Question: please help with questions 4 and 5. Prepare a cash payments budget for inventory purchases and prepare a selling and administrative expenses budget. Brown Corporation's

please help with questions 4 and 5.

Prepare a cash payments budget for inventory purchases and prepare a selling and administrative expenses budget.

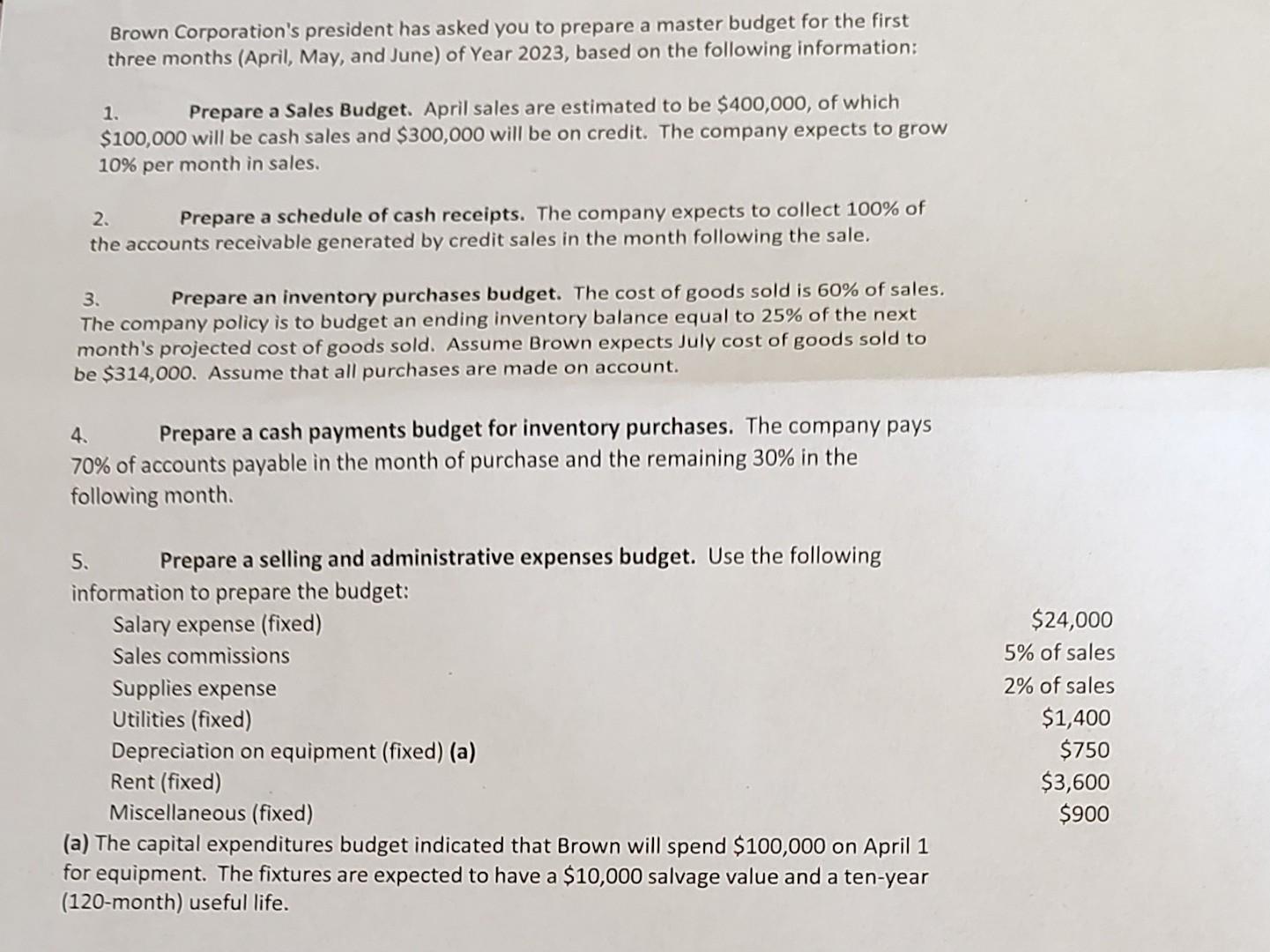

Brown Corporation's president has asked you to prepare a master budget for the first three months (April, May, and June) of Year 2023, based on the following information: 1. Prepare a Sales Budget. April sales are estimated to be $400,000, of which $100,000 will be cash sales and $300,000 will be on credit. The company expects to grow 10% per month in sales. 2. Prepare a schedule of cash receipts. The company expects to collect 100% of the accounts receivable generated by credit sales in the month following the sale. 3. Prepare an inventory purchases budget. The cost of goods sold is 60% of sales. The company policy is to budget an ending inventory balance equal to 25% of the next month's projected cost of goods sold. Assume Brown expects July cost of goods sold to be $314,000. Assume that all purchases are made on account. 4. Prepare a cash payments budget for inventory purchases. The company pays 70% of accounts payable in the month of purchase and the remaining 30% in the following month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts