Question: please help with question 5 4. Suppose an ETF holds 500,000 shares of stock A and 500,000 shares of stock B. The per-share market prices

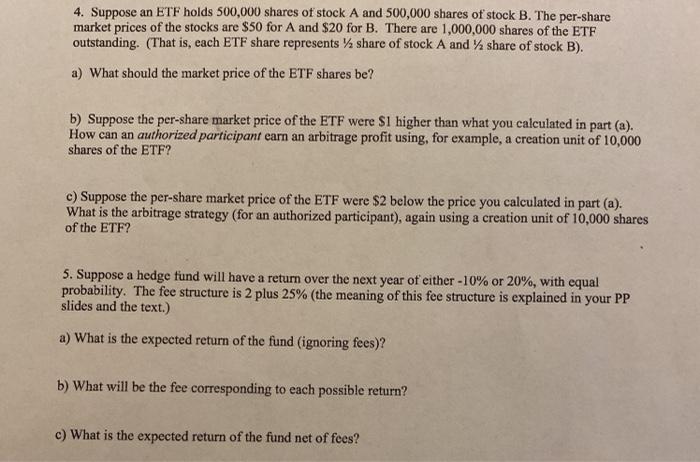

4. Suppose an ETF holds 500,000 shares of stock A and 500,000 shares of stock B. The per-share market prices of the stocks are $50 for A and $20 for B. There are 1,000,000 shares of the ETF outstanding. (That is, each ETF share represents share of stock A and share of stock B). a) What should the market price of the ETF shares be? b) Suppose the per-share market price of the ETF were $1 higher than what you calculated in part (a). How can an authorized participant earn an arbitrage profit using, for example, a creation unit of 10,000 shares of the ETF? c) Suppose the per-share market price of the ETF were $2 below the price you calculated in part (a). What is the arbitrage strategy (for an authorized participant), again using a creation unit of 10,000 shares of the ETF? 5. Suppose a hedge fund will have a return over the next year of either -10% or 20%, with equal probability. The fee structure is 2 plus 25% (the meaning of this fee structure is explained in your PP slides and the text.) a) What is the expected return of the fund (ignoring fees)? b) What will be the fee corresponding to each possible return? c) What is the expected return of the fund net of fees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts