Question: please help with some short written explanation, thank u 7 4. Jocelyn, age 60 , owns 400 shares of ABC Corporation, which she expects to

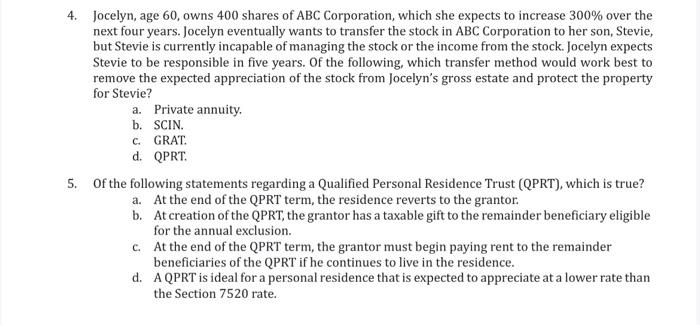

4. Jocelyn, age 60 , owns 400 shares of ABC Corporation, which she expects to increase 300% over the next four years. Jocelyn eventually wants to transfer the stock in ABC Corporation to her son, Stevie, but Stevie is currently incapable of managing the stock or the income from the stock. Jocelyn expects Stevie to be responsible in five years. Of the following, which transfer method would work best to remove the expected appreciation of the stock from Jocelyn's gross estate and protect the property for Stevie? a. Private annuity. b. SCIN. c. GRAT. d. QPRT. 5. Of the following statements regarding a Qualified Personal Residence Trust (QPRT), which is true? a. At the end of the QPRT term, the residence reverts to the grantor. b. At creation of the QPRT, the grantor has a taxable gift to the remainder beneficiary eligible for the annual exclusion. c. At the end of the QPRT term, the grantor must begin paying rent to the remainder beneficiaries of the QPRT if he continues to live in the residence. d. A QPRT is ideal for a personal residence that is expected to appreciate at a lower rate than the Section 7520 rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts