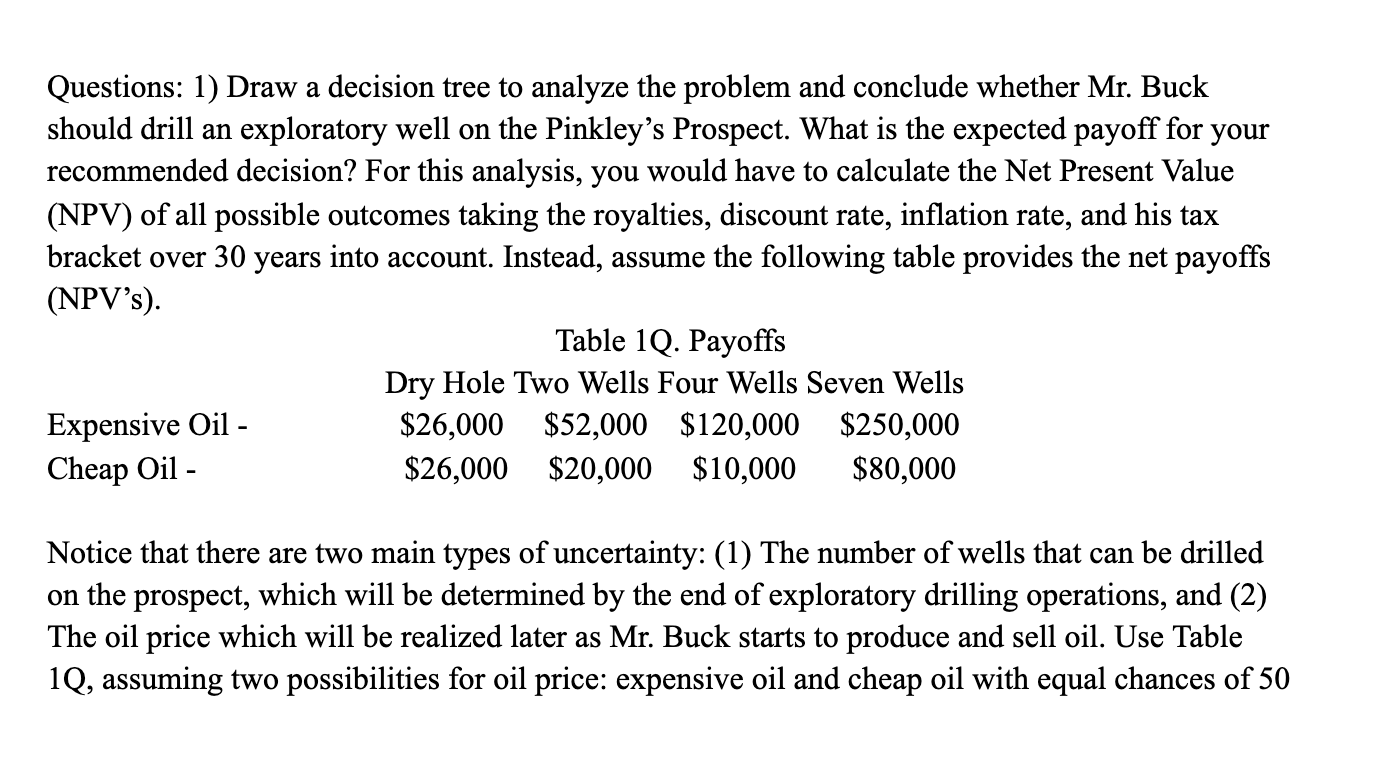

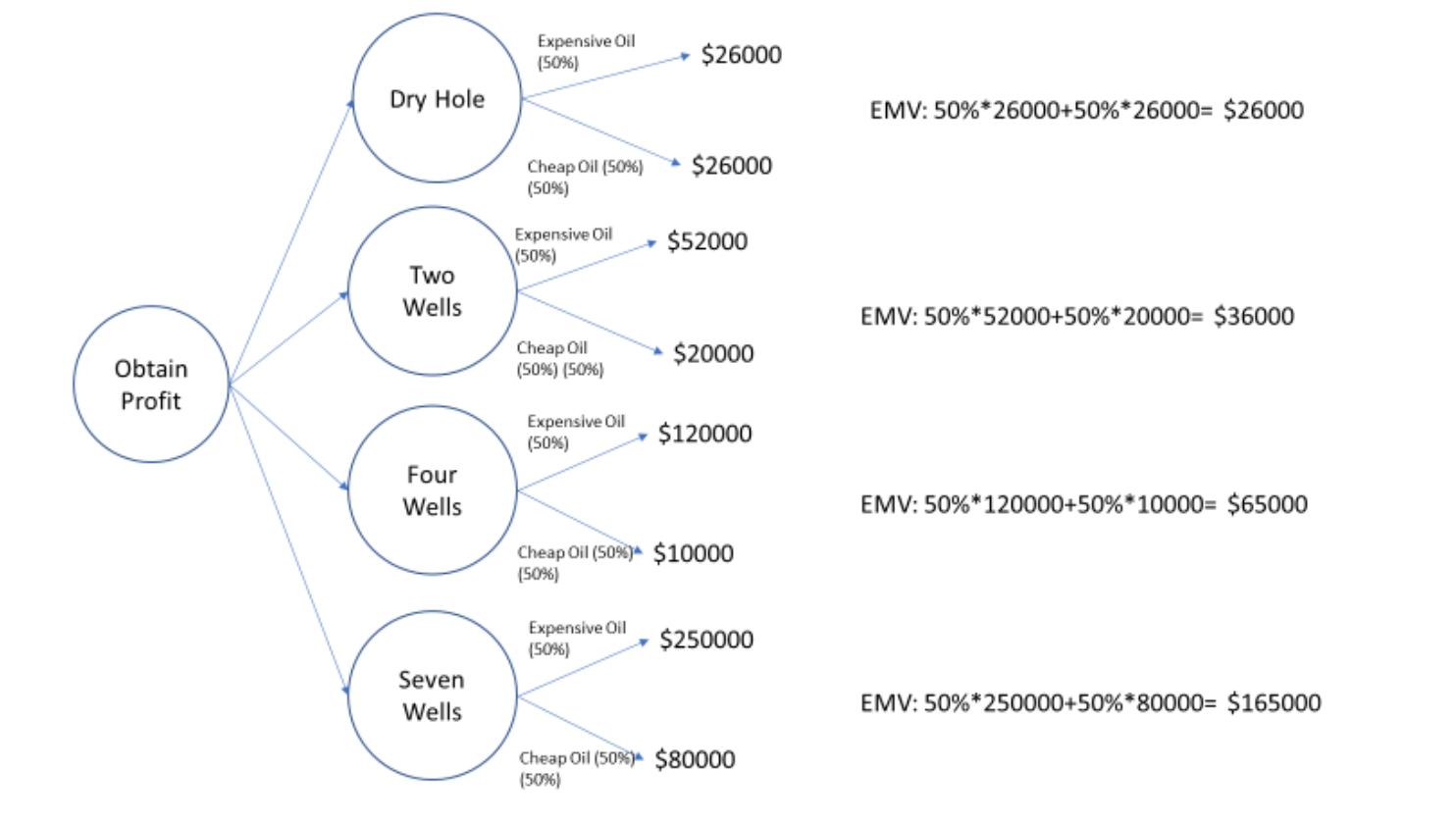

DECISION TREE FOR Q1

DECISION TREE FOR Q1

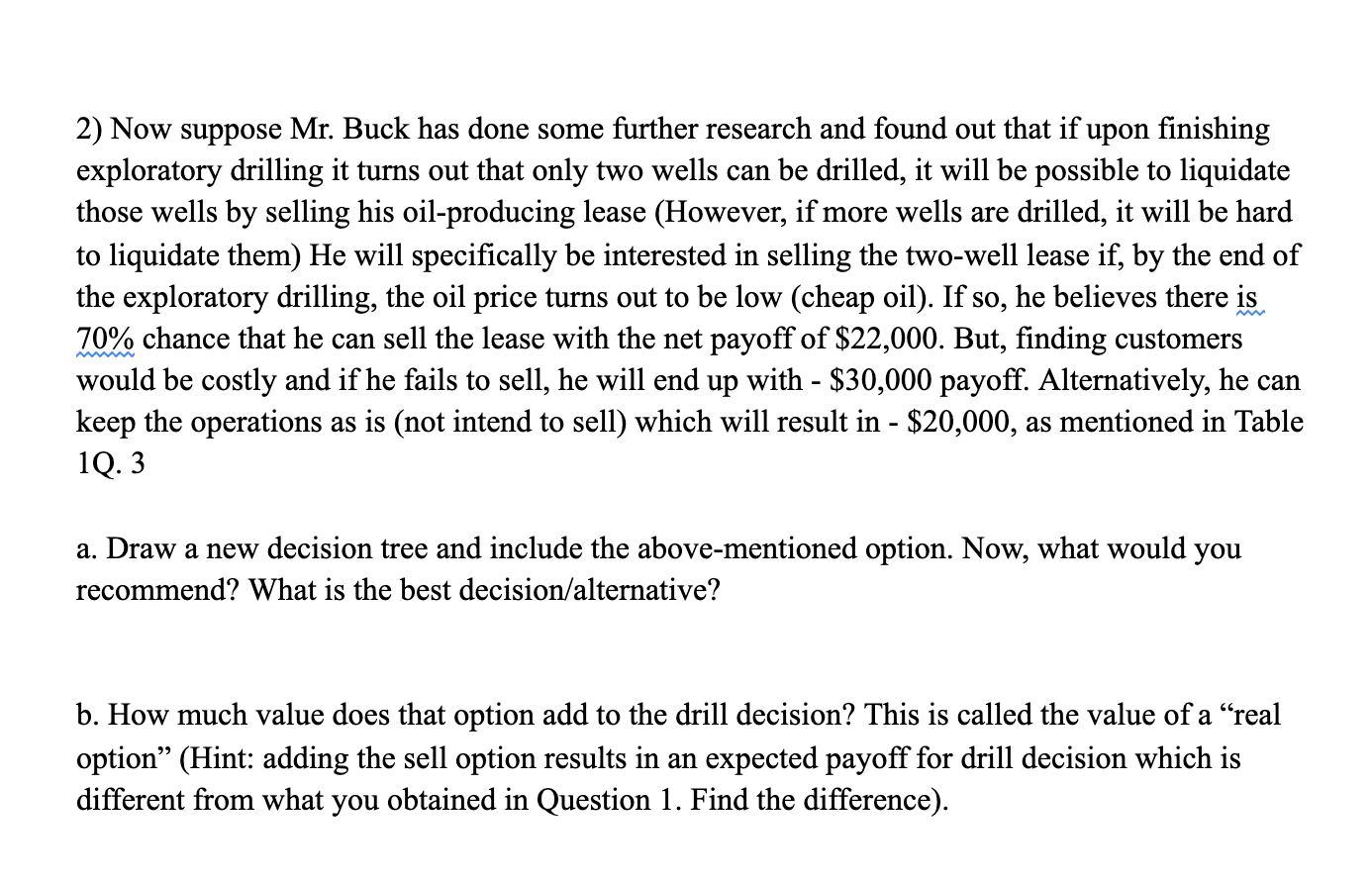

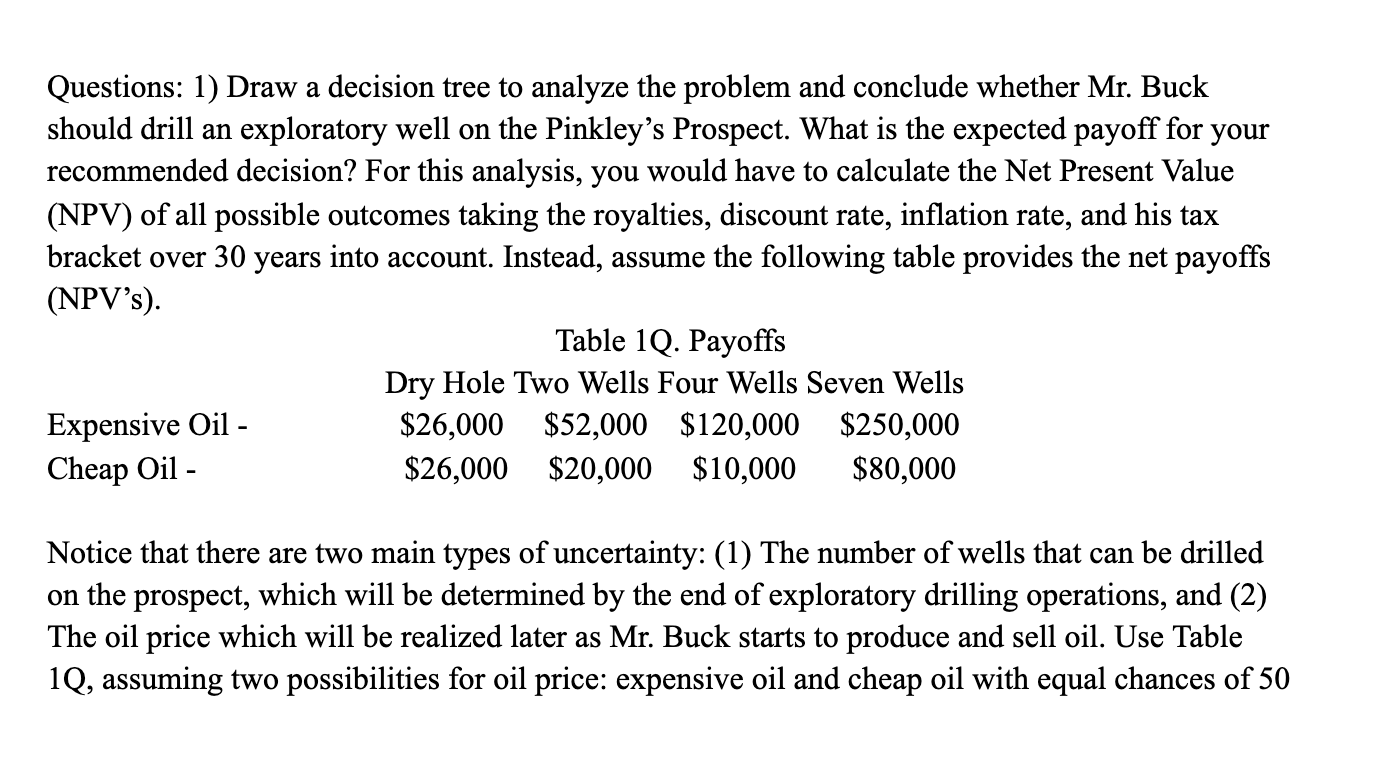

2) Now suppose Mr. Buck has done some further research and found out that if upon finishing exploratory drilling it turns out that only two wells can be drilled, it will be possible to liquidate those wells by selling his oil-producing lease (However, if more wells are drilled, it will be hard to liquidate them) He will specifically be interested in selling the two-well lease if, by the end of the exploratory drilling, the oil price turns out to be low (cheap oil). If so, he believes there is 70% chance that he can sell the lease with the net payoff of $22,000. But, finding customers would be costly and if he fails to sell, he will end up with - $30,000 payoff. Alternatively, he can keep the operations as is (not intend to sell) which will result in - $20,000, as mentioned in Table 1Q. 3 M a. Draw a new decision tree and include the above-mentioned option. Now, what would you recommend? What is the best decision/alternative? b. How much value does that option add to the drill decision? This is called the value of a real option (Hint: adding the sell option results in an expected payoff for drill decision which is different from what you obtained in Question 1. Find the difference). Questions: 1) Draw a decision tree to analyze the problem and conclude whether Mr. Buck should drill an exploratory well on the Pinkley's Prospect. What is the expected payoff for your recommended decision? For this analysis, you would have to calculate the Net Present Value (NPV) of all possible outcomes taking the royalties, discount rate, inflation rate, and his tax bracket over 30 years into account. Instead, assume the following table provides the net payoffs (NPV's). Table 1Q. Payoffs Dry Hole Two Wells Four Wells Seven Wells Expensive Oil - $26,000 $52,000 $120,000 $250,000 Cheap Oil - $26,000 $20,000 $10,000 $80,000 Notice that there are two main types of uncertainty: (1) The number of wells that can be drilled on the prospect, which will be determined by the end of exploratory drilling operations, and (2) The oil price which will be realized later as Mr. Buck starts to produce and sell oil. Use Table 1Q, assuming two possibilities for oil price: expensive oil and cheap oil with equal chances of 50 Expensive Oil (50%) $26000 Dry Hole EMV: 50%*26000+50%*26000= $26000 Cheap Oil (50%) (50%) $26000 Expensive Oil (50%) $52000 Two Wells EMV: 50%*52000+50%*20000= $36000 Cheap Oil (50%) (50%) $20000 Obtain Profit Expensive Oil (50%) $120000 Four Wells EMV: 50%*120000+50%*10000= $65000 Cheap Oil (50%)* $10000 (50%) Expensive Oil (50%) $250000 Seven Wells EMV: 50%* 250000+50%*80000= $165000 Cheap Oil (50%)* $80000 (50%) 2) Now suppose Mr. Buck has done some further research and found out that if upon finishing exploratory drilling it turns out that only two wells can be drilled, it will be possible to liquidate those wells by selling his oil-producing lease (However, if more wells are drilled, it will be hard to liquidate them) He will specifically be interested in selling the two-well lease if, by the end of the exploratory drilling, the oil price turns out to be low (cheap oil). If so, he believes there is 70% chance that he can sell the lease with the net payoff of $22,000. But, finding customers would be costly and if he fails to sell, he will end up with - $30,000 payoff. Alternatively, he can keep the operations as is (not intend to sell) which will result in - $20,000, as mentioned in Table 1Q. 3 M a. Draw a new decision tree and include the above-mentioned option. Now, what would you recommend? What is the best decision/alternative? b. How much value does that option add to the drill decision? This is called the value of a real option (Hint: adding the sell option results in an expected payoff for drill decision which is different from what you obtained in Question 1. Find the difference). Questions: 1) Draw a decision tree to analyze the problem and conclude whether Mr. Buck should drill an exploratory well on the Pinkley's Prospect. What is the expected payoff for your recommended decision? For this analysis, you would have to calculate the Net Present Value (NPV) of all possible outcomes taking the royalties, discount rate, inflation rate, and his tax bracket over 30 years into account. Instead, assume the following table provides the net payoffs (NPV's). Table 1Q. Payoffs Dry Hole Two Wells Four Wells Seven Wells Expensive Oil - $26,000 $52,000 $120,000 $250,000 Cheap Oil - $26,000 $20,000 $10,000 $80,000 Notice that there are two main types of uncertainty: (1) The number of wells that can be drilled on the prospect, which will be determined by the end of exploratory drilling operations, and (2) The oil price which will be realized later as Mr. Buck starts to produce and sell oil. Use Table 1Q, assuming two possibilities for oil price: expensive oil and cheap oil with equal chances of 50 Expensive Oil (50%) $26000 Dry Hole EMV: 50%*26000+50%*26000= $26000 Cheap Oil (50%) (50%) $26000 Expensive Oil (50%) $52000 Two Wells EMV: 50%*52000+50%*20000= $36000 Cheap Oil (50%) (50%) $20000 Obtain Profit Expensive Oil (50%) $120000 Four Wells EMV: 50%*120000+50%*10000= $65000 Cheap Oil (50%)* $10000 (50%) Expensive Oil (50%) $250000 Seven Wells EMV: 50%* 250000+50%*80000= $165000 Cheap Oil (50%)* $80000 (50%)

***PLEASE HELP WITH QUESTION 2***

***PLEASE HELP WITH QUESTION 2*** DECISION TREE FOR Q1

DECISION TREE FOR Q1