Question: Please help with question e, many thanks You are an equity analyst valuing Manchester plc and use a two-stage dividend discount model to forecast its

Please help with question e, many thanks

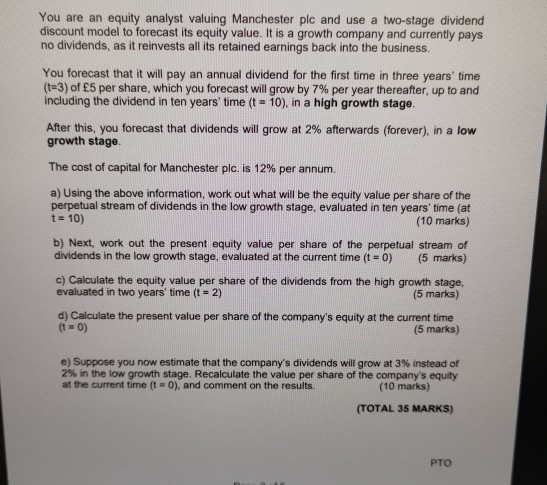

You are an equity analyst valuing Manchester plc and use a two-stage dividend discount model to forecast its equity value. It is a growth company and currently pays no dividends, as it reinvests all its retained earnings back into the business. You forecast that it will pay an annual dividend for the first time in three years' time (3) of 5 per share, which you forecast will grow by 7% per year thereafter, up to and including the dividend in ten years' time (t = 10), in a high growth stage. After this, you forecast that dividends will grow at 2% afterwards (forever), in a low growth stage The cost of capital for Manchester plc. is 12% per annum a) Using the above information, work out what will be the equity value per share of the perpetual stream of dividends in the low growth stage, evaluated in ten years' time (at t = 10) (10 marks) b) Next, work out the present equity value per share of the perpetual stream of dividends in the low growth stage, evaluated at the current time ( 0) (5 marks) c) Calculate the equity value per share of the dividends from the high growth stage, evaluated in two years' time (t = 2) (5 marks) d) Calculate the present value per share of the company's equity at the current time (t = 0) (5 marks) e) Suppose you now estimate that the company's dividends will grow at 3% instead of 2% in the low growth stage. Recalculate the value per share of the company's equity at the current time it -0), and comment on the results. (10 marks) (TOTAL 35 MARKS) PTO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts