Question: Please help with questions a & b. ASAP Project A requires an original investment of $52,100. The project will yield cash flows of $14,800 per

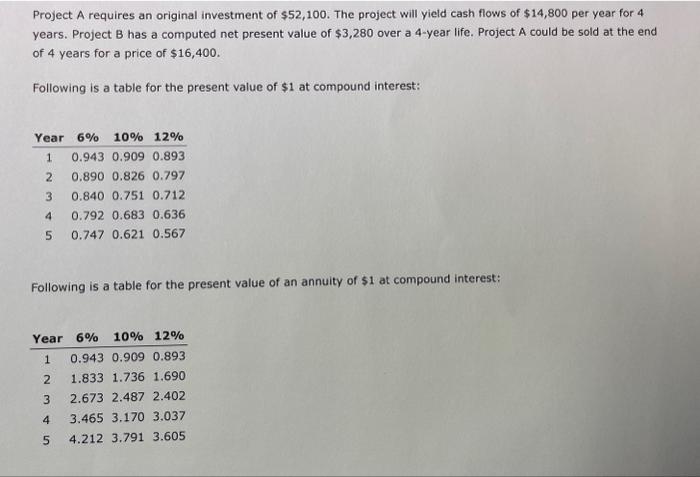

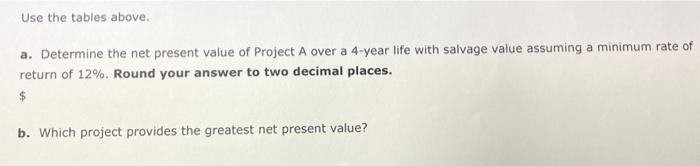

Project A requires an original investment of $52,100. The project will yield cash flows of $14,800 per year for 4 years. Project B has a computed net present value of $3,280 over a 4-year life. Project A could be sold at the end of 4 years for a price of $16,400. Following is a table for the present value of $1 at compound interest: Following is a table for the present value of an annuity of $1 at compound interest: Use the tables above. a. Determine the net present value of Project A over a 4-year life with salvage value assuming a minimum rate of return of 12%. Round your answer to two decimal places. $ b. Which project provides the greatest net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts