Question: Please help with steps a, b, c, and d. I'm currently stuck on this problem. Thanks in advance. Suppose Intel stock has a beta of

Please help with steps a, b, c, and d. I'm currently stuck on this problem.

Please help with steps a, b, c, and d. I'm currently stuck on this problem.

Thanks in advance.

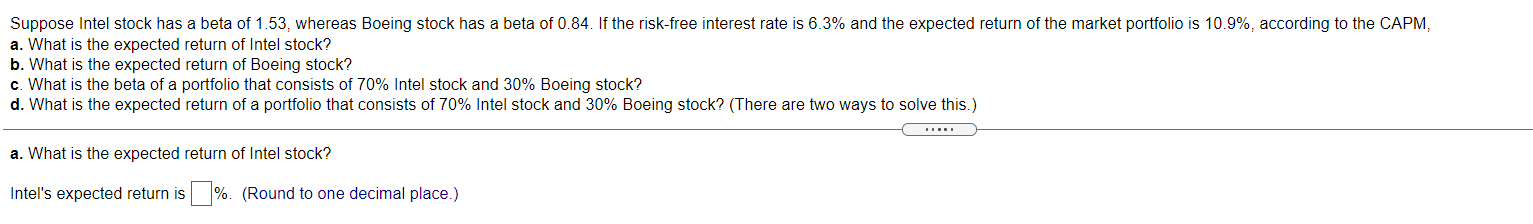

Suppose Intel stock has a beta of 1.53, whereas Boeing stock has a beta of 0.84. If the risk-free interest rate is 6.3% and the expected return of the market portfolio is 10.9%, according to the CAPM, a. What is the expected return of Intel stock? b. What is the expected return of Boeing stock? c. What is the beta of a portfolio that consists of 70% Intel stock and 30% Boeing stock? d. What is the expected return of a portfolio that consists of 70% Intel stock and 30% Boeing stock? (There are two ways to solve this.) a. What is the expected return of Intel stock? Intel's expected return is %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts