Question: please help with solutions. show work if you can please 4. Because New Market Products (NMP) markets consumer staples, it is able to make of

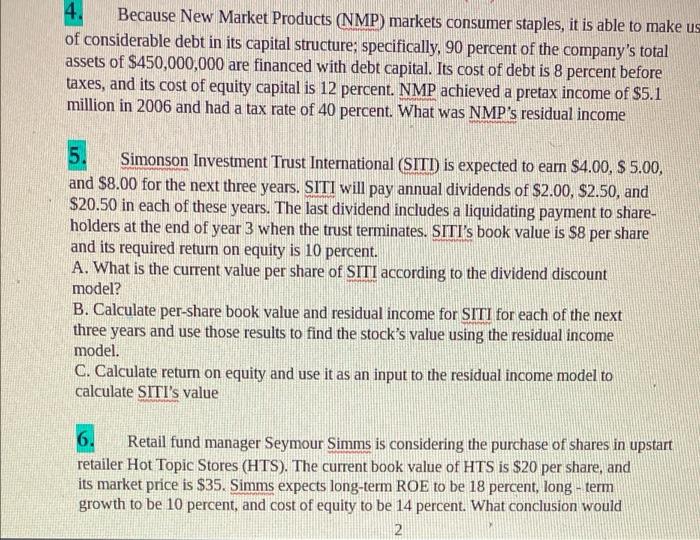

4. Because New Market Products (NMP) markets consumer staples, it is able to make of considerable debt in its capital structure; specifically, 90 percent of the company's total assets of $450,000,000 are financed with debt capital. Its cost of debt is 8 percent before taxes, and its cost of equity capital is 12 percent. NMP achieved a pretax income of $5.1 million in 2006 and had a tax rate of 40 percent. What was NMP's residual income 5. Simonson Investment Trust International (SITI) is expected to earn $4.00,$5.00, and $8.00 for the next three years. SITI will pay annual dividends of $2.00,$2.50, and $20.50 in each of these years. The last dividend includes a liquidating payment to shareholders at the end of year 3 when the trust terminates. SITI's book value is $8 per share and its required return on equity is 10 percent. A. What is the current value per share of SITI according to the dividend discount model? B. Calculate per-share book value and residual income for SITI for each of the next three years and use those results to find the stock's value using the residual income model. C. Calculate return on equity and use it as an input to the residual income model to calculate SITI's value 6. Retail fund manager Seymour Simms is considering the purchase of shares in upstart retailer Hot Topic Stores (HTS). The current book value of HTS is \$20 per share, and its market price is $35. Simms expects long-term ROE to be 18 percent, long - term growth to be 10 percent, and cost of equity to be 14 percent. What conclusion would 6. Retail fund manager Seymour Simms is considering the purchase of shares in upstart retailer Hot Topic Stores (HTS). The current book value of HTS is $20 per share, and its market price is $35. Simms expects long-term ROE to be 18 percent, long - term growth to be 10 percent, and cost of equity to be 14 percent. What conclusion would 2 you expect Simms to arrive at if he uses a single-stage residual income model to value these shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts