Question: Please help with questions #4 and #5 4. What will be the value of an annuity where you invest $50,000 at the end of each

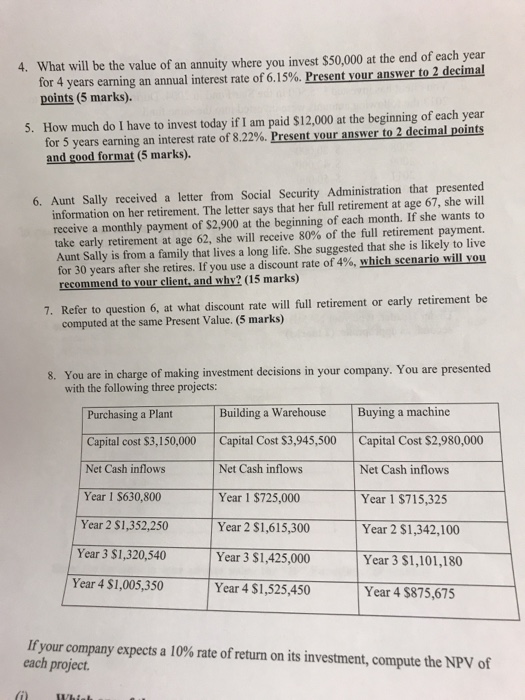

4. What will be the value of an annuity where you invest $50,000 at the end of each year for 4 years earning an annual interest rate of 6.15%. Present our answer to 2 decimal points (5 marks). How much do I have to invest today if I am paid $12,000 at the beginning of each year for 5 years earning an interest rate of 8.22%. Present your answerto2 decimalpo nts 5. and good format (5 marks). 6. Aunt Sally received a letter from Social Security Administration that presented information on her retirement. The letter says that her full retirement at age 67, she will receive a monthly payment of $2,900 at the beginning of each month. If she wants to take early retirement at age 62, she will receive 80% of the full retirement payment. Aunt Sally is from a family that lives a long life. She suggested that she is likely to live for 30 years after she retires. If you use a discount rate of 4%, which scenario will you recommend to your client, and why? (15 marks) 7. Refer to question 6, at what discount rate will full retirement or early retirement be computed at the same Present Value. (5 marks) 8. You are in charge of making investment decisions in your company. You are presented with the following three projects: Building a Warehouse Buying a machine Purchasing a Plant Capital cost S3,150,000 Net Cash inflows Year 1 $630,800 Year 2 $1,352,250 Capital Cost $3,945,500 Capital Cost $2,980,000 Net Cash inflows Year 1 $725,000 Year 2 $1,615,300 Year 3 $1,425,000 Year 4 $1,525,450 Net Cash inflows Year 1 $715,325 Year 2 S1,342,100 Year 3 $1,101,180 Year 4 $875,675 Year 3 $1,320,540 Year 4 $1,005,350 !your company expects a 10% rate of return on its investment, compute the NPV of each project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts