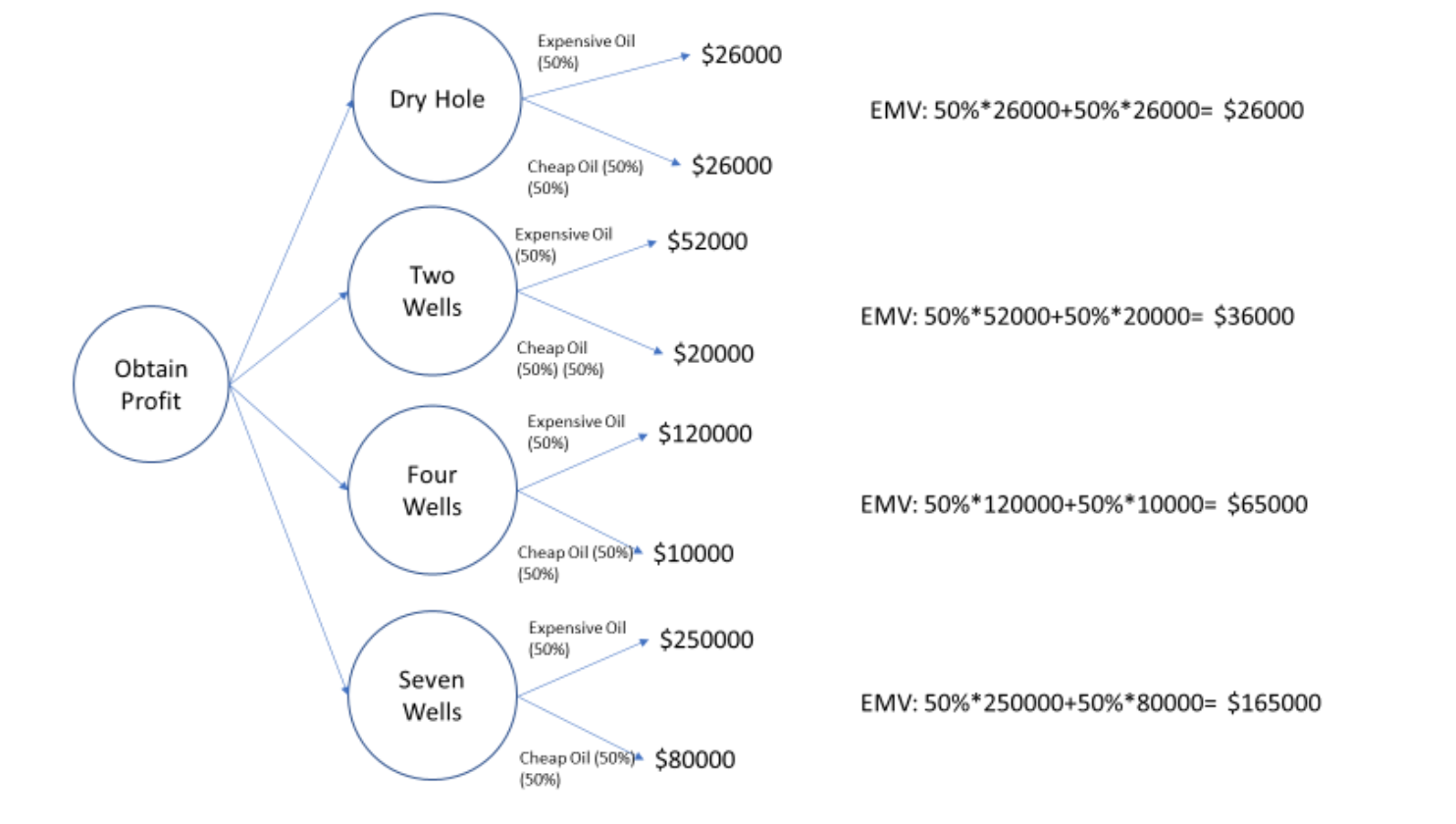

Question: Q1. Draw a decision tree to analyze the problem and conclude whether Mr. Buck should drill an exploratory well on the Pinkleys Prospect. What is

Q1. Draw a decision tree to analyze the problem and conclude whether Mr. Buck should drill an exploratory well on the Pinkleys Prospect. What is the expected payoff for your recommended decision? For this analysis, you would have to calculate the Net Present Value (NPV) of all possible outcomes taking the royalties, discount rate, inflation rate, and his tax bracket over 30 years into account. Instead, assume the following table provides the net payoffs (NPVs).

Table 1Q. Payoffs

Dry Hole Two Wells Four Wells Seven Wells

Expensive Oil - $26,000 $52,000 $120,000 $250,000

Cheap Oil - $26,000 $20,000 $10,000 $80,000

THE ANSWER TO THIS QUESTION (Q1) IS THE PICTURE ATTATCHED ABOVE

Please answer Q2 below if possible:

Q2: Now suppose Mr. Buck has done some further research and found out that if upon finishing exploratory drilling it turns out that only two wells can be drilled, it will be possible to liquidate those wells by selling his oil-producing lease (However, if more wells are drilled, it will be hard to liquidate them) He will specifically be interested in selling the two-well lease if, by the end of the exploratory drilling, the oil price turns out to be low (cheap oil). If so, he believes there is 70% chance that he can sell the lease with a net payoff of $22,000. But, finding customers would be costly and if he fails to sell, he will end up with - $30,000 payoff. Alternatively, he can keep the operations as is (not intend to sell) which will result in - $20,000

Draw a new decision tree and include the above-mentioned option. Now, what would you recommend? What is the best decision/alternative?

Expensive Oil (50%) $26000 Dry Hole EMV: 50%*26000+50%*26000= $26000 Cheap Oil (50%) (50%) $26000 Expensive Oil (50%) $52000 Two Wells EMV: 50%*52000+50%*20000= $36000 Cheap Oil (50%) (50%) $20000 Obtain Profit Expensive Oil (50%) $120000 Four Wells EMV: 50%*120000+50%*10000= $65000 Cheap Oil (50%)* $10000 (50%) Expensive Oil (50%) $250000 Seven Wells EMV: 50%* 250000+50%*80000= $165000 Cheap Oil (50%)* $80000 (50%)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts